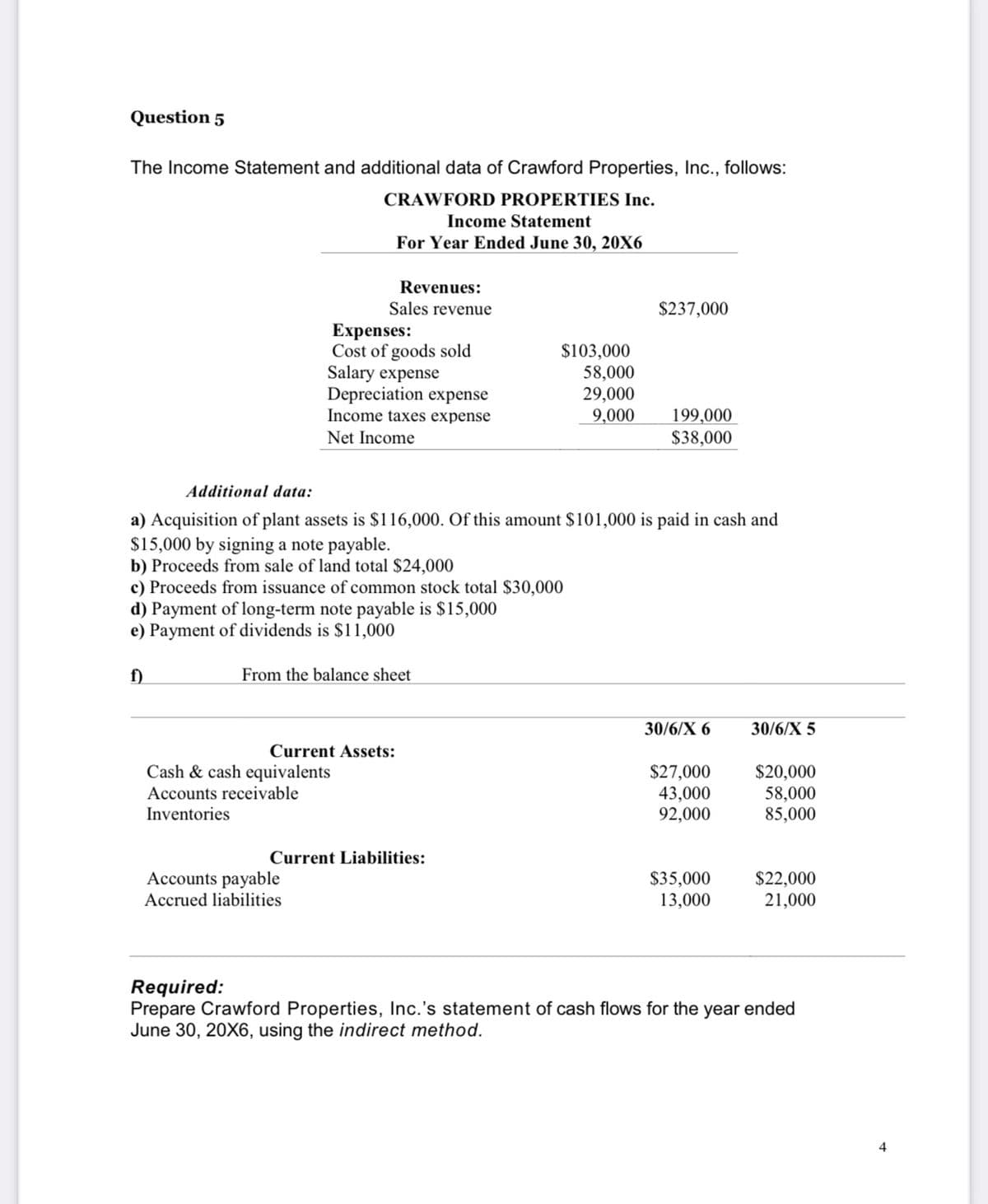

Question 5 The Income Statement and additional data of Crawford Properties, Inc., follows: CRAWFORD PROPERTIES Inc. Income Statement For Year Ended June 30, 20X6 Revenues: Sales revenue $237,000 Expenses: Cost of goods sold Salary expense Depreciation expense Income taxes expense $103,000 58,000 29,000 9,000 199,000 $38,000 Net Income Additional data: a) Acquisition of plant assets is $116,000. Of this amount $101,000 is paid in cash and $15,000 by signing a note payable. b) Proceeds from sale of land total $24,000 c) Proceeds from issuance of common stock total $30,000 d) Payment of long-term note payable is $15,000 e) Payment of dividends is $11,000 f) From the balance sheet 30/6/X 6 30/6/X 5 Current Assets: Cash & cash equivalents Accounts receivable Inventories $27,000 43,000 92,000 $20,000 58,000 85,000 Current Liabilities: Accounts payable Accrued liabilities $35,000 13,000 $22,000 21,000 Required: Prepare Crawford Properties, Inc.'s statement of cash flows for the year ended June 30, 20X6, using the indirect method.

Question 5 The Income Statement and additional data of Crawford Properties, Inc., follows: CRAWFORD PROPERTIES Inc. Income Statement For Year Ended June 30, 20X6 Revenues: Sales revenue $237,000 Expenses: Cost of goods sold Salary expense Depreciation expense Income taxes expense $103,000 58,000 29,000 9,000 199,000 $38,000 Net Income Additional data: a) Acquisition of plant assets is $116,000. Of this amount $101,000 is paid in cash and $15,000 by signing a note payable. b) Proceeds from sale of land total $24,000 c) Proceeds from issuance of common stock total $30,000 d) Payment of long-term note payable is $15,000 e) Payment of dividends is $11,000 f) From the balance sheet 30/6/X 6 30/6/X 5 Current Assets: Cash & cash equivalents Accounts receivable Inventories $27,000 43,000 92,000 $20,000 58,000 85,000 Current Liabilities: Accounts payable Accrued liabilities $35,000 13,000 $22,000 21,000 Required: Prepare Crawford Properties, Inc.'s statement of cash flows for the year ended June 30, 20X6, using the indirect method.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.2ADM: Home Depot: Asset turnover ratio The Home Depot reported the following data (in millions) in its...

Related questions

Question

I need help with this

Transcribed Image Text:Question 5

The Income Statement and additional data of Crawford Properties, Inc., follows:

CRAWFORD PROPERTIES Inc.

Income Statement

For Year Ended June 30, 20X6

Revenues:

Sales revenue

$237,000

Еxpenses:

Cost of goods sold

Salary expense

Depreciation expense

Income taxes expense

$103,000

58,000

29,000

9,000

199,000

$38,000

Net Income

Additional data:

a) Acquisition of plant assets is $116,000. Of this amount $101,000 is paid in cash and

$15,000 by signing a note payable.

b) Proceeds from sale of land total $24,000

c) Proceeds from issuance of common stock total $30,000

d) Payment of long-term note payable is $15,000

e) Payment of dividends is $11,000

f)

From the balance sheet

30/6/X 6

30/6/X 5

Current Assets:

Cash & cash equivalents

Accounts receivable

Inventories

$27,000

43,000

92,000

$20,000

58,000

85,000

Current Liabilities:

Accounts payable

Accrued liabilities

$35,000

13,000

$22,000

21,000

Required:

Prepare Crawford Properties, Inc.'s statement of cash flows for the year ended

June 30, 20X6, using the indirect method.

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning