Sophie is a single taxpayer. For the first payroll period in July 2020, she is paid wages of $2,200 monthly. Sophie claims one allowance on her pre-2020 Form W-4. Click here to access the withholding tables. IRS Publication 15-T, Federal Income Tax Withholding Method Pay period 2020 Allowance Amount Weekly $ 83 Biweekly 165 Semimonthly 179 Monthly 358 Quarterly 1,075 Semiannually 2,150 Annually 4,300 Round intermediate computations and your final answer to two decimal places. a. Use the percentage method to calculate the amount of Sophie's withholding for a monthly pay period. Sophie's withholding: b. Use the wage bracket method to determine the amount of Sophie's withholding for the same period.

Sophie is a single taxpayer. For the first payroll period in July 2020, she is paid wages of $2,200 monthly. Sophie claims one allowance on her pre-2020 Form W-4. Click here to access the withholding tables. IRS Publication 15-T, Federal Income Tax Withholding Method Pay period 2020 Allowance Amount Weekly $ 83 Biweekly 165 Semimonthly 179 Monthly 358 Quarterly 1,075 Semiannually 2,150 Annually 4,300 Round intermediate computations and your final answer to two decimal places. a. Use the percentage method to calculate the amount of Sophie's withholding for a monthly pay period. Sophie's withholding: b. Use the wage bracket method to determine the amount of Sophie's withholding for the same period.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 74APSA: Payroll Accounting Jet Enterprises has the following data available for its April 30, 2019, payroll:...

Related questions

Question

100%

Sophie is a single taxpayer. For the first payroll period in July 2020, she is paid wages of $2,200 monthly. Sophie claims one allowance on her pre-2020 Form W-4.

Click here to access the withholding tables.

IRS Publication 15-T, Federal Income Tax Withholding Method

| Pay period | 2020 Allowance Amount | |

| Weekly | $ 83 | |

| Biweekly | 165 | |

| Semimonthly | 179 | |

| Monthly | 358 | |

| Quarterly | 1,075 | |

| Semiannually | 2,150 | |

| Annually | 4,300 |

Round intermediate computations and your final answer to two decimal places.

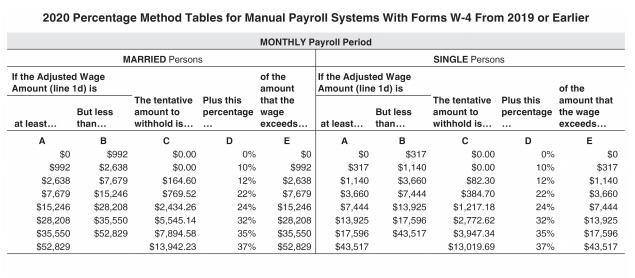

a. Use the percentage method to calculate the amount of Sophie's withholding for a monthly pay period.

Sophie's withholding:

b. Use the wage bracket method to determine the amount of Sophie's withholding for the same period.

Transcribed Image Text:2020 Percentage Method Tables for Manual Payroll Systems With Forms w-4 From 2019 or Earlier

MONTHLY Payroll Period

MARRIED Persons

SINGLE Persons

If the Adjusted Wage

Amount (line 1d) is

If the Adjusted Wage

Amount (line 1d) is

of the

amount

of the

The tentative Plus this

that the

The tentative Plus this

amount that

But less

But less

percentage the wage

exceeds...

amount to

percentage wage

amount to

at least...

than...

withhold is... .

exceeds...

at least... than...

withhold is...

A

в

D.

E

A

в

D

E

$0

$992

$0.00

0%

$0

$0

$317

$0.00

0%

$0

S992

$2,638

$0.00

10%

$992

$317

$1,140

s0.00

10%

$317

$2,638

$7,679

S164.60

12%

$2,638

$1,140

$3,660

s82.30

12%

$1,140

$7,679

$15,246

S769.52

22%

$7,679

$3,660

$7,444

$384.70

22%

$3,660

$15,246

$28,208

$2,434.26

24%

$15,246

$28,208

$7,444

$13,925

$1,217.18

24%

$7,444

$35,550

$52,829

S28,208

$5,545.14

32%

$13,925

$17,596

$2,772.62

32%

$13,925

S35,550

$7,894.58

35%

$35,550

$17,596

$43,517

$3,947.34

35%

$17,596

$52,829

$13,942.23

37%

$52,829

$43,517

$13,019.69

37%

$43,517

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning