Suppose Charles would like to use $4,000 of his savings to make a financial investment. One way of making a financial investment is to purchase stock or bonds from a private company. Suppose TouchTech, a hand-held computing firm, is selling stocks to raise money for a new lab-a practice known as finance. Buying a share of TouchTech stock would give Charles ▼ the firm. In the event that Touch Tech runs into financial difficulty, ▼ will be paid first.

Suppose Charles would like to use $4,000 of his savings to make a financial investment. One way of making a financial investment is to purchase stock or bonds from a private company. Suppose TouchTech, a hand-held computing firm, is selling stocks to raise money for a new lab-a practice known as finance. Buying a share of TouchTech stock would give Charles ▼ the firm. In the event that Touch Tech runs into financial difficulty, ▼ will be paid first.

Chapter13: Capital, Interest, Entrepreneurship, And Corporate Finance

Section: Chapter Questions

Problem 4.8P

Related questions

Question

Transcribed Image Text:1. Financial institutions in the U.S. economy

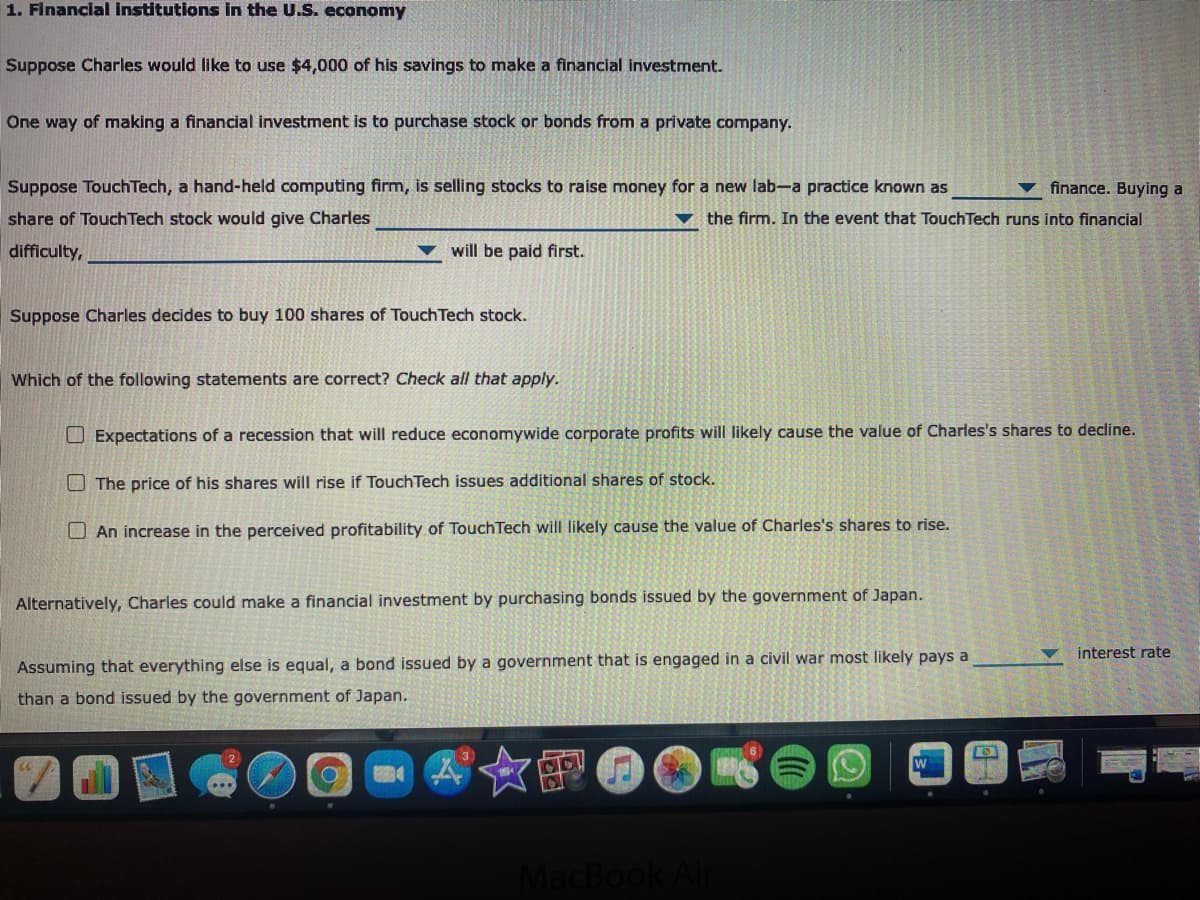

Suppose Charles would like to use $4,000 of his savings to make a financial investment.

One way of making a financial investment is to purchase stock or bonds from a private company.

Suppose Touch Tech, a hand-held computing firm, is selling stocks to raise money for a new lab-a practice known as

v finance. Buying a

share of Touch Tech stock would give Charles

vthe firm. In the event that TouchTech runs into financial

difficulty,

▼ will be paid first.

Suppose Charles decides to buy 100 shares of Touch Tech stock.

Which of the following statements are correct? Check all that apply.

O Expectations of a recession that will reduce economywide corporate profits will likely cause the value of Charles's shares to decline.

O The price of his shares will rise if TouchTech issues additional shares of stock.

O An increase in the perceived profitability of TouchTech will likely cause the value of Charles's shares to rise.

Alternatively, Charles could make a financial investment by purchasing bonds issued by the government of Japan.

interest rate

Assuming that everything else is equal, a bond issued by a government that is engaged in a civil war most likely pays a

than a bond issued by the government of Japan.

MacBook

Expert Solution

Step 1

Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a time so we are answering the first three as you have not mentioned which of these you are looking for. Please re-submit the question separately for the remaining sub-parts.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning