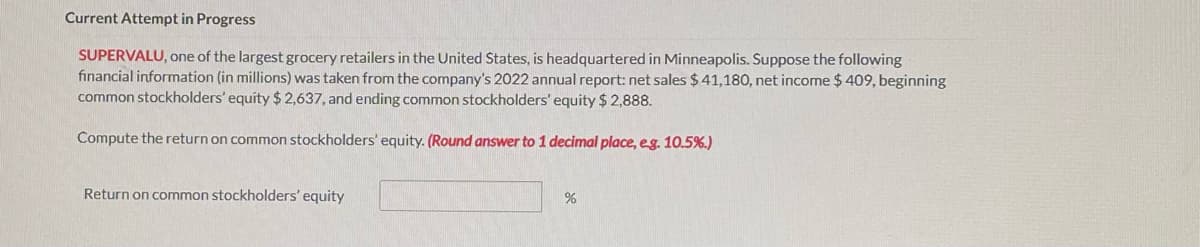

SUPERVALU, one of the largest grocery retailers in the United States, is headquartered in Minneapolis. Suppose the following financial information (in millions) was taken from the company's 2022 annual report: net sales $41,180, net income $ 409, beginning common stockholders' equity $ 2,637, and ending common stockholders' equity $2,888. Compute the return on common stockholders' equity. (Round answer to 1 decimal place, eg. 10.5%.)

SUPERVALU, one of the largest grocery retailers in the United States, is headquartered in Minneapolis. Suppose the following financial information (in millions) was taken from the company's 2022 annual report: net sales $41,180, net income $ 409, beginning common stockholders' equity $ 2,637, and ending common stockholders' equity $2,888. Compute the return on common stockholders' equity. (Round answer to 1 decimal place, eg. 10.5%.)

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 26E

Related questions

Question

Answer question completely

Transcribed Image Text:Current Attempt in Progress

SUPERVALU, one of the largest grocery retailers in the United States, is headquartered in Minneapolis. Suppose the following

financial information (in millions) was taken from the company's 2022 annual report: net sales $41,180, net income $ 409, beginning

common stockholders' equity $ 2,637, and ending common stockholders' equity $ 2,888.

Compute the return on common stockholders' equity. (Round answer to 1 decimal place, eg. 10.5%.)

Return on common stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning