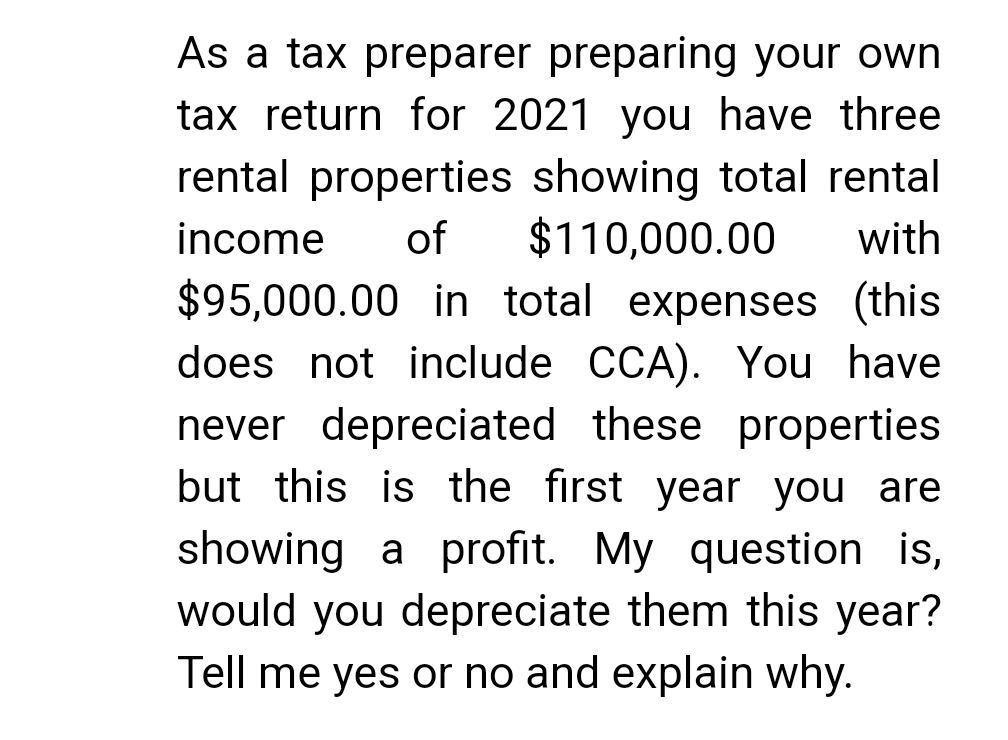

showing a profit. My question is, would you depreciate them this year? Tell me yes or no and explain why.

Q: Parnell Company acquired construction equipment on January 1, 2020, at a cost of $70,100. The…

A: Introduction: A journal entry is used to record a company that will focus on a company's accounting…

Q: Exercise # 3 Velvet Ltd provides legal services and has firms across the Asia-Pacific. It adopts a…

A: Lets understand the basics. Job costing is a costing technique which calculate the cost of job…

Q: Appendix One (Construct or lease) Objective: Should WLW lease or construct their own production…

A: NPV stands for net present value which is the difference between the Present value of total cash…

Q: A statement of financial affairs created for an insolvent corporation that is beginning the process…

A: Insolvency of the enterprises :— Insolvency is a state of financial distress in which a business or…

Q: Aztec, the parent, sells its 90 percent subsidiary, Navajo, equipment for $36,000 on May 1, 2005. At…

A: Consolidated financial statements are those statements which are prepared for consolidation and…

Q: 6. The cost unit overhead absorption rate can only be used if the business has one standard cost…

A: A method of allocating overhead and indirect expenses to goods and services is called activity-based…

Q: a. Lita Lopez invested $60,000 cash and equipment valued at $31,000 in the company in exchange for…

A: The accounting equation states that assets are equal to the sum of liabilities and shareholders'…

Q: The following information of Mimosa General Dealers for July 2021 has been provided to you: ● ● ● ●…

A: BRS (Bank Reconciliation Statement) compares the bank balance represented in the cash book with the…

Q: Company maintained a large investment in debt securities valued at approximately $ 42 billion as of…

A: Debt Securities :— Debt securities are financial assets that entitle their owners to a stream of…

Q: A 1 Standard Cost Card- Toy Robot 2 3 4 Direct labour 5 Production overhead 6 Standard contribution…

A: Variance are the differences between the actual and the budgeted costs. It can be classified into…

Q: Budgeted income statement and supporting budgets The budget director of Gold Medal Athletic Co.,…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Johnson Marine has the following costs and expected sales for the coming year. Johnson is…

A: Cost per unit can be calculated by dividing the total cost of the product by the total number of…

Q: In the case in the text regarding the shipment of cotton that was to be delivered on the ship named…

A: According to the contract act, a material mistake seems to be one that penetrates the core of the…

Q: M/S manish Boutique Ltd. During the year Manish Malhotra had taken home some clothing fabric from…

A: Business entity Concept :— The business entity concept (also known as separate entity and economic…

Q: If Income Summary has a P10,000 debit balance before it is closed to the Capital account, you know…

A: Income Summary Account is an account that is created temporarily so that all the revenues and…

Q: Vertical Analysis Income statement information for Einsworth Corporation follows: Sales Cost of…

A: Vertical Analysis of income statement :— It is the analysis of income statement where all the items…

Q: The comparative statements of financial position for Judy Inc. are presented below: JUDY INC.…

A: Cash flow from operating activities :— It is one of the section of cash flow statement which shows…

Q: Calculate the followings and show all your workings. The break-even point (in unit and sales…

A: Lets understand the basics. Break even point is a point at which no profit no loss condition arise.…

Q: Steven Company has fixed costs of $181,104. The unit selling price, variable cost per unit, and…

A: The break even sales are the sales where business earns no profit no loss during the period. The…

Q: You are creating a business from home and your neighbor is willing to sell to you a brand-new BBQ…

A: Minimum list price would be purchase price plus all expenses. In this case there will be no profit…

Q: Miller Corporation issued 7,000 shares of its $5 par value common stock in payments for attorney…

A: When shares are issued as consideration for services received and the shares are actively traded,…

Q: Increases and decreases in the long-term assets are reported on the statement of cash flows as: A.…

A: Long term assets are those which are held and used by an entity for a period of more than one year.…

Q: If a business had sales of $4,369,000 and a margin of safety of 20%, the break-even point was…

A: The sales level at which the company's revenues equal the company's costs resulting in no profits…

Q: The head of production at your manufacturing facility said, “Our manufacturing processes are doing…

A: The head of the production is the head of the production department. The head of the production…

Q: Parnell Company acquired construction equipment on January 1, 2020, at a cost of $70,100. The…

A: Introduction: A journal entry is being used to record a corporate transaction in the accounting…

Q: Prepare journal entries for this equipment for the years ending December 31, 2020, and December 31,…

A: Journal entries are those entries that include the daily transactions or events and are stated in…

Q: For the year just completed, Hanna Company had net income of $63,000. Balances in the company’s…

A: Cash flow from operating activities :— It is one of the section of cash flow statement which shows…

Q: salarıes of P80,000. The total factory utilities expense incurred for the period was P360,000,…

A: The work in process includes the cost of goods that were started during previous year but are not…

Q: Accrued salaries owed by Zane amounted to 4 days at $400 per day as of December 31, 2022. Dr. Cr.…

A: According to the given question, we are required to prepare the journal entries in our books of…

Q: Required: a. The stock options are incentive stock options. b. The stock options are nonqualified…

A: Stock Options :— A stock option gives an investor the right, but not the obligation, to buy or sell…

Q: Managers at Hughes Limited have become concerned about declining profits although market demand for…

A: Lets understand the basics. In activity based costing, cost is allocated to products based on the…

Q: (a) Why is the BSC approach to performance measurement more useful for measuring performance for…

A: The Balanced Scorecard is a method which displays organization's performance into four dimensions…

Q: Nationwide Magazine sells 62,000 subscriptions on account in March. The subscription price is $18…

A: Unearned Revenue :— It is the revenue that is not earned at the time of receiving of payment for…

Q: 33. Prepare journal entries to record the following transactions, assuming periodic inventory system…

A: Lets understand the basics. In FIFO basis company assumes that, goods come first in the inventory is…

Q: 5. Which of the following best describes a fixed cost? A. Increase proportionately with output. B.…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: On September 1, 2019, Pelican Ltd exchanged 10,000 ordinary shares held in treasury for a used…

A: The treasury stock includes the own shares of the company that are purchased from the shareholders.…

Q: As a result of remodeling services it performed on the site, La Mesa Construction, Inc. files a…

A: Claim refers to the term in which a creditor ensures to receive the payment from a debtor in…

Q: 10. The following information relates to the company's overhead costs: • Static budget variable…

A: Variance Analysis :— Variance Analysis is nothing but the Difference between Standard Cost and…

Q: If Hawkins Company has net income of $45,200, which closing entry is correct? Group of answer…

A: Closing Entry :— It is the journal entry passed at the end of the period to transfer balances of…

Q: One amount is missing in the following trial balance of proprietary accounts, and another is missing…

A: Balance sheet refers to the sheet which provides the information about the assets, liabilities and…

Q: Young Ltd commenced the period with P16,000 Cr balance in the retained earnings account and…

A: Retained earnings ending balance is the sum of retained earnings beginning balance and profit…

Q: Bank charges is an example of a timing difference. True or False Interest on overdraft is an example…

A: A bank reconciliation statement compares an entity's bank account with its financial records by…

Q: you some advice. He would like to know how much he can contribut the current year without over…

A: RRSP is registered retirement saving plan in which you can deposit certain amount which is tax…

Q: The following costs and relevant data, which represent normal activity levels, have been budgeted…

A: According to the given question, we would compute the overhead absorption rate for the three…

Q: What is a law, such as the Sarbanes–Oxley Act of 2002, under which auditors have obligations?

A: The Sarbanes–Oxley Act of 2002 is a federal Law that established Sweeping Auditing and finance…

Q: You have developed a self-study certification system for those who need credit hours for…

A: In this question as per given matric we will calculate segmentwise revenue by…

Q: The following information was extracted from the financial statements of Dollarama Ltd: Summarised…

A: Lets understand the basics. Working capital is a capital require to run day to day business…

Q: Solaris Corporation prepared the following estimates for the four quarters of the current year:…

A: Net income is the amount earned by an entity after deducting the expenses from the incomes. It is…

Q: Sales Transactions J. K. Bijan owns a retail business and made the following sales on account during…

A: There has been a sales tax of 6% on the sale which has been made by the company and it has been…

Q: 1. Indirect costs can be allocated to a cost centre if they: A. Can be identified wholly with the…

A: Comment - We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

E 21

Step by step

Solved in 2 steps

- Tom has a successful business with $100,000 of taxable income before the election to expense in 2019. He purchases one new asset in 2019, a new machine which is 7 -year MACRS property and costs $25,000. If you are Tom's tax advisor, how would you advise Tom to treat the purchase for tax purposes in 2019? Why? ______________________________________________________________________________ ______________________________________________________________________________On June 30, 2019, Kelly sold property for 240,000 cash and a 960,000 note due on September 30, 2020. The note will also pay 6% interest, which is slightly higher than the Federal rate. Kellys cost of the property was 400,000. She is concerned that Congress may increase the tax rate that will apply when the note is collected. Kellys after-tax rate of return on investments is 6%. a. What can Kelly do to avoid the expected higher tax rate? b. Assuming that Kellys marginal combined Federal and state tax rate is 25% in 2019, how much would the tax rates need to increase to make the option identified in part (a) advisable?How do the all events and economic performance requirements apply to the following transactions by an accrual basis taxpayer? a. The company guarantees its products for six months. At the end of 2019, customers had made valid claims for 600,000 that were not paid until 2020. Also, the company estimates that another 400,000 in claims from 2019 sales will be filed and paid in 2020. b. The accrual basis taxpayer reported 200,000 in corporate taxable income for 2019. The state income tax rate was 6%. The corporation paid 7,000 in estimated state income taxes in 2019 and paid 2,000 on 2018 state income taxes when it filed its 2018 state income tax return in March 2019. The company filed its 2019 state income tax return in March 2020 and paid the remaining 5,000 of its 2019 state income tax liability. c. An employee was involved in an accident while making a sales call. The company paid the injured victim 15,000 in 2019 and agreed to pay the victim 15,000 a year for the next nine years.