Shelbyville State University is a public university with a June 30 fiscal year end. Prepare the journal entries in good fom. 1 Student tuition and fees were billed for $3,800,000 with 75% collected in cash and 2.5% considered uncollectible. 2 Pell grants in the amount of $2,100,000 were received and applied to student accounts. 3 Student scholarships, for which no services were required, amounted to $550,000 and were applied to student tuition accounts. 4 The University incurred $350,000 of qualified expenditures under a cost-reimbursement grant from the Department of Defense.

Shelbyville State University is a public university with a June 30 fiscal year end. Prepare the journal entries in good fom. 1 Student tuition and fees were billed for $3,800,000 with 75% collected in cash and 2.5% considered uncollectible. 2 Pell grants in the amount of $2,100,000 were received and applied to student accounts. 3 Student scholarships, for which no services were required, amounted to $550,000 and were applied to student tuition accounts. 4 The University incurred $350,000 of qualified expenditures under a cost-reimbursement grant from the Department of Defense.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 9Q

Related questions

Question

Prepared

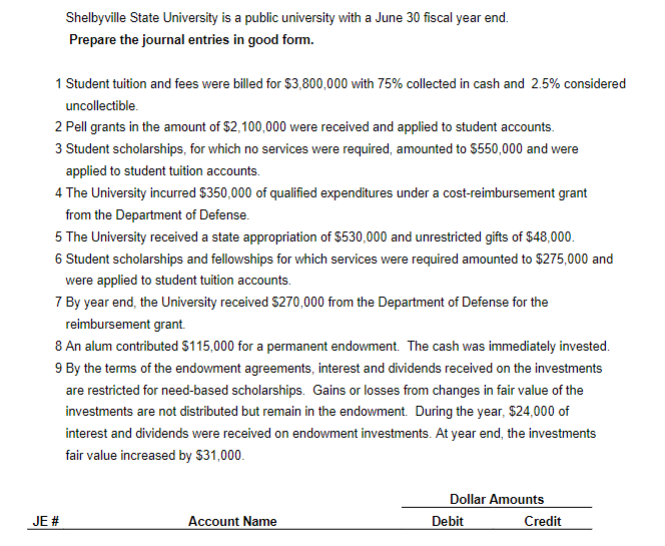

Transcribed Image Text:Shelbyville State University is a public university with a June 30 fiscal year end.

Prepare the journal entries in good form.

1 Student tuition and fees were billed for $3,800,000 with 75% collected in cash and 2.5% considered

uncollectible.

2 Pell grants in the amount of $2,100,000 were received and applied to student accounts.

3 Student scholarships, for which no services were required, amounted to $550,000 and were

applied to student tuition accounts.

4 The University incurred $350,000 of qualified expenditures under a cost-reimbursement grant

from the Department of Defense.

5 The University received a state appropriation of $530,000 and unrestricted gifts of $48,000.

6 Student scholarships and fellowships for which services were required amounted to $275,000 and

were applied to student tuition accounts.

7 By year end, the University received $270,000 from the Department of Defense for the

reimbursement grant.

8 An alum contributed $115,000 for a permanent endowment. The cash was immediately invested.

9 By the terms of the endowment agreements, interest and dividends received on the investments

are restricted for need-based scholarships. Gains or losses from changes in fair value of the

investments are not distributed but remain in the endowment. During the year, $24,000 of

interest and dividends were received on endowment investments. At year end, the investments

fair value increased by $31,000.

Dollar Amounts

JE #

Account Name

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT