Select the correct answer from the terms provided to complete the sentences below. There are more answers than questions, therefore some of the items will remain unused. Higher Reinvestment rate 3 MARR -100% to plus Infinity 6 Cash flow series Cumulative cash flows Lower Zero to one 10 Prate 11 Principal amount Non-conventional 13 Match each of the options above to the tems below. For an Investment, the Interest rate is the rate of interest earned on the When the algebraic signs on the net cash flows change more than once, the cash flow sequence is called, When there is more than one sign change in the net cash flows, multiple values are possible in the range of The total number or real values is always the number of sign changes in the cumulative cash flow sequence. The composite rate of return assumes that net positive cash flows not immediately needed by the project are reinvested at the Norstrom's criterion uses the to determine if a unique rate may exist An Interest rate calculated on the original amount each periodis than one based on the unrecovered balance. 12 Equal to or less than Unrecovered balance ▾

Select the correct answer from the terms provided to complete the sentences below. There are more answers than questions, therefore some of the items will remain unused. Higher Reinvestment rate 3 MARR -100% to plus Infinity 6 Cash flow series Cumulative cash flows Lower Zero to one 10 Prate 11 Principal amount Non-conventional 13 Match each of the options above to the tems below. For an Investment, the Interest rate is the rate of interest earned on the When the algebraic signs on the net cash flows change more than once, the cash flow sequence is called, When there is more than one sign change in the net cash flows, multiple values are possible in the range of The total number or real values is always the number of sign changes in the cumulative cash flow sequence. The composite rate of return assumes that net positive cash flows not immediately needed by the project are reinvested at the Norstrom's criterion uses the to determine if a unique rate may exist An Interest rate calculated on the original amount each periodis than one based on the unrecovered balance. 12 Equal to or less than Unrecovered balance ▾

Chapter13: Capital, Interest, Entrepreneurship, And Corporate Finance

Section: Chapter Questions

Problem 4.8P

Related questions

Question

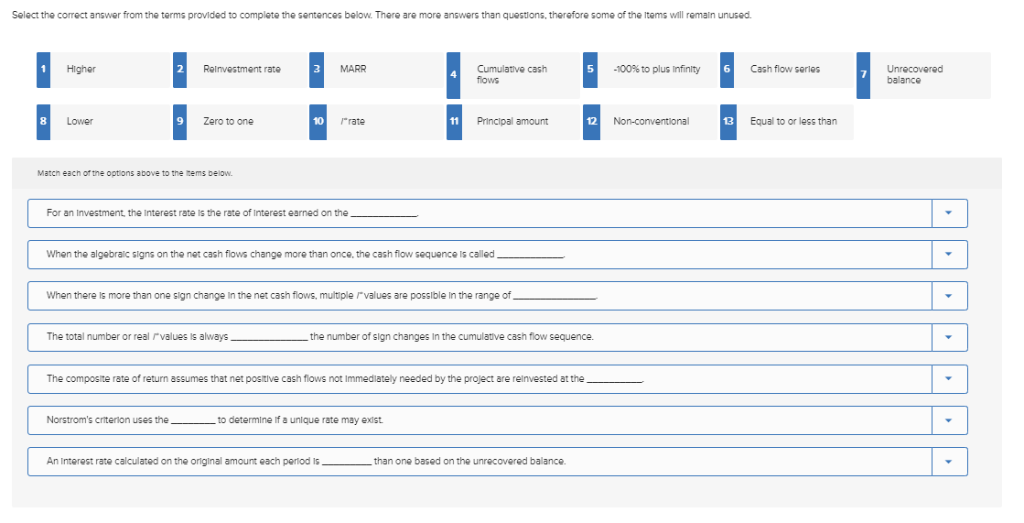

Transcribed Image Text:Select the correct answer from the terms provided to complete the sentences below. There are more answers than questions, therefore some of the items will remain unused.

1 Higher

Reinvestment rate

3

MARR

-100% to plus Infinity 6

Cash flow series

Cumulative cash

flows

8

Zero to one

Lower

10

/"rate

11 Principal amount

Non-conventional

12

Equal to or less than

13

Match each of the options above to the items below.

For an Investment, the Interest rate is the rate of interest earned on the

When the algebraic signs on the net cash flows change more than once, the cash flow sequence is called

When there is more than one sign change in the net cash flows, multiple values are possible in the range of

The total number or real values is always

the number of sign changes in the cumulative cash flow sequence.

The composite rate of return assumes that net positive cash flows not Immediately needed by the project are reinvested at the

Norstrom's criterion uses the

to determine if a unique rate may exist.

An Interest rate calculated on the original amount each period is

than one based on the unrecovered balance.

Unrecovered

balance

▼

▾

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning