Aggregate Demand I: Building the IS LM Model-End of Chapter Problem Although our development of the Keynesian cross in this chapter assumes that taxes are a fixed armunt, most countries levy some taxes that rise automatically with national income. Let's represent this type of tax system by writing tax revenue (7) as T=7*+tY, where Y is income, 7 is a lump-sum tax, and t is the marginal tax rate. When income rises by $1, the value of new taxes collected is tx$1. Use this information to answer the next three questions. a. How does this type of tax system change the way consumption responds to changes in GDP? The effect of an increase in income on consumption is b. In the Keynesian cross, how does this tax system alter the government-purchases multiplier? The government-purchases multiplier becomes In the IS LM model, how does this tax system alter the slope of the IS curve? Activat Go to Set tion in the interest rate now has a impact on real output, making The IS curve

Aggregate Demand I: Building the IS LM Model-End of Chapter Problem Although our development of the Keynesian cross in this chapter assumes that taxes are a fixed armunt, most countries levy some taxes that rise automatically with national income. Let's represent this type of tax system by writing tax revenue (7) as T=7*+tY, where Y is income, 7 is a lump-sum tax, and t is the marginal tax rate. When income rises by $1, the value of new taxes collected is tx$1. Use this information to answer the next three questions. a. How does this type of tax system change the way consumption responds to changes in GDP? The effect of an increase in income on consumption is b. In the Keynesian cross, how does this tax system alter the government-purchases multiplier? The government-purchases multiplier becomes In the IS LM model, how does this tax system alter the slope of the IS curve? Activat Go to Set tion in the interest rate now has a impact on real output, making The IS curve

Chapter11: Managing Aggregate Demand: Fiscal Policy

Section: Chapter Questions

Problem 5DQ

Related questions

Question

5

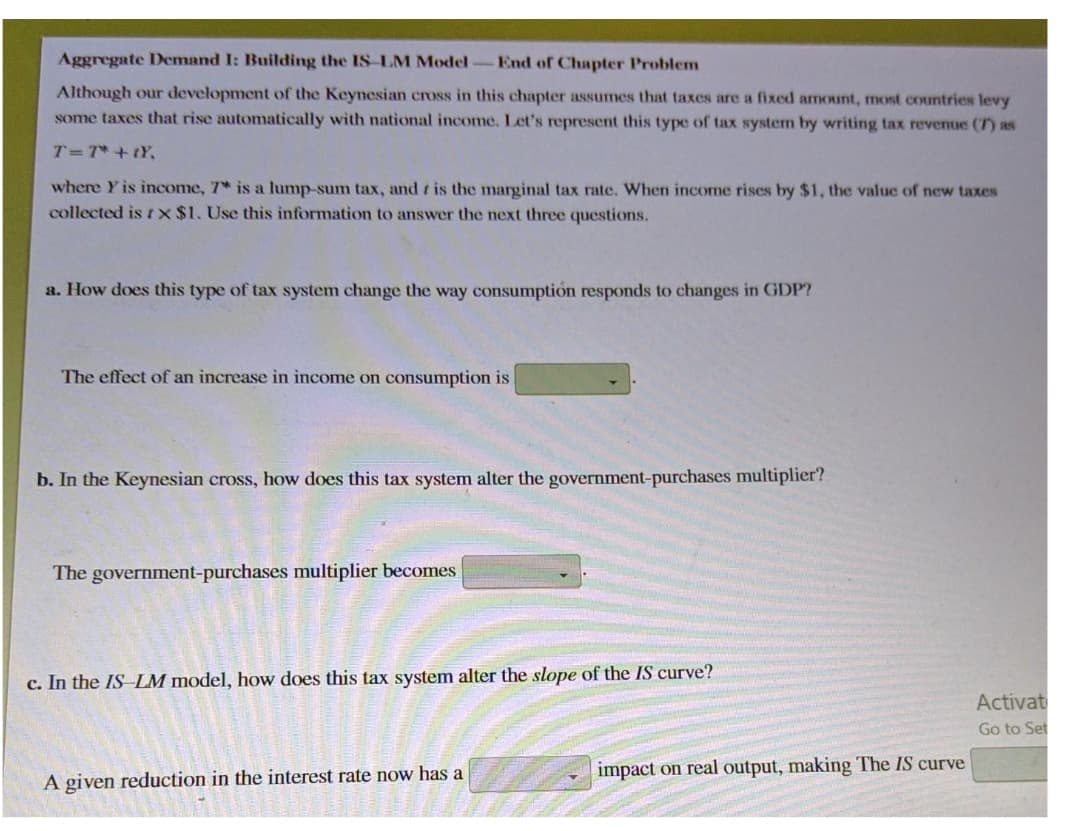

Transcribed Image Text:Aggregate Demand I: Building the IS-LM Model-End of Chapter Problem

Although our development of the Keynesian cross in this chapter assumes that taxes are a fixed armount, most countries levy

some taxes that rise automatically with national income. Let's represent this type of tax system by writing tax revenue (7) as

T=7* +tY,

where Y is income, 7* is a lump-sum tax, and t is the marginal tax rate. When income rises by $1, the value of new taxes

collected is t X $1. Use this information to answer the next three questions.

a. How does this type of tax system change the way consumption responds to changes in GDP?

The effect of an increase in income on consumption is

b. In the Keynesian cross, how does this tax system alter the government-purchases multiplier?

The government-purchases multiplier becomes

c. In the IS LM model, how does this tax system alter the slope of the IS curve?

Activat

Go to Set

impact on real output, making The IS curve

A given reduction in the interest rate now has a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning