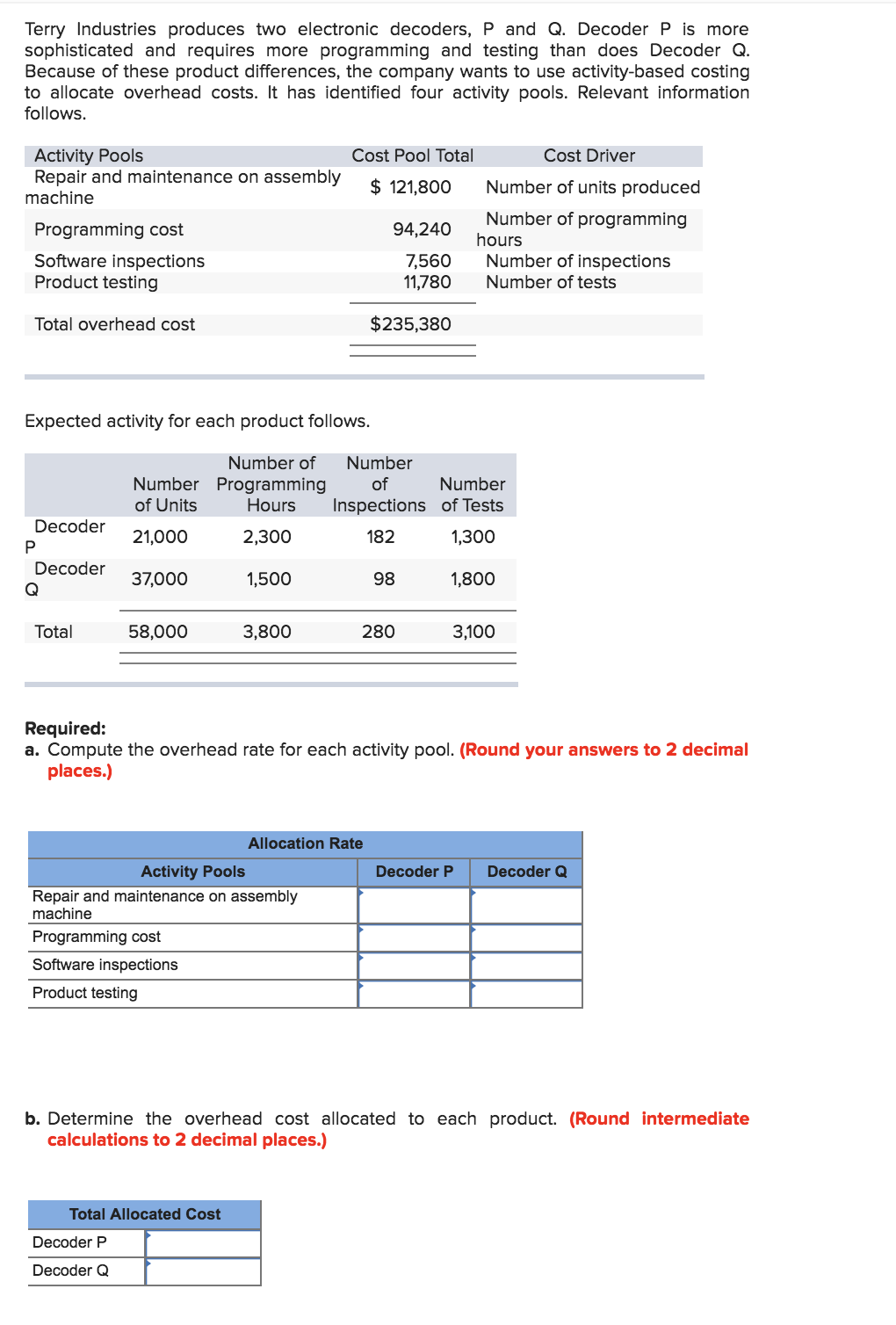

Terry Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to allocate overhead costs. It has identified four activity pools. Relevant information follows. Activity Pools Repair and maintenance on assembly machine Cost Pool Total Cost Driver Number of units produced 121,800 Number of programming Programming cost 94,240 hours Number of inspections Number of tests Software inspections Product testing 7,560 11,780 $235,380 Total overhead cost Expected activity for each product follows. Number of Number Number Programming of Units of Number Inspections of Tests Hours Decoder 21,000 2,300 182 1,300 P Decoder 1,500 37,000 98 1,800 Q Total 58,000 3,800 280 3,100 Required: a. Compute the overhead rate for each activity pool. (Round your answers to 2 decimal places.) Allocation Rate Activity Pools Decoder P Decoder Q Repair and maintenance on assembly machine Programming cost Software inspections Product testing b. Determine the overhead cost allocated to each product. (Round intermed iate calculations to 2 decimal places.) Total Allocated Cost Decoder P Decoder Q

Terry Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to allocate overhead costs. It has identified four activity pools. Relevant information follows. Activity Pools Repair and maintenance on assembly machine Cost Pool Total Cost Driver Number of units produced 121,800 Number of programming Programming cost 94,240 hours Number of inspections Number of tests Software inspections Product testing 7,560 11,780 $235,380 Total overhead cost Expected activity for each product follows. Number of Number Number Programming of Units of Number Inspections of Tests Hours Decoder 21,000 2,300 182 1,300 P Decoder 1,500 37,000 98 1,800 Q Total 58,000 3,800 280 3,100 Required: a. Compute the overhead rate for each activity pool. (Round your answers to 2 decimal places.) Allocation Rate Activity Pools Decoder P Decoder Q Repair and maintenance on assembly machine Programming cost Software inspections Product testing b. Determine the overhead cost allocated to each product. (Round intermed iate calculations to 2 decimal places.) Total Allocated Cost Decoder P Decoder Q

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 5CE: Roberts Company produces two weed eaters: basic and advanced. The company has four activities:...

Related questions

Question

Transcribed Image Text:Terry Industries produces two electronic decoders, P and Q. Decoder P is more

sophisticated and requires more programming and testing than does Decoder Q.

Because of these product differences, the company wants to use activity-based costing

to allocate overhead costs. It has identified four activity pools. Relevant information

follows.

Activity Pools

Repair and maintenance on assembly

machine

Cost Pool Total

Cost Driver

Number of units produced

121,800

Number of programming

Programming cost

94,240

hours

Number of inspections

Number of tests

Software inspections

Product testing

7,560

11,780

$235,380

Total overhead cost

Expected activity for each product follows.

Number of

Number

Number Programming

of Units

of

Number

Inspections of Tests

Hours

Decoder

21,000

2,300

182

1,300

P

Decoder

1,500

37,000

98

1,800

Q

Total

58,000

3,800

280

3,100

Required:

a. Compute the overhead rate for each activity pool. (Round your answers to 2 decimal

places.)

Allocation Rate

Activity Pools

Decoder P

Decoder Q

Repair and maintenance on assembly

machine

Programming cost

Software inspections

Product testing

b. Determine the overhead cost allocated to each product. (Round intermed iate

calculations to 2 decimal places.)

Total Allocated Cost

Decoder P

Decoder Q

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning