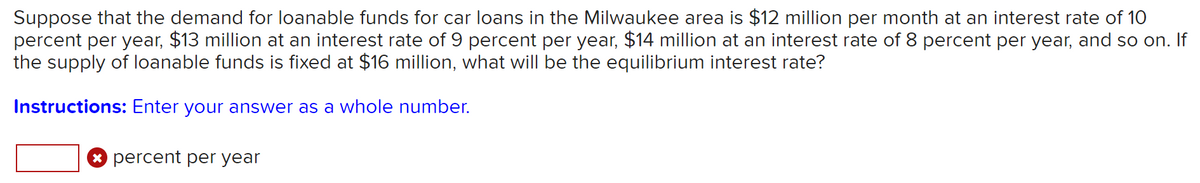

Suppose that the demand for loanable funds for car loans in the Milwaukee area is $12 million per month at an interest rate of 10 percent per year, $13 million at an interest rate of 9 percent per year, $14 million at an interest rate of 8 percent per year, and so on. If the supply of loanable funds is fixed at $16 million, what will be the equilibrium interest rate? Instructions: Enter your answer as a whole number. * percent per year

Suppose that the demand for loanable funds for car loans in the Milwaukee area is $12 million per month at an interest rate of 10 percent per year, $13 million at an interest rate of 9 percent per year, $14 million at an interest rate of 8 percent per year, and so on. If the supply of loanable funds is fixed at $16 million, what will be the equilibrium interest rate? Instructions: Enter your answer as a whole number. * percent per year

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.2P

Related questions

Question

100%

Transcribed Image Text:Suppose that the demand for loanable funds for car loans in the Milwaukee area is $12 million per month at an interest rate of 10

percent per year, $13 million at an interest rate of 9 percent per year, $14 million at an interest rate of 8 percent per year, and so on. If

the supply of loanable funds is fixed at $16 million, what will be the equilibrium interest rate?

Instructions: Enter your answer as a whole number.

* percent per year

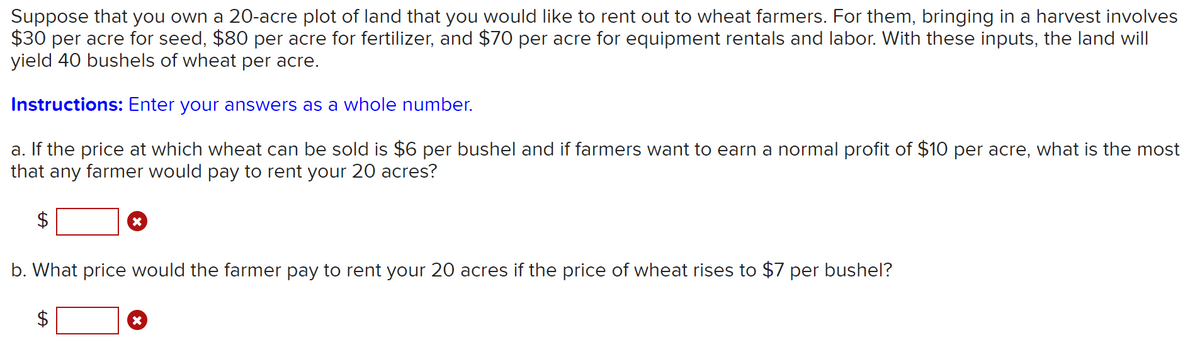

Transcribed Image Text:Suppose that you own a 20-acre plot of land that you would like to rent out to wheat farmers. For them, bringing in a harvest involves

$30 per acre for seed, $80 per acre for fertilizer, and $70 per acre for equipment rentals and labor. With these inputs, the land will

yield 40 bushels of wheat per acre.

Instructions: Enter your answers as a whole number.

a. If the price at which wheat can be sold is $6 per bushel and if farmers want to earn a normal profit of $10 per acre, what is the most

that any farmer would pay to rent your 20 acres?

$

b. What price would the farmer pay to rent your 20 acres if the price of wheat rises to $7 per bushel?

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning