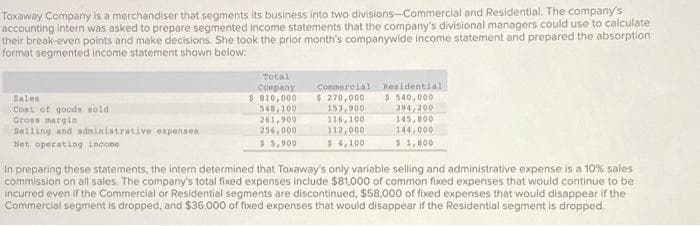

Toxaway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's accounting intern was asked to prepare segmented income statements that the company's divisional managers could use to calculate their break-even points and make decisions. She took the prior month's companywide income statement and prepared the absorption format segmented income statement shown below: Sales Coat of goods sold Gross margin Selling and administrative expenses Net operating income Total Company $ 810,000 540,100 261,900 256,000 $ 5,900 Commercial Residential $ 270,000 $ 540,000 394,200 145,800 144,000 $ 1,800 153,900 116,100 112,000 $ 4,100 In preparing these statements, the intern determined that Toxaway's only variable selling and administrative expense is a 10% sales commission on all sales. The company's total fixed expenses include $81,000 of common fixed expenses that would continue to be incurred even if the Commercial or Residential segments are discontinued, $58,000 of fixed expenses that would disappear if the Commercial segment is dropped, and $36,000 of fixed expenses that would disappear if the Residential segment is dropped.

Toxaway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's accounting intern was asked to prepare segmented income statements that the company's divisional managers could use to calculate their break-even points and make decisions. She took the prior month's companywide income statement and prepared the absorption format segmented income statement shown below: Sales Coat of goods sold Gross margin Selling and administrative expenses Net operating income Total Company $ 810,000 540,100 261,900 256,000 $ 5,900 Commercial Residential $ 270,000 $ 540,000 394,200 145,800 144,000 $ 1,800 153,900 116,100 112,000 $ 4,100 In preparing these statements, the intern determined that Toxaway's only variable selling and administrative expense is a 10% sales commission on all sales. The company's total fixed expenses include $81,000 of common fixed expenses that would continue to be incurred even if the Commercial or Residential segments are discontinued, $58,000 of fixed expenses that would disappear if the Commercial segment is dropped, and $36,000 of fixed expenses that would disappear if the Residential segment is dropped.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 18E

Related questions

Question

Please do not give solution in image format thanku

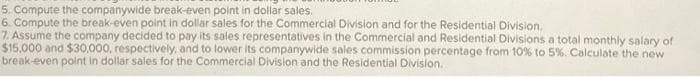

Transcribed Image Text:5. Compute the companywide break-even point in dollar sales.

6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division.

7. Assume the company decided to pay its sales representatives in the Commercial and Residential Divisions a total monthly salary of

$15,000 and $30,000, respectively, and to lower its companywide sales commission percentage from 10% to 5%. Calculate the new

break-even point in dollar sales for the Commercial Division and the Residential Division.

Transcribed Image Text:Toxaway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's

accounting intern was asked to prepare segmented income statements that the company's divisional managers could use to calculate

their break-even points and make decisions. She took the prior month's companywide income statement and prepared the absorption

format segmented income statement shown below:

Sales

Coat of goods sold

Gross margin

Selling and administrative expenses

Net operating incone

Total

Company

$ 810,000

540,100

261,900

256,000

$ 5,900

Commercial Residential

$ 270,000

$540,000

153,900

116,100

112,000

$ 4,100

394,200

145,800

144,000

$ 1,800

In preparing these statements, the intern determined that Toxaway's only variable selling and administrative expense is a 10% sales

commission on all sales. The company's total fixed expenses include $81,000 of common fixed expenses that would continue to be

incurred even if the Commercial or Residential segments are discontinued, $58,000 of fixed expenses that would disappear if the

Commercial segment is dropped, and $36,000 of fixed expenses that would disappear if the Residential segment is dropped.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1: Define break-even point

VIEWStep 2: Computation of Companywide Break even point in dollar sales is as follows:

VIEWStep 3: Computation of Segment's Break even point in dollar sales is as follows:

VIEWStep 4: Computation of Segment's Revised Break even point in dollar sales is as follows:

VIEWSolution

VIEWTrending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning