Sep. 1 Received $42,000 cash and gave capital to Steven. 4 Purchased office supplies, $500, and furniture, $2,100, on account. Performed services for a law firm and received $1,400 cash. 7 Paid $21,000 cash to acquire land to be used in operations. 10 Performed services for a hotel and received its promise to pay the $1,800 within one week. 14 Paid for the furniture purchased September 4 on account. 15 Paid assistant's semimonthly salary, $1,430. 17 Received cash on account, $1,700. 20 Prepared a design for a school on account, $650. 25 Received $2.300 cash for design services to be performed in October.

Sep. 1 Received $42,000 cash and gave capital to Steven. 4 Purchased office supplies, $500, and furniture, $2,100, on account. Performed services for a law firm and received $1,400 cash. 7 Paid $21,000 cash to acquire land to be used in operations. 10 Performed services for a hotel and received its promise to pay the $1,800 within one week. 14 Paid for the furniture purchased September 4 on account. 15 Paid assistant's semimonthly salary, $1,430. 17 Received cash on account, $1,700. 20 Prepared a design for a school on account, $650. 25 Received $2.300 cash for design services to be performed in October.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Topic Video

Question

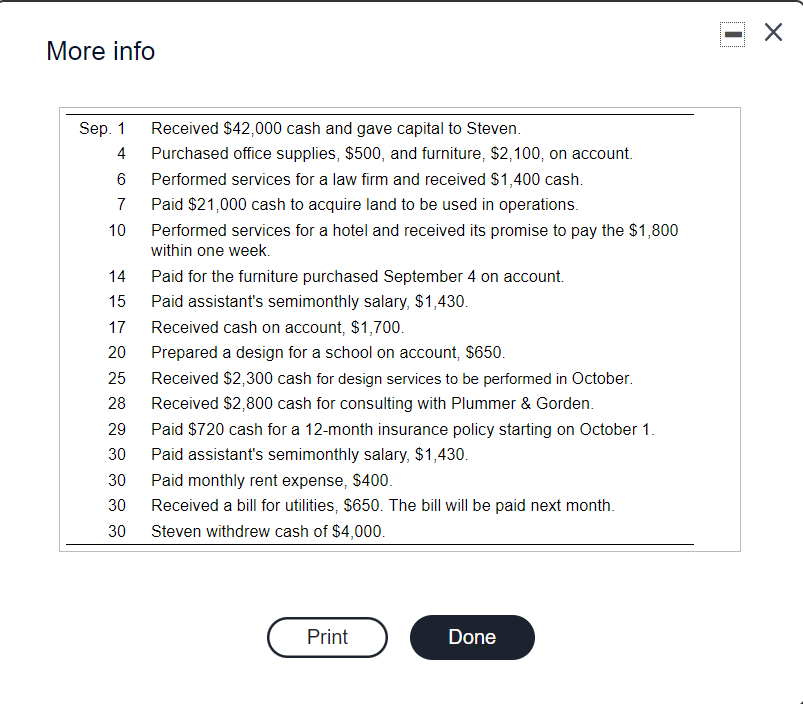

Transcribed Image Text:More info

Sep. 1

Received $42,000 cash and gave capital to Steven.

4

Purchased office supplies, $500, and furniture, $2,100, on account.

Performed services for a law firm and received $1,400 cash.

7

Paid $21,000 cash to acquire land to be used in operations.

10

Performed services for a hotel and received its promise to pay the $1,800

within one week.

14

Paid for the furniture purchased September 4 on account.

15

Paid assistant's semimonthly salary, $1,430.

17

Received cash on account, $1,700.

20

Prepared a design for a school on account, $650.

25

Received $2,300 cash for design services to be performed in October.

28

Received $2,800 cash for consulting with Plummer & Gorden.

Paid $720 cash for a 12-month insurance policy starting on October 1.

Paid assistant's semimonthly salary, $1,430.

29

30

30

Paid monthly rent expense, $400.

Received a bill for utilities, $650. The bill will be paid next month.

30

30

Steven withdrew cash of $4,000.

Print

Done

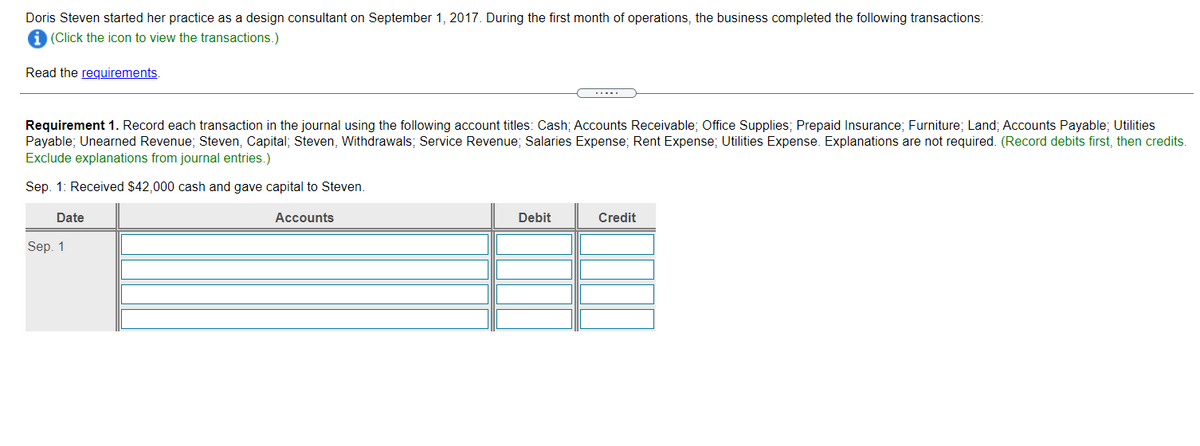

Transcribed Image Text:Doris Steven started her practice as a design consultant on September 1, 2017. During the first month of operations, the business completed the following transactions:

(Click the icon to view the transactions.)

Read the requirements.

Requirement 1. Record each transaction in the journal using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Furniture; Land; Accounts Payable; Utilities

Payable; Unearned Revenue; Steven, Capital; Steven, Withdrawals; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense. Explanations are not required. (Record debits first, then credits.

Exclude explanations from journal entries.)

Sep. 1: Received $42,000 cash and gave capital to Steven.

Date

Accounts

Debit

Credit

Sep. 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning