Suppose Interest rates are 3 percent in Japan and 6 percent in Canada. The current value of the exchange rate is 110 Japanese yen per dollar, and it is generally expected that in one year the exchange rate will be 106 7 yen per dollar. However, new information is released that changes everyone's expectations, and they think the exchange rate in one year will still be 110 yen per dollar. As a result of this change, OA the demand for Canadian dollars increases B. the supply of Canadian dollars decreases OC. people will borrow in Canada and lend in Japan OD the demand for Canadian dollars decreates OE. Aand B

Suppose Interest rates are 3 percent in Japan and 6 percent in Canada. The current value of the exchange rate is 110 Japanese yen per dollar, and it is generally expected that in one year the exchange rate will be 106 7 yen per dollar. However, new information is released that changes everyone's expectations, and they think the exchange rate in one year will still be 110 yen per dollar. As a result of this change, OA the demand for Canadian dollars increases B. the supply of Canadian dollars decreases OC. people will borrow in Canada and lend in Japan OD the demand for Canadian dollars decreates OE. Aand B

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter13: Open-economy Macroeconomics: Basic Concepts

Section: Chapter Questions

Problem 9PA

Related questions

Question

3

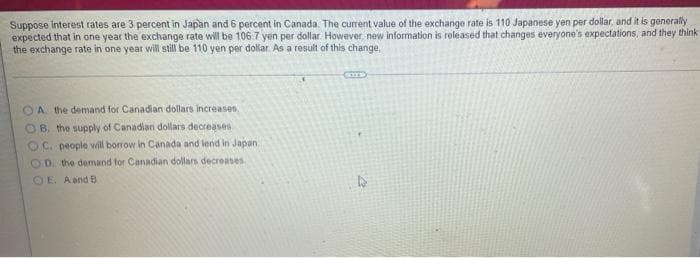

Transcribed Image Text:Suppose Interest rates are 3 percent in Japan and 6 percent in Canada. The current value of the exchange rate is 110 Japanese yen per dollar, and it is generally

expected that in one year the exchange rate will be 106.7 yen per dollar However, new information is released that changes everyone's expectations, and they think

the exchange rate in one year wil still be 110 yen per dollar. As a result of this change,

OA the demand for Canadian dollars increases

OB. the supply of Canadian dollars decreases

OC. people will borrow in Canada and lend in Japan

OD. the demand for Canadian dollars decreases

OE. A and B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning