Simon Company's year-end balance sheets follow, At December 31 Assets Current Yr 1 Yr Ago 2 Yrs Ago Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net $ 30,847 85,864 112,410 9,639 278,899 $ 36,772 $ 37,181 60, 602 82,558 9,090 257,236 $ 446,258 $ 368, 200 49,574 52,807 4,131 224, 507 Total assets $ 517,659 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 131,475 $ 73,909 $ 48,116 95,373 163,50e 127,311 83,813 163,500 72,771 $ 446,258 $ 368,200 101,613 163, 500 107,236 $ 517,659 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivab assets favorable or unfavorable?

Simon Company's year-end balance sheets follow, At December 31 Assets Current Yr 1 Yr Ago 2 Yrs Ago Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net $ 30,847 85,864 112,410 9,639 278,899 $ 36,772 $ 37,181 60, 602 82,558 9,090 257,236 $ 446,258 $ 368, 200 49,574 52,807 4,131 224, 507 Total assets $ 517,659 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 131,475 $ 73,909 $ 48,116 95,373 163,50e 127,311 83,813 163,500 72,771 $ 446,258 $ 368,200 101,613 163, 500 107,236 $ 517,659 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivab assets favorable or unfavorable?

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 8PEB: Financial statement data for years ending December 31 for Tango Company follow: a. Determine the...

Related questions

Question

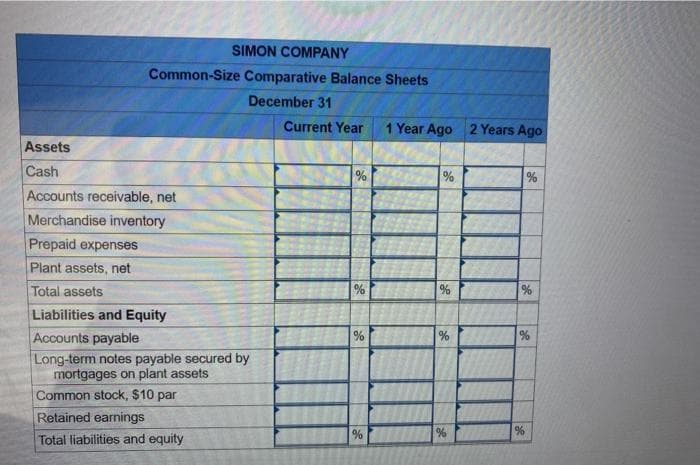

Transcribed Image Text:SIMON COMPANY

Common-Size Comparative Balance Sheets

December 31

Current Year

1 Year Ago 2 Years Ago

Assets

Cash

%

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

%

Liabilities and Equity

Accounts payable

%

%

%

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par

Retained earnings

Total liabilities and equity

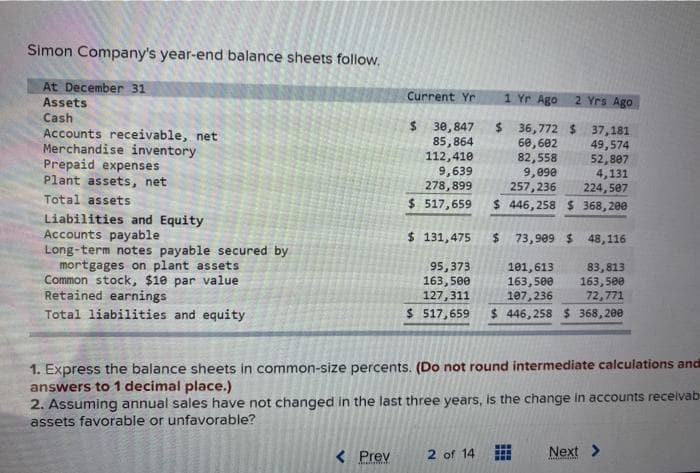

Transcribed Image Text:Simon Company's year-end balance sheets follow,

At December 31

Current Yr

1 Yr Ago

2 Yrs Ago

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

$ 30,847

85,864

112,410

9,639

278,899

$4

36,772 $ 37,181

60,602

82,558

9,090

257, 236

49,574

52,807

4,131

224,507

Total assets

$ 517,659

$ 446,258 S 368, 200

Liabilities and Equity

Accounts payable

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par value

Retained earnings

$ 131,475

73,909 $ 48,116

95,373

163, 500

127,311

83,813

163, 500

72,771

$ 446,258 $ 368,200

101,613

163, 500

107,236

Total liabilities and equity

$ 517,659

1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and

answers to 1 decimal place.)

2. Assuming annual sales have not changed in the last three years, is the change in accounts receivab

assets favorable or unfavorable?

< Prev

2 of 14

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning