tion 8 Not yet answered Marked out of 2.00 P Flag question year-end financial statements of Time Company reveal average shareholders' equity attributable to cont usand, net income attributable to the company of $29,068 thousand, and average net operating assets of = company's return on equity (ROE) for the year is: ect one: a. 5.5% O b. There is not enough information to calculate the ratio. c. 9.0% O d.3.8%

tion 8 Not yet answered Marked out of 2.00 P Flag question year-end financial statements of Time Company reveal average shareholders' equity attributable to cont usand, net income attributable to the company of $29,068 thousand, and average net operating assets of = company's return on equity (ROE) for the year is: ect one: a. 5.5% O b. There is not enough information to calculate the ratio. c. 9.0% O d.3.8%

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.9BE

Related questions

Question

Transcribed Image Text:Question 8 Not yet answered

Marked out of 2.00

P Flag question

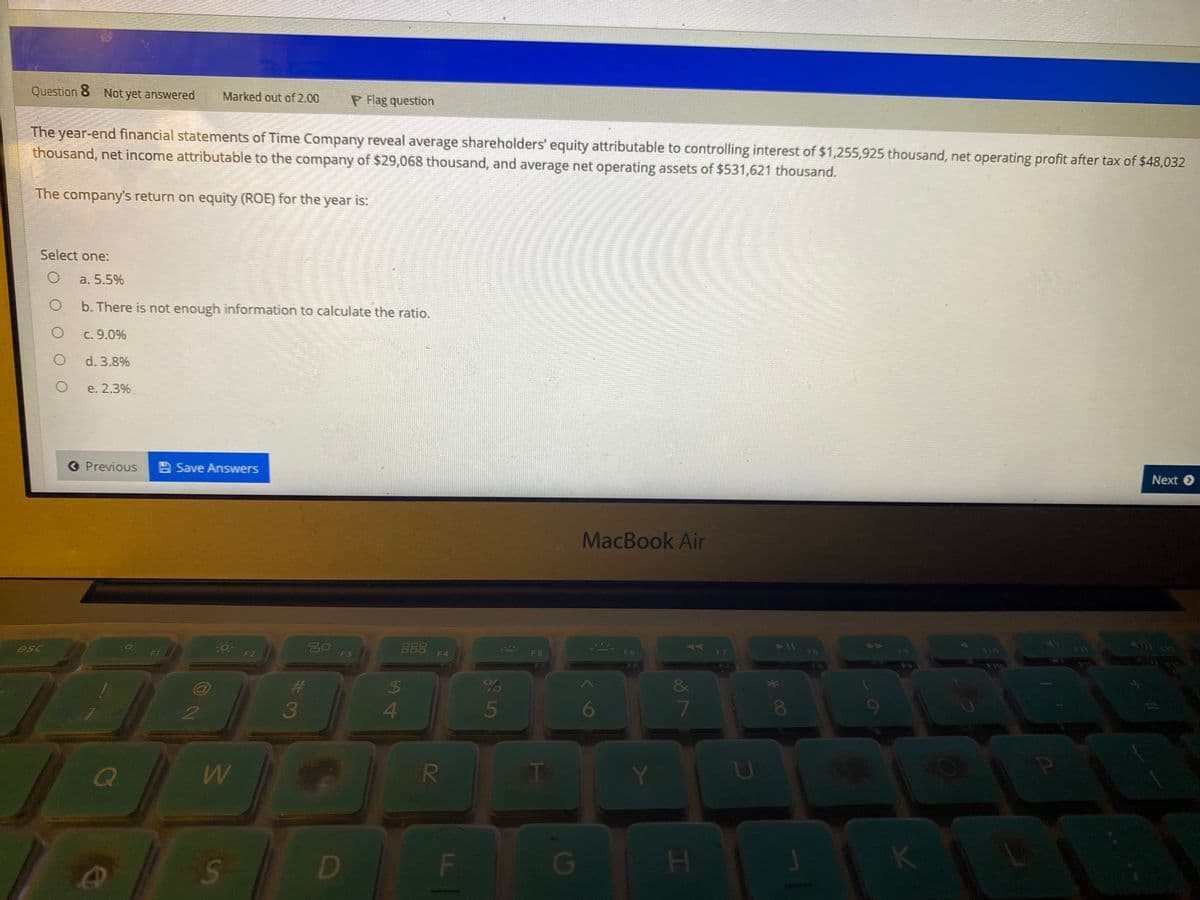

The

year-end financial statements of Time Company reveal average shareholders' equity attributable to controlling interest of $1,255,925 thousand, net operating profit after tax of $48,032

thousand, net income attributable to the company of $29,068 thousand, and average net operating assets of $531,621 thousand.

The company's return on equity (ROE) for the year is:

Select one:

a. 5.5%

b. There is not enough information to calculate the ratio.

C. 9.0%

d. 3.8%

e. 2.3%

O Previous

A Save Answers

Next O

MacBook Air

20

F3

888

12

esc

F1

F10

F4

F5

F6

F7

F8

F10

%23

*

2

3

4.

5

6

00

9-

Q

Y.

D

F

G

K

R

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning