Suppose a closed economy with no government spending or taxing is capable of producing an output of $1900 at full employment. Suppose also that autonomous consumption is $100, intended investment is $90, and the mpc is 0.50. How much additional autonomous spending (for instance, from the government) is needed to move the economy to full employment?

Suppose a closed economy with no government spending or taxing is capable of producing an output of $1900 at full employment. Suppose also that autonomous consumption is $100, intended investment is $90, and the mpc is 0.50. How much additional autonomous spending (for instance, from the government) is needed to move the economy to full employment?

Chapter8: The Keynesian Model

Section: Chapter Questions

Problem 5SQ

Related questions

Question

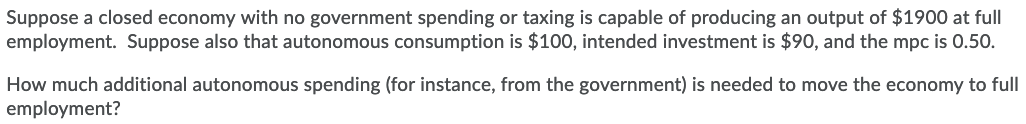

Transcribed Image Text:Suppose a closed economy with no government spending or taxing is capable of producing an output of $1900 at full

employment. Suppose also that autonomous consumption is $100, intended investment is $90, and the mpc is 0.50.

How much additional autonomous spending (for instance, from the government) is needed to move the economy to full

employment?

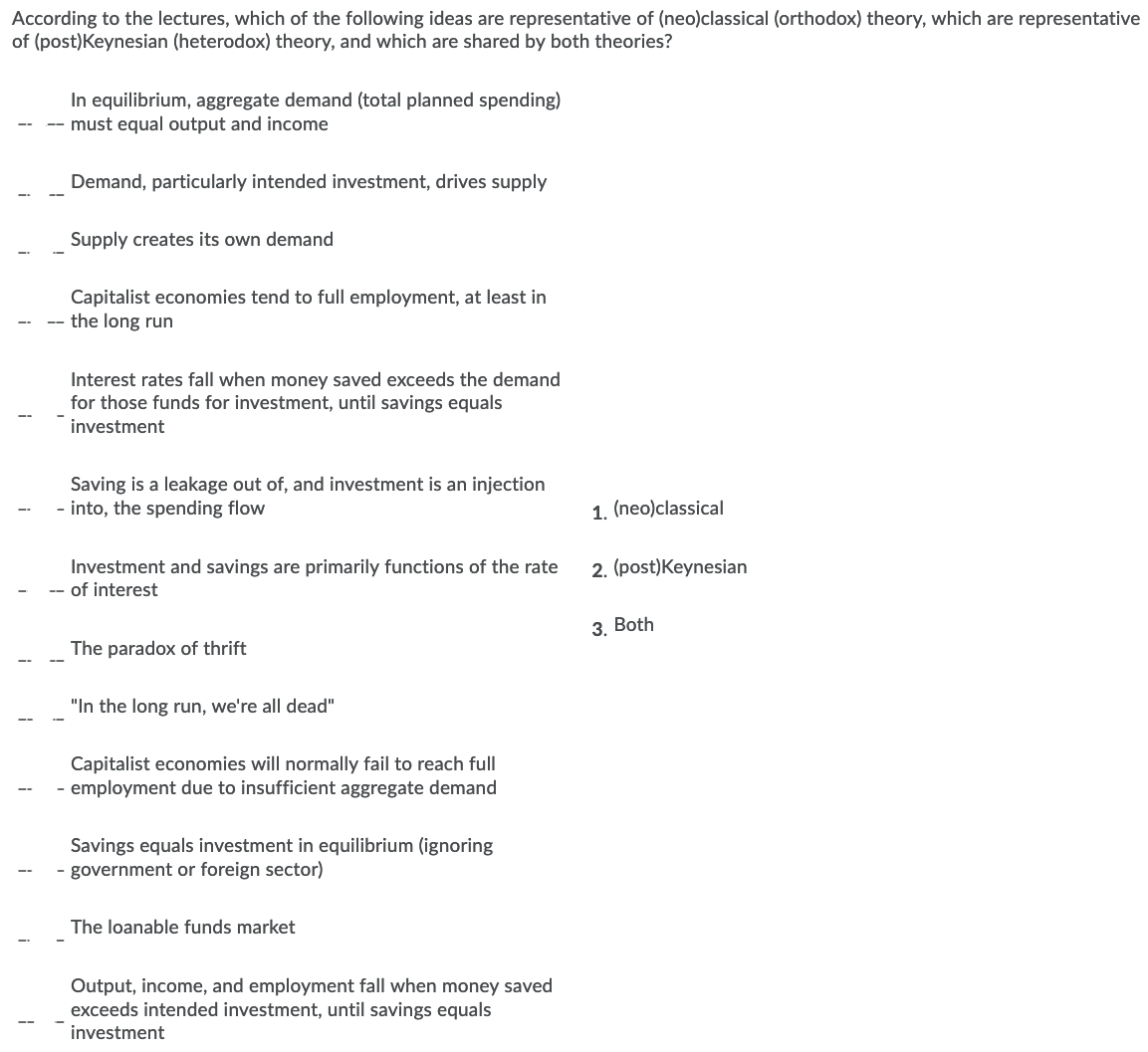

Transcribed Image Text:According to the lectures, which of the following ideas are representative of (neo)classical (orthodox) theory, which are representative

of (post)Keynesian (heterodox) theory, and which are shared by both theories?

In equilibrium, aggregate demand (total planned spending)

-- must equal output and income

Demand, particularly intended investment, drives supply

Supply creates its own demand

Capitalist economies tend to full employment, at least in

-- the long run

Interest rates fall when money saved exceeds the demand

for those funds for investment, until savings equals

investment

Saving is a leakage out of, and investment is an injection

- into, the spending flow

1. (neo)classical

Investment and savings are primarily functions of the rate

-- of interest

2. (post)Keynesian

3. Both

The paradox of thrift

"In the long run, we're all dead"

Capitalist economies will normally fail to reach full

- employment due to insufficient aggregate demand

Savings equals investment in equilibrium (ignoring

government or foreign sector)

The loanable funds market

Output, income, and employment fall when money saved

exceeds intended investment, until savings equals

investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning