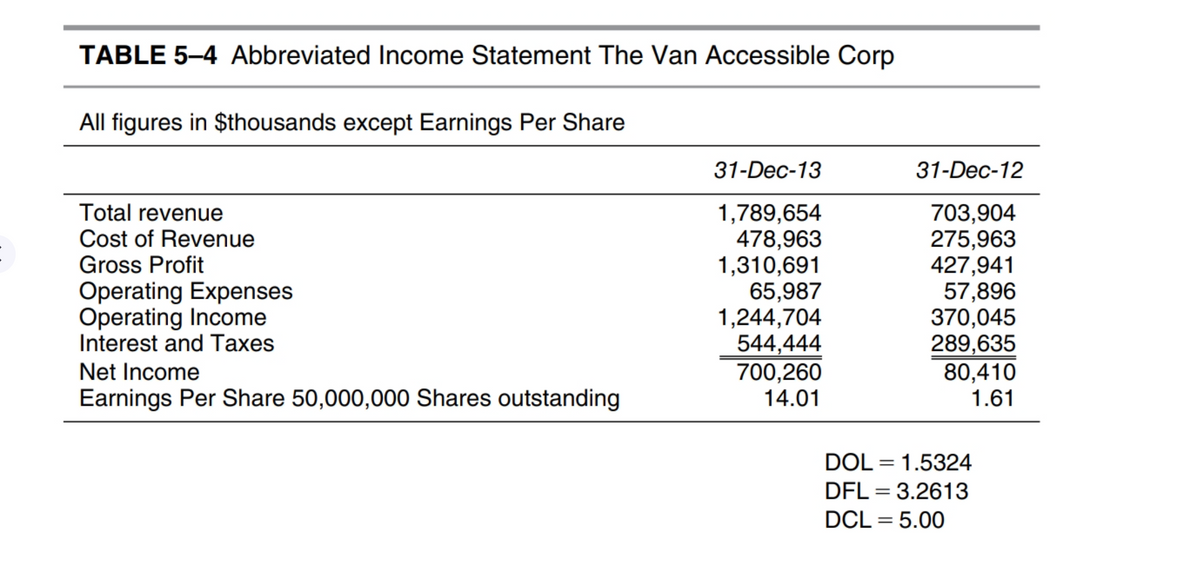

TABLE 5–4 Abbreviated Income Statement The Van Accessible Corp All figures in $thousands except Earnings Per Share 31-Dec-13 31-Dec-12 Total revenue Cost of Revenue Gross Profit 1,789,654 478,963 1,310,691 65,987 1,244,704 544,444 700,260 14.01 703,904 275,963 427,941 57,896 370,045 289,635 80,410 1.61 Operating Expenses Operating Income Interest and Taxes Net Income Earnings Per Share 50,000,000 Shares outstanding

TABLE 5–4 Abbreviated Income Statement The Van Accessible Corp All figures in $thousands except Earnings Per Share 31-Dec-13 31-Dec-12 Total revenue Cost of Revenue Gross Profit 1,789,654 478,963 1,310,691 65,987 1,244,704 544,444 700,260 14.01 703,904 275,963 427,941 57,896 370,045 289,635 80,410 1.61 Operating Expenses Operating Income Interest and Taxes Net Income Earnings Per Share 50,000,000 Shares outstanding

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 17.1EX

Related questions

Question

Using the Van Accessible data from Table 5–4:

- Calculate the degree of operating leverage (DOL).

- Calculate the degree of financial leverage (DFL).

- Calculate the degree of combined leverage (DCL).

- Explain what DOL, DFL, and DCL mean.

Transcribed Image Text:TABLE 5–4 Abbreviated Income Statement The Van Accessible Corp

All figures in $thousands except Earnings Per Share

31-Dec-13

31-Dec-12

Total revenue

Cost of Revenue

Gross Profit

1,789,654

478,963

1,310,691

65,987

1,244,704

544,444

700,260

14.01

703,904

275,963

427,941

57,896

370,045

289,635

80,410

1.61

Operating Expenses

Operating Income

Interest and Taxes

Net Income

Earnings Per Share 50,000,000 Shares outstanding

DOL = 1.5324

DFL = 3.2613

%3D

DCL = 5.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning