Suppose instead the government imposes the $3 tax on top of the posted price (i.e. paid by consumers). What is the new equilibrium posted price? How much do the consumers pay for each unit of the good? What is the new market equilibrium quantity? How does consumer surplus and producer surplus compare to those in part (c)? Suppose instead of the tax, the government limits quantity produced to be no more than 36 units. Imagine that in order to produce the good, firms must get permission from the government; the government can thus restrict total production by withholding permissions. What will be the equilibrium price in this scenario? Compare this policy, in terms of how it impacts producers and consumers, to the tax. What would producers prefer, the quantity restriction or the tax?

Suppose instead the government imposes the $3 tax on top of the posted price (i.e. paid by consumers). What is the new equilibrium posted price? How much do the consumers pay for each unit of the good? What is the new market equilibrium quantity? How does consumer surplus and producer surplus compare to those in part (c)? Suppose instead of the tax, the government limits quantity produced to be no more than 36 units. Imagine that in order to produce the good, firms must get permission from the government; the government can thus restrict total production by withholding permissions. What will be the equilibrium price in this scenario? Compare this policy, in terms of how it impacts producers and consumers, to the tax. What would producers prefer, the quantity restriction or the tax?

Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781305971509

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter7: Consumers, Producers, And The Efficiency Of Markets

Section: Chapter Questions

Problem 6PA

Related questions

Question

Solve part d and e

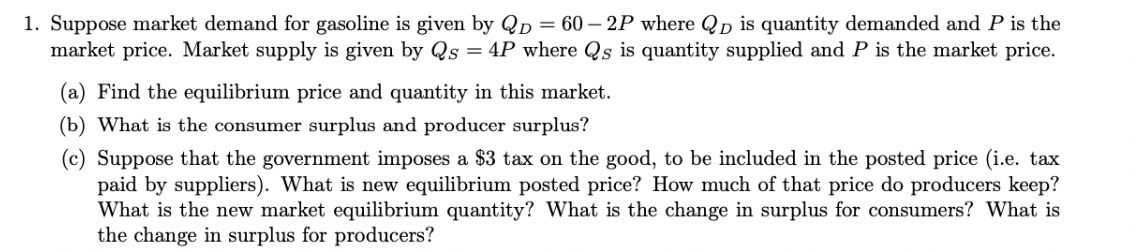

Transcribed Image Text:1. Suppose market demand for gasoline is given by QD = 60-2P where QD is quantity demanded and P is the

market price. Market supply is given by Qs = 4P where Qs is quantity supplied and P is the market price.

(a) Find the equilibrium price and quantity in this market.

(b) What is the consumer surplus and producer surplus?

(c) Suppose that the government imposes a $3 tax on the good, to be included in the posted price (i.e. tax

paid by suppliers). What is new equilibrium posted price? How much of that price do producers keep?

What is the new market equilibrium quantity? What is the change in surplus for consumers? What is

the change in surplus for producers?

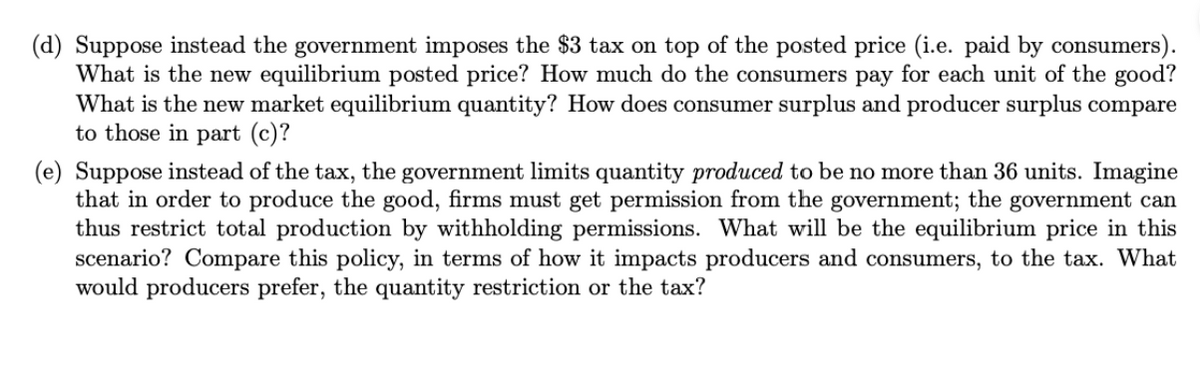

Transcribed Image Text:(d) Suppose instead the government imposes the $3 tax on top of the posted price (i.e. paid by consumers).

What is the new equilibrium posted price? How much do the consumers pay for each unit of the good?

What is the new market equilibrium quantity? How does consumer surplus and producer surplus compare

to those in part (c)?

(e) Suppose instead of the tax, the government limits quantity produced to be no more than 36 units. Imagine

that in order to produce the good, firms must get permission from the government; the government can

thus restrict total production by withholding permissions. What will be the equilibrium price in this

scenario? Compare this policy, in terms of how it impacts producers and consumers, to the tax. What

would producers prefer, the quantity restriction or the tax?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning