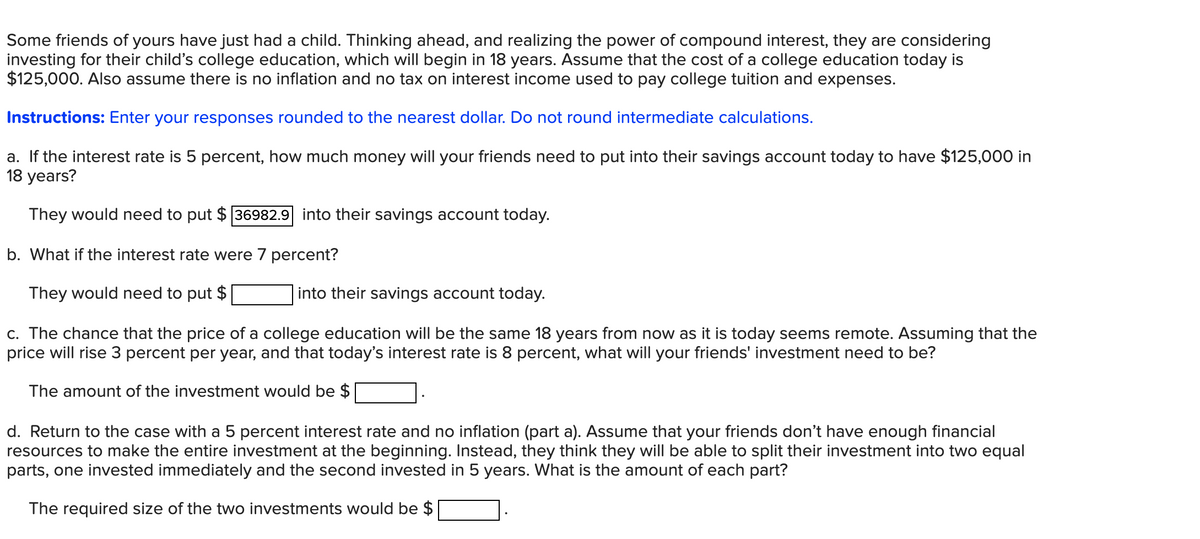

Some friends of yours have just had a child. Thinking ahead, and realizing the power of compound interest, they are considering investing for their child's college education, which will begin in 18 years. Assume that the cost of a college education today is $125,000. Also assume there is no inflation and no tax on interest income used to pay college tuition and expenses. Instructions: Enter your responses rounded to the nearest dollar. Do not round intermediate calculations. a. If the interest rate is 5 percent, how much money will your friends need to put into their savings account today to have $125,000 in 18 years? They would need to put $ 36982.9 into their savings account today. b. What if the interest rate were 7 percent? They would need to put $ into their savings account today. c. The chance that the price of a college education will be the same 18 years from now as it is today seems remote. Assuming that the price will rise 3 percent per year, and that today's interest rate is 8 percent, what will your friends' investment need to be? The amount of the investment would be $ [ d. Return to the case with a 5 percent interest rate and no inflation (part a). Assume that your friends don't have enough financial resources to make the entire investment at the beginning. Instead, they think they will be able to split their investment into two equal parts, one invested immediately and the second invested in 5 years. What is the amount of each part?

Some friends of yours have just had a child. Thinking ahead, and realizing the power of compound interest, they are considering investing for their child's college education, which will begin in 18 years. Assume that the cost of a college education today is $125,000. Also assume there is no inflation and no tax on interest income used to pay college tuition and expenses. Instructions: Enter your responses rounded to the nearest dollar. Do not round intermediate calculations. a. If the interest rate is 5 percent, how much money will your friends need to put into their savings account today to have $125,000 in 18 years? They would need to put $ 36982.9 into their savings account today. b. What if the interest rate were 7 percent? They would need to put $ into their savings account today. c. The chance that the price of a college education will be the same 18 years from now as it is today seems remote. Assuming that the price will rise 3 percent per year, and that today's interest rate is 8 percent, what will your friends' investment need to be? The amount of the investment would be $ [ d. Return to the case with a 5 percent interest rate and no inflation (part a). Assume that your friends don't have enough financial resources to make the entire investment at the beginning. Instead, they think they will be able to split their investment into two equal parts, one invested immediately and the second invested in 5 years. What is the amount of each part?

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter22: Inflation

Section: Chapter Questions

Problem 34P: The total price of purchasing a basket of goods in the United Kingdom over four years is: year...

Related questions

Question

Transcribed Image Text:Some friends of yours have just had a child. Thinking ahead, and realizing the power of compound interest, they are considering

investing for their child's college education, which will begin in 18 years. Assume that the cost of a college education today is

$125,000. Also assume there is no inflation and no tax on interest income used to pay college tuition and expenses.

Instructions: Enter your responses rounded to the nearest dollar. Do not round intermediate calculations.

a. If the interest rate is 5 percent, how much money will your friends need to put into their savings account today to have $125,000 in

18 years?

They would need to put $ 36982.9 into their savings account today.

b. What if the interest rate were 7 percent?

They would need to put $

into their savings account today.

c. The chance that the price of a college education will be the same 18 years from now as it is today seems remote. Assuming that the

price will rise 3 percent per year, and that today's interest rate is 8 percent, what will your friends' investment need to be?

The amount of the investment would be $

d. Return to the case with a 5 percent interest rate and no inflation (part a). Assume that your friends don't have enough financial

resources to make the entire investment at the beginning. Instead, they think they will be able to split their investment into two equal

parts, one invested immediately and the second invested in 5 years. What is the amount of each part?

The required size of the two investments would be $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax