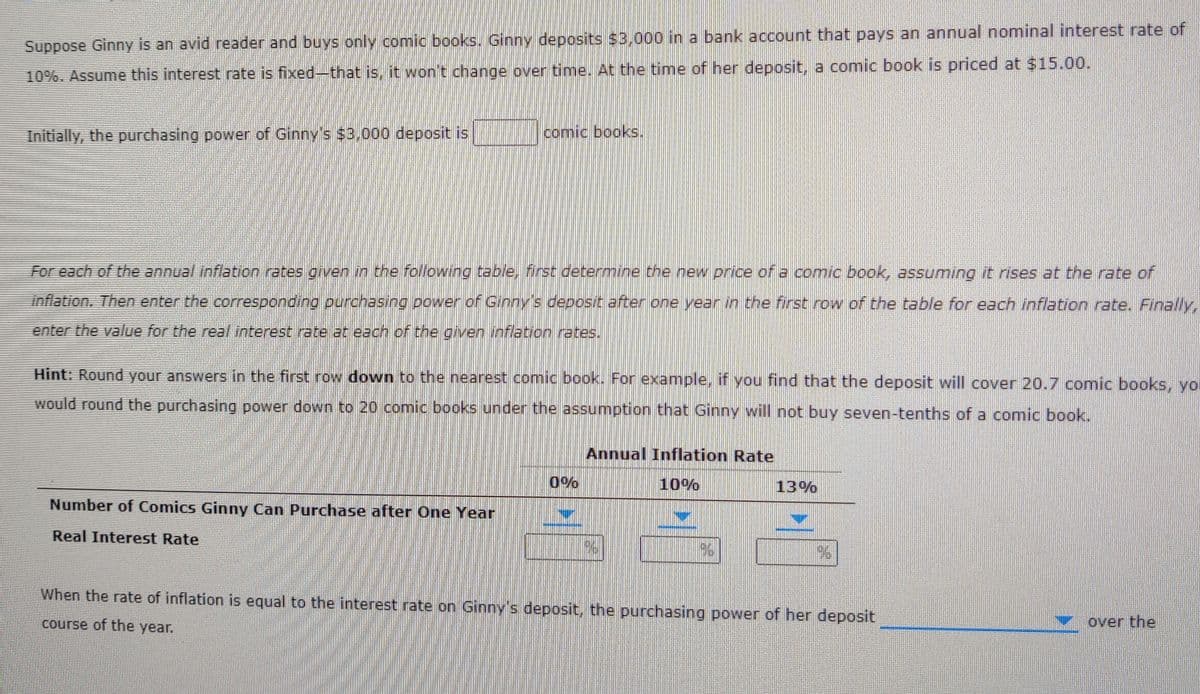

Suppose Ginny is an avid reader and buys only comic books. Ginny deposits $3,000 in a bank account that pays an annual nominal interest rate 10%. Assume this interest rate is fixed-that is, it won't change over time. At the time of her deposit, a comic book is priced at $15.00. Initially, the purchasing power of Ginny's $3,000 deposit is comic books. For each of the annual inflation rates given in the following table, first determine the new price of a comic book, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Ginny's deposit after one year in the first row of the table for each inflation rate. Fina enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest comic book. For example, if you find that the deposit will cover 20.7 comic books, would round the purchasing power down to 20 comic books under the assumption that Ginny will not buy seven-tenths of a comic book. Annual Inflation Rate 0% 10% 13% Number of Comics Ginny Can Purchase after One Year Real Interest Rate When the rate of inflation is equal to the interest rate on Ginny's deposit, the purchasing power of her deposit course of the year. over the

Suppose Ginny is an avid reader and buys only comic books. Ginny deposits $3,000 in a bank account that pays an annual nominal interest rate 10%. Assume this interest rate is fixed-that is, it won't change over time. At the time of her deposit, a comic book is priced at $15.00. Initially, the purchasing power of Ginny's $3,000 deposit is comic books. For each of the annual inflation rates given in the following table, first determine the new price of a comic book, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Ginny's deposit after one year in the first row of the table for each inflation rate. Fina enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest comic book. For example, if you find that the deposit will cover 20.7 comic books, would round the purchasing power down to 20 comic books under the assumption that Ginny will not buy seven-tenths of a comic book. Annual Inflation Rate 0% 10% 13% Number of Comics Ginny Can Purchase after One Year Real Interest Rate When the rate of inflation is equal to the interest rate on Ginny's deposit, the purchasing power of her deposit course of the year. over the

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter2: The One Lesson Of Business

Section: Chapter Questions

Problem 2.6IP

Related questions

Question

Transcribed Image Text:Suppose Ginny is an avid reader and buys only comic books. Ginny deposits $3.000 in a bank account that pays an annual nominal interest rate of

10%. Assume this interest rate is fixed-that is, it won't change over time. At the time of her deposit, a comic book is priced at $15.00.

Initially, the purchasing power of Ginny's $3,000 deposit is

comic books.

For each of the annual inflation rates given in the following table, first determine the new price of a comic book, assuming it rises at the rate of

inflation. Then enter the corresponding ourchasing power of Cinny's deposit ater one vear in the first row of the table for each inflation rate. Finally,

enter the value for the real interest rate at each of the given inflation rates.

Hint: Round your answers in the first row down to the nearest comic book. For example, if you find that the deposit will cover 20.7 comic books, yor

would round the purchasing power down to 20 comic books under the assumption that Ginny will not buy seven-tenths of a comic book.

Annual Inflation Rate

0%

10%

13%

Number of Comics Ginny Can Purchase after One Year

Real Interest Rate

When the rate of inflation is equal to the interest rate on Ginny's deposit, the purchasing power of her deposit

course of the year.

over the

Expert Solution

Step 1

Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a time so we are answering the first three as you have not mentioned which of these you are looking for. Please re-submit the question separately for the remaining sub-parts.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax