Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets Cash $ 35,715 $ 41,747 $ 42,626 Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 89,400 62,300 50,100 114,000 11,501 348,728 82,500 10,959 319,170 58,000 4,736 270,838 Total assets $599,344 $ 516,676 $ 426,300 Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings $150,729 113,803 162,500 172,312 $ 88,191 120,024 162,500 145,961 $ 56,834 95,154 162,500 111,812 Total liabilities and equity $599,344 $ 516,676 $ 426,300 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: 1 Yr Ago $ 614,844 For Year Ended December 31 Current Yr Sales $ 779,147 $ 475,280 $ 399,649 Cost of goods sold Other operating expenses Interest expense Income tax expense 241,536 155,556 13,245 10,129 14,141 9,223 Total costs and expenses 740,190 578,569 Net income $ 38,957 $4 36,275 Earnings per share $ 2.40 2.23

Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets Cash $ 35,715 $ 41,747 $ 42,626 Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 89,400 62,300 50,100 114,000 11,501 348,728 82,500 10,959 319,170 58,000 4,736 270,838 Total assets $599,344 $ 516,676 $ 426,300 Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings $150,729 113,803 162,500 172,312 $ 88,191 120,024 162,500 145,961 $ 56,834 95,154 162,500 111,812 Total liabilities and equity $599,344 $ 516,676 $ 426,300 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: 1 Yr Ago $ 614,844 For Year Ended December 31 Current Yr Sales $ 779,147 $ 475,280 $ 399,649 Cost of goods sold Other operating expenses Interest expense Income tax expense 241,536 155,556 13,245 10,129 14,141 9,223 Total costs and expenses 740,190 578,569 Net income $ 38,957 $4 36,275 Earnings per share $ 2.40 2.23

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

![Required information

Exercise 13-9 (Algo) Analyzing and interpreting liquidity LO P3

[The following information applies to the questions displayed below.]

Simon Company's year-end balance sheets follow.

At December 31

Current Yr

1 Yr Ago 2 Yrs Ago

Assets

Cash

$ 35,715

$4

41,747 $ 42,626

Accounts receivable, net

Merchandise inventory

Prepaid expenses

62,300

82,500

10,959

89,400

50,100

58,000

114,000

11,501

348,728

4,736

Plant assets, net

319,170

270,838

Total assets

$599,344

$ 516,676 $ 426,300

Liabilities and Equity

Accounts payable

Long-term notes payable

Common stock, $10 par value

Retained earnings

$150,729

$ 88,191 $ 56,834

113,803

120,024

95,154

162,500

162,500

162,500

145,961

$ 516,676

172,312

111,812

Total liabilities and equity

$599,344

$ 426,300

The company's income statements for the current year and one year ago follow. Assume that all sales are on credit:

For Year Ended December 31

1 Yr Ago

$ 614,844

Current Yr

Sales

$ 779,147

Cost of goods sold

Other operating expenses

$ 475,280

$ 399,649

241,536

155,556

14,141

13,245

10,129

Interest expense

Income tax expense

9,223

Total costs and expenses

740,190

578,569

Net income

38,957

$ 36,275

Earnings per share

2.40

$

2.23

Exercise 13-9 (Algo) Part 1](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F36d1b5a6-8ee7-421f-bf8b-8d36de9294e2%2F7265f7c5-73ff-4a28-bc5b-51217b89769d%2Fmghe039_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

Exercise 13-9 (Algo) Analyzing and interpreting liquidity LO P3

[The following information applies to the questions displayed below.]

Simon Company's year-end balance sheets follow.

At December 31

Current Yr

1 Yr Ago 2 Yrs Ago

Assets

Cash

$ 35,715

$4

41,747 $ 42,626

Accounts receivable, net

Merchandise inventory

Prepaid expenses

62,300

82,500

10,959

89,400

50,100

58,000

114,000

11,501

348,728

4,736

Plant assets, net

319,170

270,838

Total assets

$599,344

$ 516,676 $ 426,300

Liabilities and Equity

Accounts payable

Long-term notes payable

Common stock, $10 par value

Retained earnings

$150,729

$ 88,191 $ 56,834

113,803

120,024

95,154

162,500

162,500

162,500

145,961

$ 516,676

172,312

111,812

Total liabilities and equity

$599,344

$ 426,300

The company's income statements for the current year and one year ago follow. Assume that all sales are on credit:

For Year Ended December 31

1 Yr Ago

$ 614,844

Current Yr

Sales

$ 779,147

Cost of goods sold

Other operating expenses

$ 475,280

$ 399,649

241,536

155,556

14,141

13,245

10,129

Interest expense

Income tax expense

9,223

Total costs and expenses

740,190

578,569

Net income

38,957

$ 36,275

Earnings per share

2.40

$

2.23

Exercise 13-9 (Algo) Part 1

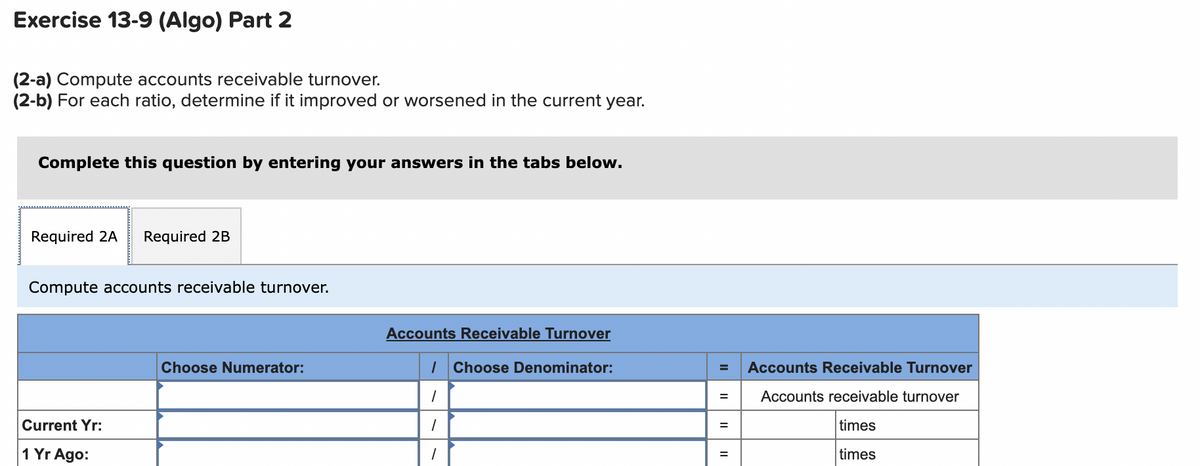

Transcribed Image Text:Exercise 13-9 (Algo) Part 2

(2-a) Compute accounts receivable turnover.

(2-b) For each ratio, determine if it improved or worsened in the current year.

Complete this question by entering your answers in the tabs below.

Required 2A

Required 2B

Compute accounts receivable turnover.

Accounts Receivable Turnover

Choose Numerator:

I Choose Denominator:

Accounts Receivable Turnover

Accounts receivable turnover

Current Yr:

times

%3D

1 Yr Ago:

times

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning