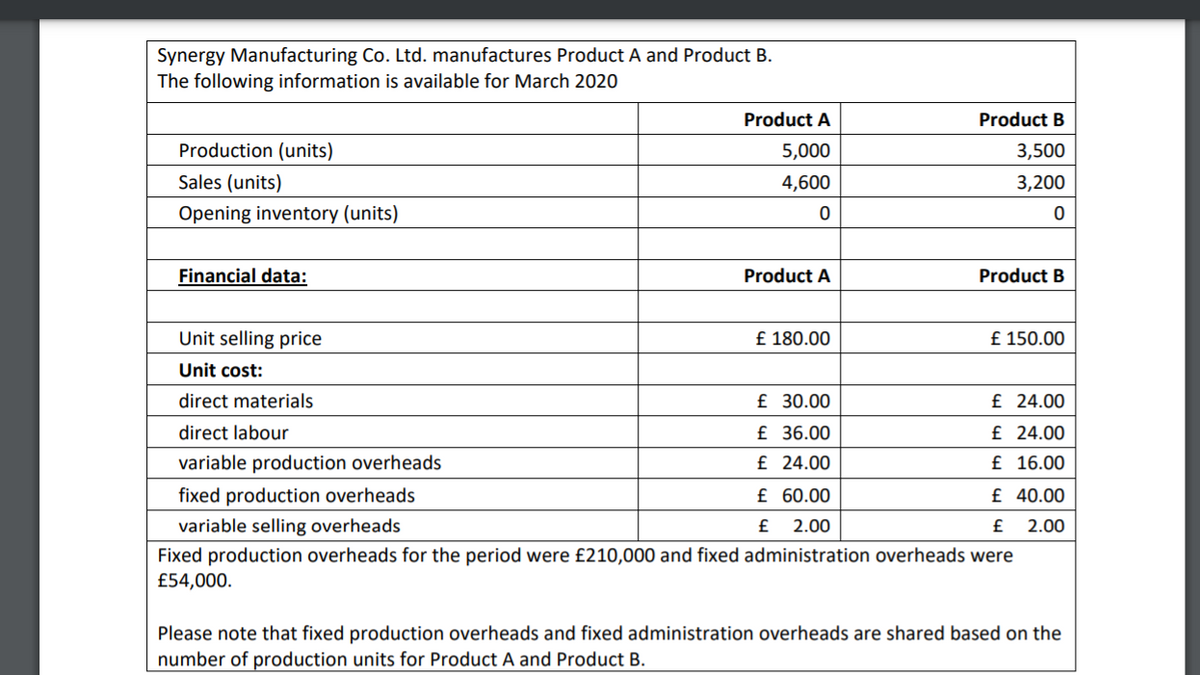

Synergy Manufacturing Co. Ltd. manufactures Product A and Product B. The following information is available for March 2020 Product A Product B Production (units) 5,000 3,500 Sales (units) 4,600 3,200 Opening inventory (units) Financial data: Product A Product B Unit selling price £ 180.00 £ 150.00 Unit cost: direct materials £ 30.00 £ 24.00 direct labour £ 36.00 £ 24.00 variable production overheads £ 24.00 £ 16.00 fixed production overheads £ 60.00 £ 40.00 variable selling overheads £ 2.00 £ 2.00 Fixed production overheads for the period were £210,000 and fixed administration overheads were £54,000. Please note that fixed production overheads and fixed administration overheads are shared based on the number of production units for Product A and Product B. Required: Based on the details provided in the table below, prepare and interpret accurate income statements for the company using a range of management accounting techniques, such as marginal and absorption costs.

Synergy Manufacturing Co. Ltd. manufactures Product A and Product B. The following information is available for March 2020 Product A Product B Production (units) 5,000 3,500 Sales (units) 4,600 3,200 Opening inventory (units) Financial data: Product A Product B Unit selling price £ 180.00 £ 150.00 Unit cost: direct materials £ 30.00 £ 24.00 direct labour £ 36.00 £ 24.00 variable production

Required:

Based on the details provided in the table below, prepare and interpret accurate income statements for the company using a range of

Step by step

Solved in 3 steps