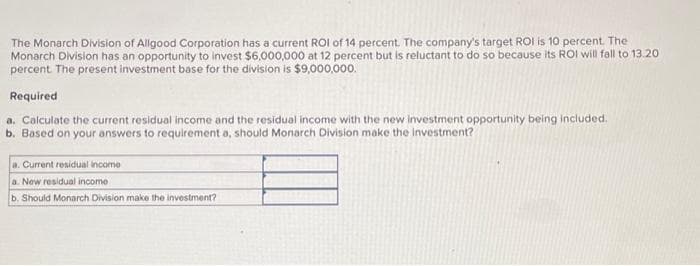

The Monarch Division of Allgood Corporation has a current ROI of 14 percent. The company's target ROI is 10 percent. The Monarch Division has an opportunity to invest $6,000,000 at 12 percent but is reluctant to do so because its ROI will fall to 13.20 percent. The present investment base for the division is $9,000,000. Required a. Calculate the current residual income and the residual income with the new investment opportunity being included. b. Based on your answers to requirement a, should Monarch Division make the investment? a. Current residual income a. New residual income b. Should Monarch Division make the investment?

The Monarch Division of Allgood Corporation has a current ROI of 14 percent. The company's target ROI is 10 percent. The Monarch Division has an opportunity to invest $6,000,000 at 12 percent but is reluctant to do so because its ROI will fall to 13.20 percent. The present investment base for the division is $9,000,000. Required a. Calculate the current residual income and the residual income with the new investment opportunity being included. b. Based on your answers to requirement a, should Monarch Division make the investment? a. Current residual income a. New residual income b. Should Monarch Division make the investment?

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 18PROB

Related questions

Question

please do not propvide solution in image format thank you!

Transcribed Image Text:The Monarch Division of Allgood Corporation has a current ROI of 14 percent. The company's target ROI is 10 percent. The

Monarch Division has an opportunity to invest $6,000,000 at 12 percent but is reluctant to do so because its ROI will fall to 13.20

percent. The present investment base for the division is $9,000,000.

Required

a. Calculate the current residual income and the residual income with the new investment opportunity being included.

b. Based on your answers to requirement a, should Monarch Division make the investment?

a. Current residual income

a. New residual income

b. Should Monarch Division make the investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT