1. The Fresno Company manufactures slippers and sells them at $13 a pair. Variable manufacturing cost is $6.50 a pair, and allocated fixed manufacturing cost is $2.00 a pair. It has enough idle capacity available accept a one-time-only special order of 5,000 pairs of slippers at $8.50 a pair. Fresno will not incur any marketing costs as a result of the special order. What would the effect on operating income be if the special order could be accepted without affecting normal sales: (a) $0, (b) $10,000 increase, (c) $32,500 increase, or (d) $42,500 increase? Show your calculations. Begin by selecting the labels to calculate the effect on operating income and then enter in the supporting calculations. Special order price per unit Variable manufacturing cost per unit Contribution margin per unit x units in special order Effect on operating income

1. The Fresno Company manufactures slippers and sells them at $13 a pair. Variable manufacturing cost is $6.50 a pair, and allocated fixed manufacturing cost is $2.00 a pair. It has enough idle capacity available accept a one-time-only special order of 5,000 pairs of slippers at $8.50 a pair. Fresno will not incur any marketing costs as a result of the special order. What would the effect on operating income be if the special order could be accepted without affecting normal sales: (a) $0, (b) $10,000 increase, (c) $32,500 increase, or (d) $42,500 increase? Show your calculations. Begin by selecting the labels to calculate the effect on operating income and then enter in the supporting calculations. Special order price per unit Variable manufacturing cost per unit Contribution margin per unit x units in special order Effect on operating income

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 2CMA

Related questions

Question

karan

subject-Accounting

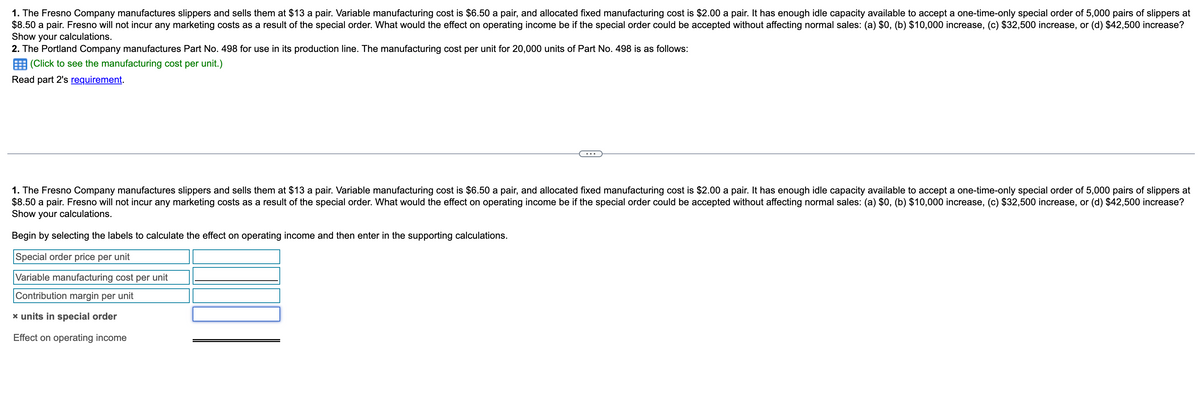

Transcribed Image Text:1. The Fresno Company manufactures slippers and sells them at $13 a pair. Variable manufacturing cost is $6.50 a pair, and allocated fixed manufacturing cost is $2.00 a pair. It has enough idle capacity available to accept a one-time-only special order of 5,000 pairs of slippers at

$8.50 a pair. Fresno will not incur any marketing costs as a result of the special order. What would the effect on operating income be if the special order could be accepted without affecting normal sales: (a) $0, (b) $10,000 increase, (c) $32,500 increase, or (d) $42,500 increase?

Show your calculations.

2. The Portland Company manufactures Part No. 498 for use in its production line. The manufacturing cost per unit for 20,000 units of Part No. 498 is as follows:

(Click to see the manufacturing cost per unit.)

Read part 2's requirement.

1. The Fresno Company manufactures slippers and sells them at $13 a pair. Variable manufacturing cost is $6.50 a pair, and allocated fixed manufacturing cost is $2.00 a pair. It has enough idle capacity available to accept a one-time-only special order of 5,000 pairs of slippers at

$8.50 a pair. Fresno will not incur any marketing costs as a result of the special order. What would the effect on operating income be if the special order could be accepted without affecting normal sales: (a) $0, (b) $10,000 increase, (c) $32,500 increase, or (d) $42,500 increase?

Show your calculations.

Begin by selecting the labels to calculate the effect on operating income and then enter in the supporting calculations.

Special order price per unit

Variable manufacturing cost per unit

Contribution margin per unit

* units in special order

Effect on operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT