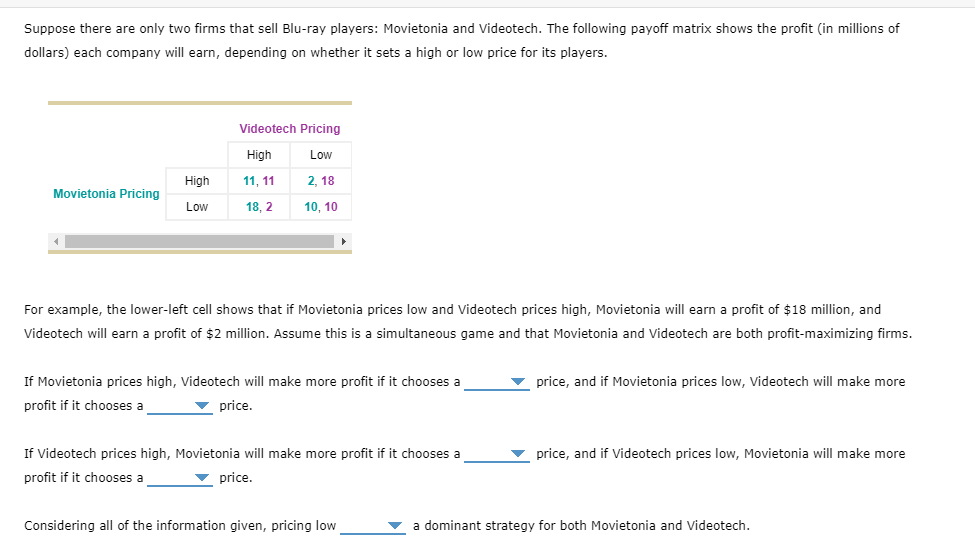

Suppose there are only two firms that sell Blu-ray players: Movietonia and Videotech. The following payoff matrix shows the profit (in millions of dollars) each company will earn, depending on whether it sets a high or low price for its players. Videotech Pricing High Low High 11, 11 2, 18 Movietonia Pricing Low 18, 2 10, 10 For example, the lower-left cell shows that if Movietonia prices low and Videotech prices high, Movietonia will earn a profit of $18 million, and Videotech will earn a profit of $2 million. Assume this is a simultaneous game and that Movietonia and Videotech are both profit-maximizing firms. If Movietonia prices high, Videotech will make more profit if it chooses a price, and if Movietonia prices low, Videotech will make more profit if it chooses a price. If Videotech prices high, Movietonia will make more profit if it chooses a price, and if Videotech prices low, Movietonia will make more profit if it chooses a price. Considering all of the information given, pricing low a dominant strategy for both Movietonia and Videotech.

Suppose there are only two firms that sell Blu-ray players: Movietonia and Videotech. The following payoff matrix shows the profit (in millions of dollars) each company will earn, depending on whether it sets a high or low price for its players. Videotech Pricing High Low High 11, 11 2, 18 Movietonia Pricing Low 18, 2 10, 10 For example, the lower-left cell shows that if Movietonia prices low and Videotech prices high, Movietonia will earn a profit of $18 million, and Videotech will earn a profit of $2 million. Assume this is a simultaneous game and that Movietonia and Videotech are both profit-maximizing firms. If Movietonia prices high, Videotech will make more profit if it chooses a price, and if Movietonia prices low, Videotech will make more profit if it chooses a price. If Videotech prices high, Movietonia will make more profit if it chooses a price, and if Videotech prices low, Movietonia will make more profit if it chooses a price. Considering all of the information given, pricing low a dominant strategy for both Movietonia and Videotech.

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter17: Oligopoly

Section: Chapter Questions

Problem 9PA

Related questions

Question

100%

2. Using a payoff matrix to determine the equilibrium outcome

Please help

Transcribed Image Text:Suppose there are only two firms that sell Blu-ray players: Movietonia and Videotech. The following payoff matrix shows the profit (in millions of

dollars) each company will earn, depending on whether it sets a high or low price for its players.

Videotech Pricing

High

Low

High

11, 11

2, 18

Movietonia Pricing

Low

18, 2

10, 10

For example, the lower-left cell shows that if Movietonia prices low and Videotech prices high, Movietonia will earn a profit of $18 million, and

Videotech will earn a profit of $2 million. Assume this is a simultaneous game and that Movietonia and Videotech are both profit-maximizing firms.

If Movietonia prices high, Videotech will make more profit if it chooses a

v price, and

Movietonia prices low, Videotech will make more

profit if it chooses a

v price.

If Videotech prices high, Movietonia will make more profit if it chooses a

v price, and if Videotech prices low, Movietonia will make more

profit if it chooses a

v price.

Considering all of the information given, pricing low

v a dominant strategy for both Movietonia and Videotech.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning