Suppose you are an economist at the US Army Corps of Engineers. The Corps is considering whether to build a dam (such as the Kinzua Dam) to prevent flooding on a major river. The Corps asks you to conduct a cost benefit analysis of the project. The dam is expected to be in service for over 100 years, so you can assume the time horizon is essentially infinite. You have the following information: Estimated costs: • $1 billion in construction costs in the first year $10 million in maintenance costs every year, forever Estimated benefits: • $20 million in property damage avoided every year, forever • 3 flooding deaths prevented every year, forever la. Assumer-3% and the value of a statistical life is $10 million. Calculate the present value of net benefits for the dam. Do you recommend that the project be approved? 1b. Assume the VSL is still $10 million. How big would the discount rate have to be to change your recommendation of the dam's approval? (In other words, find r such that the present value of net benefits is zero)

Suppose you are an economist at the US Army Corps of Engineers. The Corps is considering whether to build a dam (such as the Kinzua Dam) to prevent flooding on a major river. The Corps asks you to conduct a cost benefit analysis of the project. The dam is expected to be in service for over 100 years, so you can assume the time horizon is essentially infinite. You have the following information: Estimated costs: • $1 billion in construction costs in the first year $10 million in maintenance costs every year, forever Estimated benefits: • $20 million in property damage avoided every year, forever • 3 flooding deaths prevented every year, forever la. Assumer-3% and the value of a statistical life is $10 million. Calculate the present value of net benefits for the dam. Do you recommend that the project be approved? 1b. Assume the VSL is still $10 million. How big would the discount rate have to be to change your recommendation of the dam's approval? (In other words, find r such that the present value of net benefits is zero)

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter1: Introduction And Goals Of The Firm

Section: Chapter Questions

Problem 4E: In the Southern Company Managerial Challenge, which alternative for complying with the Clean Air Act...

Related questions

Question

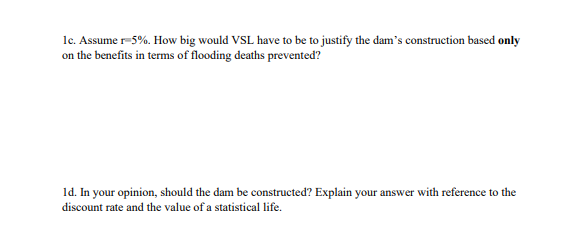

Transcribed Image Text:1c. Assume r-5%. How big would VSL have to be to justify the dam's construction based only

on the benefits in terms of flooding deaths prevented?

1d. In your opinion, should the dam be constructed? Explain your answer with reference to the

discount rate and the value of a statistical life.

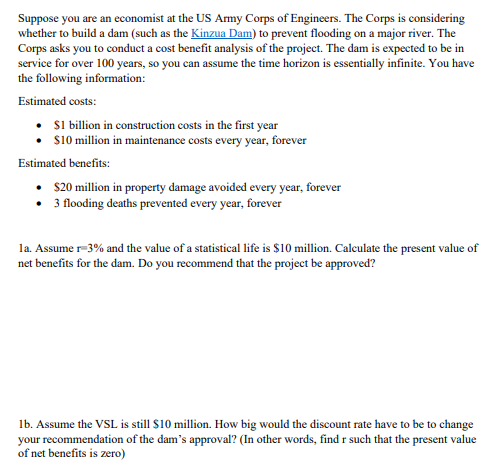

Transcribed Image Text:Suppose you are an economist at the US Army Corps of Engineers. The Corps is considering

whether to build a dam (such as the Kinzua Dam) to prevent flooding on a major river. The

Corps asks you to conduct a cost benefit analysis of the project. The dam is expected to be in

service for over 100 years, so you can assume the time horizon is essentially infinite. You have

the following information:

Estimated costs:

• $1 billion in construction costs in the first year

$10 million in maintenance costs every year, forever

Estimated benefits:

$20 million in property damage avoided every year, forever

• 3 flooding deaths prevented every year, forever

1a. Assume r-3% and the value of a statistical life is $10 million. Calculate the present value of

net benefits for the dam. Do you recommend that the project be approved?

1b. Assume the VSL is still $10 million. How big would the discount rate have to be to change

your recommendation of the dam's approval? (In other words, find r such that the present value

of net benefits is zero)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning