"That old equipment for producing oil drums is worn out," said Bill Seebach, president of Hondrich Company. "We need to make a decision quickly." The company is trying to decide whether it should rent new equipment and continue to make its oil drums internally or whether it should discontinue production and purchase them from an outside supplier. The alternatives follow: Alternative 1: Rent new equipment for producing the oil drums for $208,000 per year. Alternative 2: Purchase oil drums from an outside supplier for $18.90 each. Hondrich Company's costs per unit of producing the oil drums internally (with the old equipment) are given below. These costs are based on a current activity level of 40,000 units per year:

"That old equipment for producing oil drums is worn out," said Bill Seebach, president of Hondrich Company. "We need to make a decision quickly." The company is trying to decide whether it should rent new equipment and continue to make its oil drums internally or whether it should discontinue production and purchase them from an outside supplier. The alternatives follow: Alternative 1: Rent new equipment for producing the oil drums for $208,000 per year. Alternative 2: Purchase oil drums from an outside supplier for $18.90 each. Hondrich Company's costs per unit of producing the oil drums internally (with the old equipment) are given below. These costs are based on a current activity level of 40,000 units per year:

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P

Related questions

Question

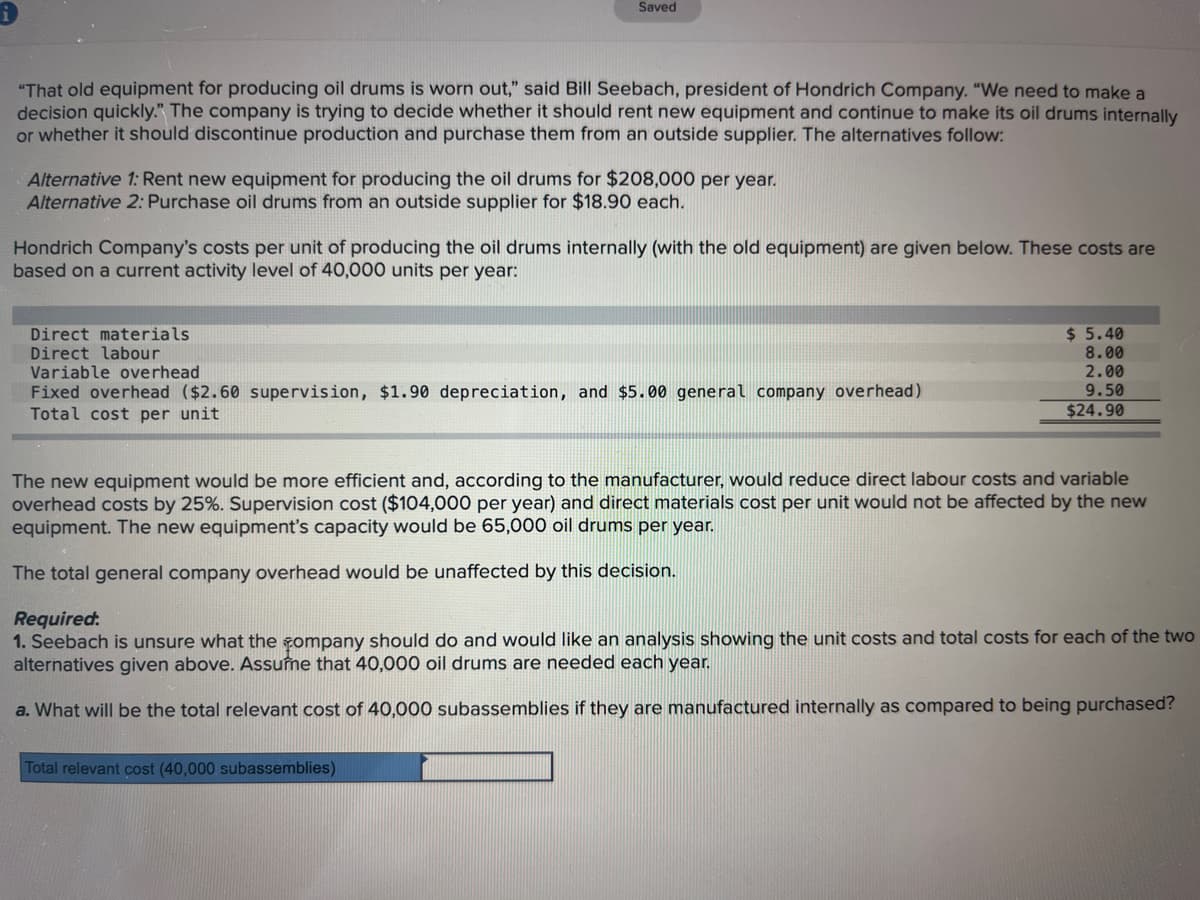

Transcribed Image Text:"That old equipment for producing oil drums is worn out," said Bill Seebach, president of Hondrich Company. "We need to make a

decision quickly." The company is trying to decide whether it should rent new equipment and continue to make its oil drums internally

or whether it should discontinue production and purchase them from an outside supplier. The alternatives follow:

Saved

Alternative 1: Rent new equipment for producing the oil drums for $208,000 per year.

Alternative 2: Purchase oil drums from an outside supplier for $18.90 each.

Hondrich Company's costs per unit of producing the oil drums internally (with the old equipment) are given below. These costs are

based on a current activity level of 40,000 units per year:

Direct materials

Direct labour

Variable overhead

Fixed overhead ($2.60 supervision, $1.90 depreciation, and $5.00 general company overhead)

Total cost per unit

$5.40

8.00

2.00

9.50

$24.90

The new equipment would be more efficient and, according to the manufacturer, would reduce direct labour costs and variable

overhead costs by 25%. Supervision cost ($104,000 per year) and direct materials cost per unit would not be affected by the new

equipment. The new equipment's capacity would be 65,000 oil drums per year.

The total general company overhead would be unaffected by this decision.

Total relevant cost (40,000 subassemblies)

Required:

1. Seebach is unsure what the company should do and would like an analysis showing the unit costs and total costs for each of the two

alternatives given above. Assume that 40,000 oil drums are needed each year.

a. What will be the total relevant cost of 40,000 subassemblies if they are manufactured internally as compared to being purchased?

Transcribed Image Text:15

es

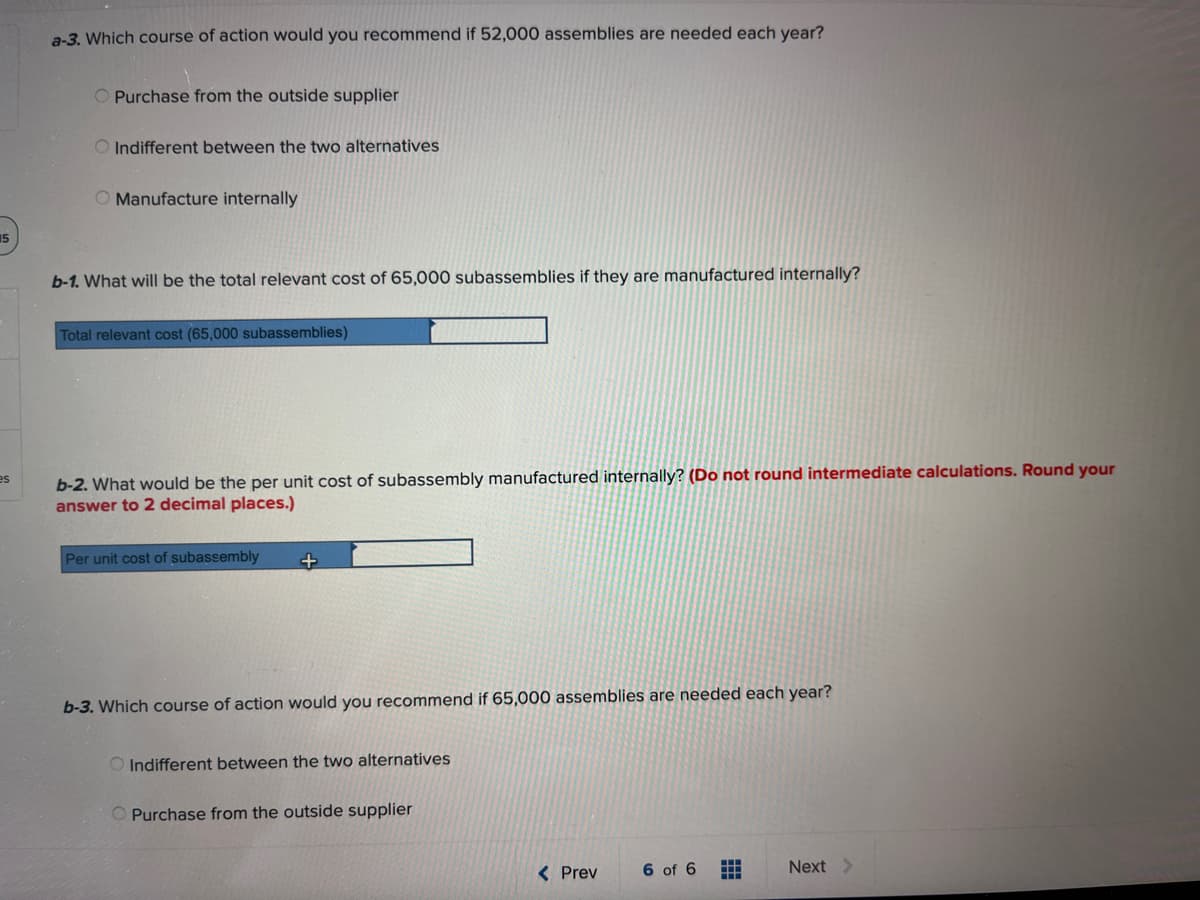

a-3. Which course of action would you recommend if 52,000 assemblies are needed each year?

O Purchase from the outside supplier

O Indifferent between the two alternatives

O Manufacture internally

b-1. What will be the total relevant cost of 65,000 subassemblies if they are manufactured internally?

Total relevant cost (65,000 subassemblies)

b-2. What would be the per unit cost of subassembly manufactured internally? (Do not round intermediate calculations. Round your

answer to 2 decimal places.)

Per unit cost of subassembly

+

b-3. Which course of action would you recommend if 65,000 assemblies are needed each year?

O Indifferent between the two alternatives

Purchase from the outside supplier

< Prev

6 of 6

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning