Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 72E

Ratio Analysis

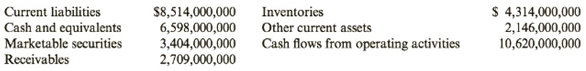

Intel Corporation provided the following information on its balance sheet and statement of

Required:

1. Calculate the (a)

2. CONCEPTUAL CONNECTION Interpret these results.

3. CONCEPTUAL CONNECTION Assume that Intel, as a requirement of one of its loans, must maintain a current ratio of at least 2.30. Given the large amount of cash, how could Intel accomplish this on December 31 (be specific as to dollar amounts)?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Indicate the effect of the transactions listed in the following table on total current assets, current ration, and net income. Use (+) to indicate an increase, (-) to indicate a decrease, and (0) to indicate either no effect or an indeterminate effect. Be prepared to state any necessary assumptions and assume an initial current ratio of more than 1.0.

Cash is obtained through short-term bank loans.

Ratio Analysis

Intel Corporation provided the following information on its balance sheet and statement of cash flows (in millions):

Current liabilities

$ 22,310

Inventories

$ 8,744

Cash and equivalents

4,194

Other current assets

1,713

Marketable securities*

8,929

Cash flows from operating activities

33,145

Receivables

7,659

*Marketable Securities include Trading Assets of $7,847

Specifically, how much cash must Intel use in order to achieve a current ratio of 1.50? Enter your answer in million.

Please Complete the Following:

1. Complete a vertical and horizontal analysis on the tabs labeled "Balance Sheet" and "Income Statement", use total assets on the balance sheet and net sales on the income statement for your vertical analysis.

2. Using the balance sheet and income statement, complete the ratios on the tab labeled "Ratios"

3. Answer the final OBSERVATION QUESTION (listed under Ratios calculations)

Consolidated Balance Sheets (USD $)

12/31/2020

Vertical Analysis

12/31/2019

Vertical Analysis

Horizontal Analysis

In Millions, unless otherwise specified

Current Assets:

Cash and Cash Equivalents

$1,723

$1,929

Receivables, net

1,484

1,398

Merchandise Inventories

11,079

11,057

Other Current Assets

1,016

895

Total Current Assets

15,302

15,279

Property and Equipment, at…

Chapter 8 Solutions

Cornerstones of Financial Accounting

Ch. 8 - Prob. 1DQCh. 8 - Prob. 2DQCh. 8 - Prob. 3DQCh. 8 - Prob. 4DQCh. 8 - Prob. 5DQCh. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Prob. 8DQCh. 8 - Prob. 9DQCh. 8 - Prob. 10DQ

Ch. 8 - Prob. 11DQCh. 8 - Prob. 12DQCh. 8 - Prob. 13DQCh. 8 - Prob. 14DQCh. 8 - Prob. 15DQCh. 8 - Prob. 16DQCh. 8 - Prob. 17DQCh. 8 - Prob. 18DQCh. 8 - Prob. 19DQCh. 8 - Prob. 20DQCh. 8 - Prob. 1MCQCh. 8 - Prob. 2MCQCh. 8 - Prob. 3MCQCh. 8 - Refer to the information for Kinsella Seed above....Ch. 8 - Prob. 5MCQCh. 8 - Prob. 6MCQCh. 8 - Prob. 7MCQCh. 8 - Prob. 8MCQCh. 8 - Prob. 9MCQCh. 8 - When a credit is made to federal income taxes...Ch. 8 - Prob. 11MCQCh. 8 - Prob. 12MCQCh. 8 - Prob. 13MCQCh. 8 - Prob. 14MCQCh. 8 - Prob. 15MCQCh. 8 - Prob. 16MCQCh. 8 - Prob. 17MCQCh. 8 - Which of the following transactions would cause...Ch. 8 - Issuing Notes Payable On June 30, Carmean Inc....Ch. 8 - Notes Payable Rogers Machinery Company borrowed...Ch. 8 - Prob. 21CECh. 8 - Accrued Interest On March 1, the Garner...Ch. 8 - Prob. 23CECh. 8 - Prob. 24CECh. 8 - Sales Tax Cobb Baseball Bats sold 45 bats for $50...Ch. 8 - Payroll Taxes Hernandez Builders has a gross...Ch. 8 - Prob. 27CECh. 8 - Prob. 28CECh. 8 - Unearned Sales Revenue Brand Landscaping offers a...Ch. 8 - Prob. 30CECh. 8 - Prob. 31CECh. 8 - Prob. 32CECh. 8 - Liquidity Ratios NWAs financial statements contain...Ch. 8 - Prob. 34CECh. 8 - Accounts Payable On May 18, Stanton Electronics...Ch. 8 - Accounts and Notes Payable On February 15, Barbour...Ch. 8 - Issuing Notes Payable On September 30, Bello...Ch. 8 - Notes Payable Renchen Company, which manufactures...Ch. 8 - Accrued Interest On July 1, Brimley Company issued...Ch. 8 - Accrued Interest On May 1, the Garnett Corporation...Ch. 8 - Accrued Property Taxes Annual property taxes...Ch. 8 - Accrued Income Taxes Nolan Inc. had taxable income...Ch. 8 - Prob. 43BECh. 8 - Accrued Wages A company employs a part-time staff...Ch. 8 - Prob. 45BECh. 8 - Prob. 46BECh. 8 - Prob. 47BECh. 8 - Prob. 48BECh. 8 - Payroll Taxes Sids Grocery Store has 100 employees...Ch. 8 - Prob. 50BECh. 8 - Payroll Taxes Its the Tooth Dental works to...Ch. 8 - Unearned Sales Revenue Curtiss Carpet Cleaning...Ch. 8 - Unearned Rent Revenue Mannion Property Management...Ch. 8 - Contingent Liabilities Many companies provide...Ch. 8 - Prob. 55BECh. 8 - Prob. 56BECh. 8 - Prob. 57BECh. 8 - Liquidity Ratios JRLs financial statements contain...Ch. 8 - Prob. 59BECh. 8 - Prob. 60ECh. 8 - Recording Various Liabilities Glenview Hardware...Ch. 8 - Recording Various Liabilities Plymouth Electronics...Ch. 8 - Reporting Liabilities Morton Electronics had the...Ch. 8 - Accounts Payable Sleek Ride, a company providing...Ch. 8 - Accrued Liabilities Charger Inc. had the following...Ch. 8 - Accrued Liabilities Thornwood Tile had the...Ch. 8 - Prob. 67ECh. 8 - Payroll Accounting and Discussion of Labor Costs...Ch. 8 - Unearned Revenue Jennifers Landscaping Services...Ch. 8 - Prob. 70ECh. 8 - Warranties Eds Athletics sells bicycles and other...Ch. 8 - Ratio Analysis Intel Corporation provided the...Ch. 8 - Payable Transactions Richmond Company engaged in...Ch. 8 - Payroll Accounting Jet Enterprises has the...Ch. 8 - Note Payable and Accrued Interest Fairbome Company...Ch. 8 - Prob. 76APSACh. 8 - Prob. 77APSACh. 8 - Prob. 78APSACh. 8 - Prob. 79APSACh. 8 - Ratio Analysis Consider the following information...Ch. 8 - Payable Transactions Daniels Company engaged in...Ch. 8 - Payroll Accounting McLaughlin Manufacturing has...Ch. 8 - Note Payable and Accrued Interest Ellsworth...Ch. 8 - Prob. 76BPSBCh. 8 - Prob. 77BPSBCh. 8 - Prob. 78BPSBCh. 8 - Prob. 79BPSBCh. 8 - Ratio Analysis Consider the following information...Ch. 8 - Prob. 81.1CCh. 8 - Prob. 81.2CCh. 8 - Prob. 81.3CCh. 8 - Prob. 82.1CCh. 8 - Prob. 82.2CCh. 8 - Prob. 82.3CCh. 8 - Prob. 83.1CCh. 8 - Prob. 83.2CCh. 8 - Prob. 83.3CCh. 8 - Prob. 83.4CCh. 8 - Prob. 83.5CCh. 8 - Prob. 83.6CCh. 8 - Prob. 83.7CCh. 8 - Prob. 83.8CCh. 8 - Prob. 83.9CCh. 8 - Prob. 84.1CCh. 8 - Prob. 84.2CCh. 8 - Prob. 84.3CCh. 8 - Prob. 84.4CCh. 8 - Prob. 84.5CCh. 8 - Comparative Analysis: Under Armour, Inc., versus...Ch. 8 - Prob. 84.7CCh. 8 - Prob. 84.8CCh. 8 - Prob. 85.1CCh. 8 - Prob. 85.2CCh. 8 - Prob. 85.3C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ratio Analysis Consider the following information taken from Chicago Water Slides (CWSs) financial statements: Also, CWSs operating cash flows were $25,658 and $29,748 in 2019 and 2018, respectively. Note: Round all answers to two decimal places. Required: 1. Calculate the current ratios for 2019 and 2018. 2. Calculate the quick ratios for 2019 and 2018. 3. Calculate the cash ratios for 2019 and 2018. 4. Calculate the operating cash flow ratios for 2019 and 2018. 5. CONCEPTUAL CONNECTION Provide some reasons why CWSs liquidity may be considered to be improving and some reasons why it may be worsening.arrow_forwardLiquidity Ratios NWAs financial statements contain the following information: Note: Round answers to two decimal places. Required: 1. What is its current ratio? 2. What is its quick ratio? 3. What is its cash ratio? 4. Discuss NWAs liquidity using these ratios.arrow_forwardRatios Analyses: McCormick Refer to the information for McCormick above. Additional information for 20X3 it as follows (amounts in millions): Required: Next Level Compute the following for 20X3. Provide a brief description of what each ratio reveals about McCormick 1. return on common equity 2. debt-to-assets 3. debt-toequity 4. current 5. quick (McCormick uses cash and equivalents, short-term securities and receivables in their quick ratio calculation.) 6. inventory turnover days 7. accounts receivable turnover days 8. accounts payable turnover days 9. operating cycle (in days) 10. total asset turnover Use the following information for 14-17 and 14-18: The Hershey Company is one of the worlds leading producers of chocolates, candies, and confections. It sells chocolates and candies, mints and gums, baking ingredients, toppings, and beverages. Hersheys consolidated balance sheets for 20X2 and 20X3 follow.arrow_forward

- Analyzing Cash Flow Ratios Meagan Enterprises reported the following information for the past year of operations:For each transaction, indicate whether the ratio will (I) increase, (D) decrease, or (N) have no effect. Transaction FreeCash Flow$400,000 Operating-Cash-Flow-to-Current Liabilities Ratio1.1 times Operating-Cash-Flow-to-Capital Expenditures Ratio5.0 times a. Recorded credit sales of $17,000 b. Collected $6,000 owed from customers c. Purchased $50,000 of equipment on long-term credit d. Purchased $70,000 of equipment for cash e. Paid $17,000 of wages with cash f. Recorded utility bill of $14,750 that has not been paidarrow_forwardNot Graded Analyzing Cash Flow RatiosMolly Enterprises reported the following information for the past year of operations:For each transaction, indicate whether the ratio will Increase, Decrease, or have No Effect. Transaction FreeCash Flow$250,000 Operating-Cash-Flow-to-Current Liabilities Ratio1.0 times Operating-Cash-Flow-to-Capital Expenditures Ratio3.0 times a. Recorded credit sales of $5,000 Answer Answer Answer b. Collected $3,000 owed from customers Answer Answer Answer c. Purchased $20,000 of equipment on long-term credit Answer Answer Answer d. Purchased $15,000 of equipment for cash Answer Answer Answer e. Paid $4,000 of wages with cash Answer Answer Answer f. Recorded utility bill of $1,500 that has not been paid Answer Answer Answerarrow_forwardMatch each of the following term with the corresponding description. Not all descriptions will be used._____ Operating activities_____ Indirect method_____ Cash equivalent_____ Investing activities_____ Direct method_____ Financing activitiesA. Measures the percent of net income that comes from high-margin products.B. Includes such events as the receipt of dividends and interest on investment assets.C. Includes assets that are very liquid and have original maturities of three months or less.D. The percent of total debt represented by a company's cash account.E. These activities include only purchases made with borrowed funds.F. Where cash flows from operating activities are calculated by converting each revenue and expense item from an accrual to a cash basis.G. This ratio multiplies net income by the average rate of interest the company receives on its investments.H. This ratio uses net income instead of operating cash flow to Analysis a company's ability to finance the cost of its…arrow_forward

- Using the Exhibit below, assume that the balance of Accounts Receivable was $61,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Receivable is $62,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts receivable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on…arrow_forwarda)Calculate the equity (total asset –total liability) to asset ratio of the bank (Hint: equity to asset ratio = total equity/total asset) b)Calculate the duration and convexity of the both asset and liability sides; c)If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio; d)In c)’s scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero duration and zero convexity) from the equity holders. How much cash does the bank need to raise? e)Do you agree with the following statement? Explain why.“The information about a bond’s duration and convexity adjustment is sufficient to quantify interest rate risk exposure.”arrow_forwardCan you explain how you got the figure for purchase of equipment (215,000) and also please answer the below multiple choice: The term cash as used on the statement of cash flows includes all the following EXCEPT: A) cash due from customers within 30 days. B) cash on hand. C) cash equivalents. D) cash in bank Which of the following statements accurately describes the statement of cash flows? A) It shows the relative proportion of debt and assets. B) It shows the link between accrual-based income and the cash reported on the balance sheet. C) It indicates when long-term debt will mature. D) It shows the link between book income and earnings per share. Which of the following is NOT a true statement about the statement of cash flows? A) It shows where cash came from and how it was spent. B) It reports why cash increased or decreased. C) It covers a specific span of time the same as the income statement. D) It shows how the profits or losses of the company were generated.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License