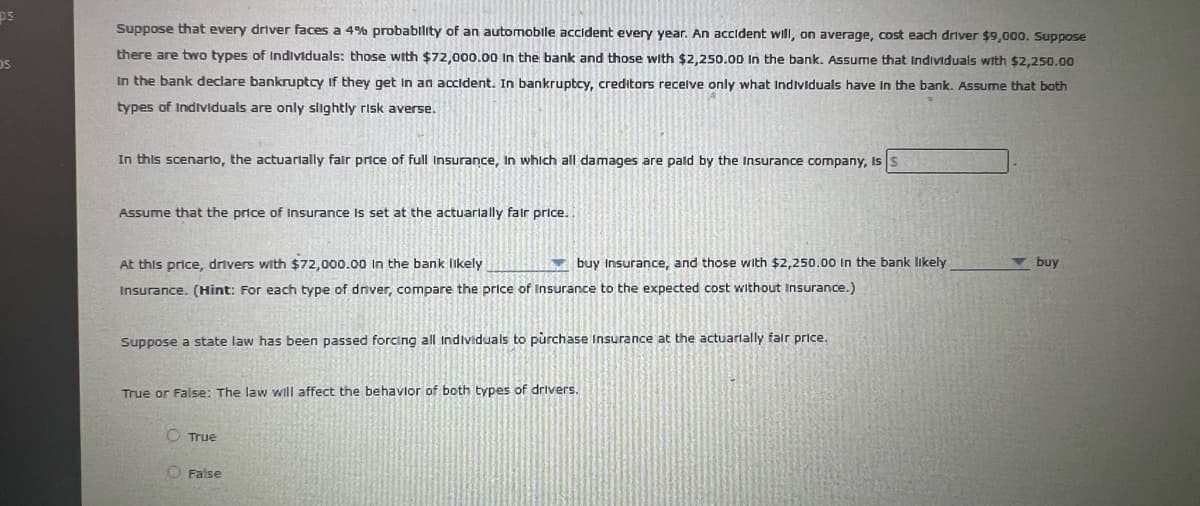

Suppose that every driver faces a 4% probability of an automoblle accident every year. An accident will, on average, cost each driver $9,000. Suppose there are two types of Individuals: those with $72,000.00 In the bank and those with $2,250.00 In the bank. Assume that Individuals with $2,250.00 In the bank declare bankruptcy If they get in an acident. In bankruptcy, creditors recelve only what Individuals have In the bank. Assume that both types of Individuals are only slightly risk averse. In this scenario, the actuarially fair price of full Insurance, In which all damages are pald by the Insurance company, Is Assume that the price of Insurance Is set at the actuarially fair price. At this price, drivers with $72,000.00 in the bank likely buy Insurance, and those with $2,250.00 In the bank likely v buy Insurance. (Hint: For each type of dnver, compare the price of Insurance to the expected cost without Insurance.) Suppose a state law has been passed forcing all individuals to purchase Insurance at the actuarlally falr price. True or False: The law will affect the behavlor of both types of drivers. O True O False

Suppose that every driver faces a 4% probability of an automoblle accident every year. An accident will, on average, cost each driver $9,000. Suppose there are two types of Individuals: those with $72,000.00 In the bank and those with $2,250.00 In the bank. Assume that Individuals with $2,250.00 In the bank declare bankruptcy If they get in an acident. In bankruptcy, creditors recelve only what Individuals have In the bank. Assume that both types of Individuals are only slightly risk averse. In this scenario, the actuarially fair price of full Insurance, In which all damages are pald by the Insurance company, Is Assume that the price of Insurance Is set at the actuarially fair price. At this price, drivers with $72,000.00 in the bank likely buy Insurance, and those with $2,250.00 In the bank likely v buy Insurance. (Hint: For each type of dnver, compare the price of Insurance to the expected cost without Insurance.) Suppose a state law has been passed forcing all individuals to purchase Insurance at the actuarlally falr price. True or False: The law will affect the behavlor of both types of drivers. O True O False

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.5P

Related questions

Question

Transcribed Image Text:ps

Suppose that every driver faces a 4% probability of an automoblle accident every year. An accident will, on average, cost each driver $9,000. Suppose

there are two types of Individuals: those with $72,000.00 In the bank and those with $2,250.00 In the bank. Assume that Individuals with $2,250.00

In the bank declare bankruptcy If they get in an accldent. In bankruptcy, creditors recelve only what Individuals have In the bank. Assume that both

types of Indtviduals are only slightly risk averse.

In this scenarto, the actuarially fair price of full Insurance, In which all damages are pald by the Insurance company, Is

Assume that the price of Insurance Is set at the actuarlally falr price.

At this price, drivers with $72,000.00 in the bank likely

buy Insurance, and those with $2,250,00 In the bank likely

v buy

Insurance. (Hint: For each type of dnver, compare the price of Insurance to the expected cost without Insurance.)

Suppose a state law has been passed forcing all Individuals to purchase Insurance at the actuarlally falr price.

True or False: The law will affect the behavlor of both types of drivers.

O True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax