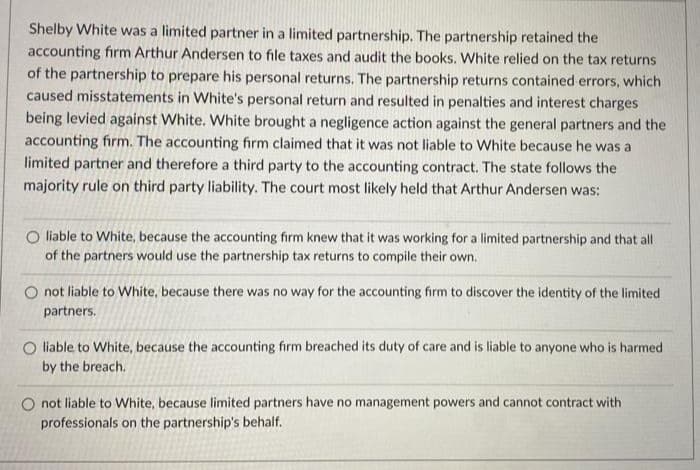

Shelby White was a limited partner in a limited partnership. The partnership retained the accounting firm Arthur Andersen to file taxes and audit the books. White relied on the tax returns of the partnership to prepare his personal returns. The partnership returns contained errors, which caused misstatements in White's personal return and resulted in penalties and interest charges being levied against White. White brought a negligence action against the general partners and the accounting firm. The accounting firm claimed that it was not liable to White because he was a limited partner and therefore a third party to the accounting contract. The state follows the majority rule on third party liability. The court most likely held that Arthur Andersen was: O liable to White, because the accounting firm knew that it was working for a limited partnership and that all of the partners would use the partnership tax returns to compile their own. O not liable to White, because there was no way for the accounting firm to discover the identity of the limited partners. O liable to White, because the accounting firm breached its duty of care and is liable to anyone who is harmed by the breach. O not liable to White, because limited partners have no management powers and cannot contract with professionals on the partnership's behalf.

Percentage

A percentage is a number indicated as a fraction of 100. It is a dimensionless number often expressed using the symbol %.

Algebraic Expressions

In mathematics, an algebraic expression consists of constant(s), variable(s), and mathematical operators. It is made up of terms.

Numbers

Numbers are some measures used for counting. They can be compared one with another to know its position in the number line and determine which one is greater or lesser than the other.

Subtraction

Before we begin to understand the subtraction of algebraic expressions, we need to list out a few things that form the basis of algebra.

Addition

Before we begin to understand the addition of algebraic expressions, we need to list out a few things that form the basis of algebra.

R2

Trending now

This is a popular solution!

Step by step

Solved in 2 steps