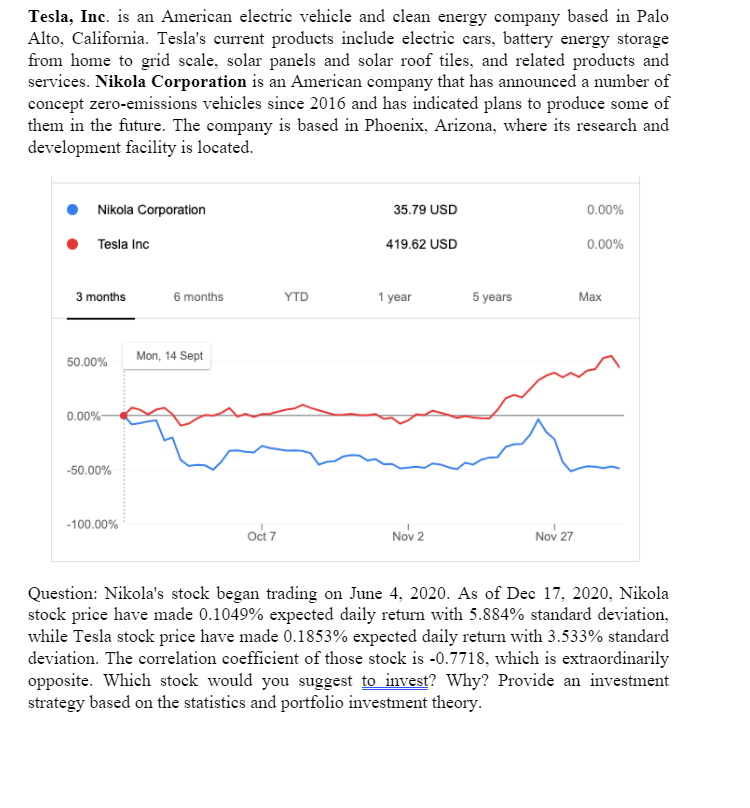

Tesla, Inc. is an American electric vehicle and clean energy company based in Palo Alto, California. Tesla's current products include electric cars, battery energy storage from home to grid scale, solar panels and solar roof tiles, and related products and services. Nikola Corporation is an American company that has announced a number of concept zero-emissions vehicles since 2016 and has indicated plans to produce some of them in the future. The company is based in Phoenix, Arizona, where its research and development facility is located. Nikola Corporation 35.79 USD 0.00% Tesla Inc 419.62 USD 0.00% 3 months 6 months YTD 1 year 5 years Маx Mon, 14 Sept 50.00% 0.00%- -50.00% -100.00% Oct 7 Nov 2 Nov 27 Question: Nikola's stock began trading on June 4, 2020. As of Dec 17, 2020, Nikola stock price have made 0.1049% expected daily return with 5.884% standard deviation, while Tesla stock price have made 0.1853% expected daily return with 3.533% standard deviation. The correlation coefficient of those stock is -0.7718, which is extraordinarily opposite. Which stock would you suggest to invest? Why? Provide an investment strategy based on the statistics and portfolio investment theory.

Tesla, Inc. is an American electric vehicle and clean energy company based in Palo Alto, California. Tesla's current products include electric cars, battery energy storage from home to grid scale, solar panels and solar roof tiles, and related products and services. Nikola Corporation is an American company that has announced a number of concept zero-emissions vehicles since 2016 and has indicated plans to produce some of them in the future. The company is based in Phoenix, Arizona, where its research and development facility is located. Nikola Corporation 35.79 USD 0.00% Tesla Inc 419.62 USD 0.00% 3 months 6 months YTD 1 year 5 years Маx Mon, 14 Sept 50.00% 0.00%- -50.00% -100.00% Oct 7 Nov 2 Nov 27 Question: Nikola's stock began trading on June 4, 2020. As of Dec 17, 2020, Nikola stock price have made 0.1049% expected daily return with 5.884% standard deviation, while Tesla stock price have made 0.1853% expected daily return with 3.533% standard deviation. The correlation coefficient of those stock is -0.7718, which is extraordinarily opposite. Which stock would you suggest to invest? Why? Provide an investment strategy based on the statistics and portfolio investment theory.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 2CDQ

Related questions

Question

100%

Please do take your time.

Also, note you can use outside sources.

Thanks for any help on it, I have been working on it but do not understand.

Transcribed Image Text:Tesla, Inc. is an American electric vehicle and clean energy company based in Palo

Alto, California. Tesla's current products include electric cars, battery energy storage

from home to grid scale, solar panels and solar roof tiles, and related products and

services. Nikola Corporation is an American company that has announced a number of

concept zero-emissions vehicles since 2016 and has indicated plans to produce some of

them in the future. The company is based in Phoenix, Arizona, where its research and

development facility is located.

Nikola Corporation

35.79 USD

0.00%

Tesla Inc

419.62 USD

0.00%

3 months

6 months

YTD

1 year

5 years

Маx

50.00%

Mon, 14 Sept

0.00%-

-50.00%

-100.00%

oct 7

Nov 2

Nov 27

Question: Nikola's stock began trading on June 4, 2020. As of Dec 17, 2020, Nikola

stock price have made 0.1049% expected daily return with 5.884% standard deviation,

while Tesla stock price have made 0.1853% expected daily return with 3.533% standard

deviation. The correlation coefficient of those stock is -0.7718, which is extraordinarily

opposite. Which stock would you suggest to invest? Why? Provide an investment

strategy based on the statistics and portfolio investment theory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning