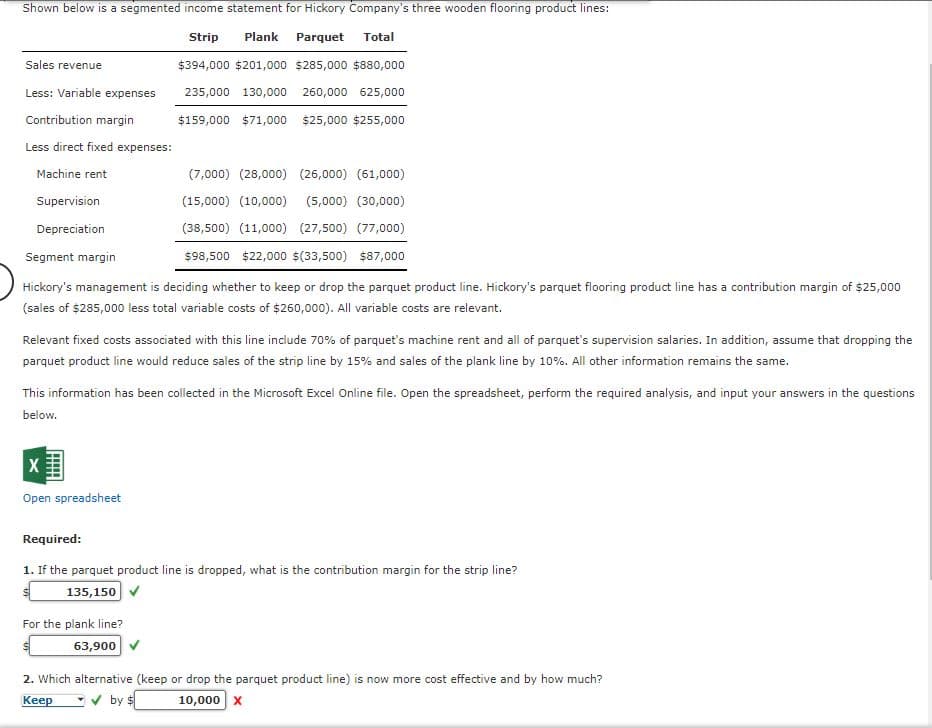

Shown below is a segmented income statement for Hickory Company's three wooden flooring product lines: Strip Plank Parquet Total $394,000 $201,000 $285,000 $880,000 235,000 130,000 260,000 625,000 $159,000 $71,000 $25,000 $255,000 Sales revenue Less: Variable expenses Contribution margin Less direct fixed expenses: Machine rent Supervision Depreciation Segment margin Hickory's management is deciding whether to keep or drop the parquet product line. Hickory's parquet flooring product line has a contribution margin of $25,000 (sales of $285,000 less total variable costs of $260,000). All variable costs are relevant. (7,000) (28,000) (26,000) (61,000) (15,000) (10,000) (5,000) (30,000) (38,500) (11,000) (27,500) (77,000) $98,500 $22,000 $(33,500) $87,000 Relevant fixed costs associated with this line include 70% of parquet's machine rent and all of parquet's supervision salaries. In addition, assume that dropping the parquet product line would reduce sales of the strip line by 15% and sales of the plank line by 10%. All other information remains the same. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Required: 1. If the parquet product line is dropped, what is the contribution margin for the strip line? 135,150 ✓ For the plank line? 63,900 2. Which alternative (keep or drop the parquet product line) is now more cost effective and by how much? Keep ✔ by $ 10,000 X

Shown below is a segmented income statement for Hickory Company's three wooden flooring product lines: Strip Plank Parquet Total $394,000 $201,000 $285,000 $880,000 235,000 130,000 260,000 625,000 $159,000 $71,000 $25,000 $255,000 Sales revenue Less: Variable expenses Contribution margin Less direct fixed expenses: Machine rent Supervision Depreciation Segment margin Hickory's management is deciding whether to keep or drop the parquet product line. Hickory's parquet flooring product line has a contribution margin of $25,000 (sales of $285,000 less total variable costs of $260,000). All variable costs are relevant. (7,000) (28,000) (26,000) (61,000) (15,000) (10,000) (5,000) (30,000) (38,500) (11,000) (27,500) (77,000) $98,500 $22,000 $(33,500) $87,000 Relevant fixed costs associated with this line include 70% of parquet's machine rent and all of parquet's supervision salaries. In addition, assume that dropping the parquet product line would reduce sales of the strip line by 15% and sales of the plank line by 10%. All other information remains the same. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Required: 1. If the parquet product line is dropped, what is the contribution margin for the strip line? 135,150 ✓ For the plank line? 63,900 2. Which alternative (keep or drop the parquet product line) is now more cost effective and by how much? Keep ✔ by $ 10,000 X

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter8: Tactical Decision-making And Relevant Analysis

Section: Chapter Questions

Problem 44E

Related questions

Question

Transcribed Image Text:Shown below is a segmented income statement for Hickory Company's three wooden flooring product lines:

Strip Plank Parquet Total

$394,000 $201,000 $285,000 $880,000

235,000 130,000 260,000 625,000

$159,000 $71,000 $25,000 $255,000

Sales revenue

Less: Variable expenses

Contribution margin

Less direct fixed expenses:

Machine rent

Supervision

Depreciation

Segment margin

Hickory's management is deciding whether to keep or drop the parquet product line. Hickory's parquet flooring product line has a contribution margin of $25,000

(sales of $285,000 less total variable costs of $260,000). All variable costs are relevant.

Relevant fixed costs associated with this line include 70% of parquet's machine rent and all of parquet's supervision salaries. In addition, assume that dropping the

parquet product line would reduce sales of the strip line by 15% and sales of the plank line by 10%. All other information remains the same.

(7,000) (28,000) (26,000) (61,000)

(15,000) (10,000) (5,000) (30,000)

(38,500) (11,000) (27,500) (77,000)

$98,500 $22,000 $(33,500) $87,000

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions

below.

X

Open spreadsheet

Required:

1. If the parquet product line is dropped, what is the contribution margin for the strip line?

$

135,150 ✔

For the plank line?

63,900 ✔

2. Which alternative (keep or drop the parquet product line) is now more cost effective and by how much?

Keep

✓by $

10,000 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning