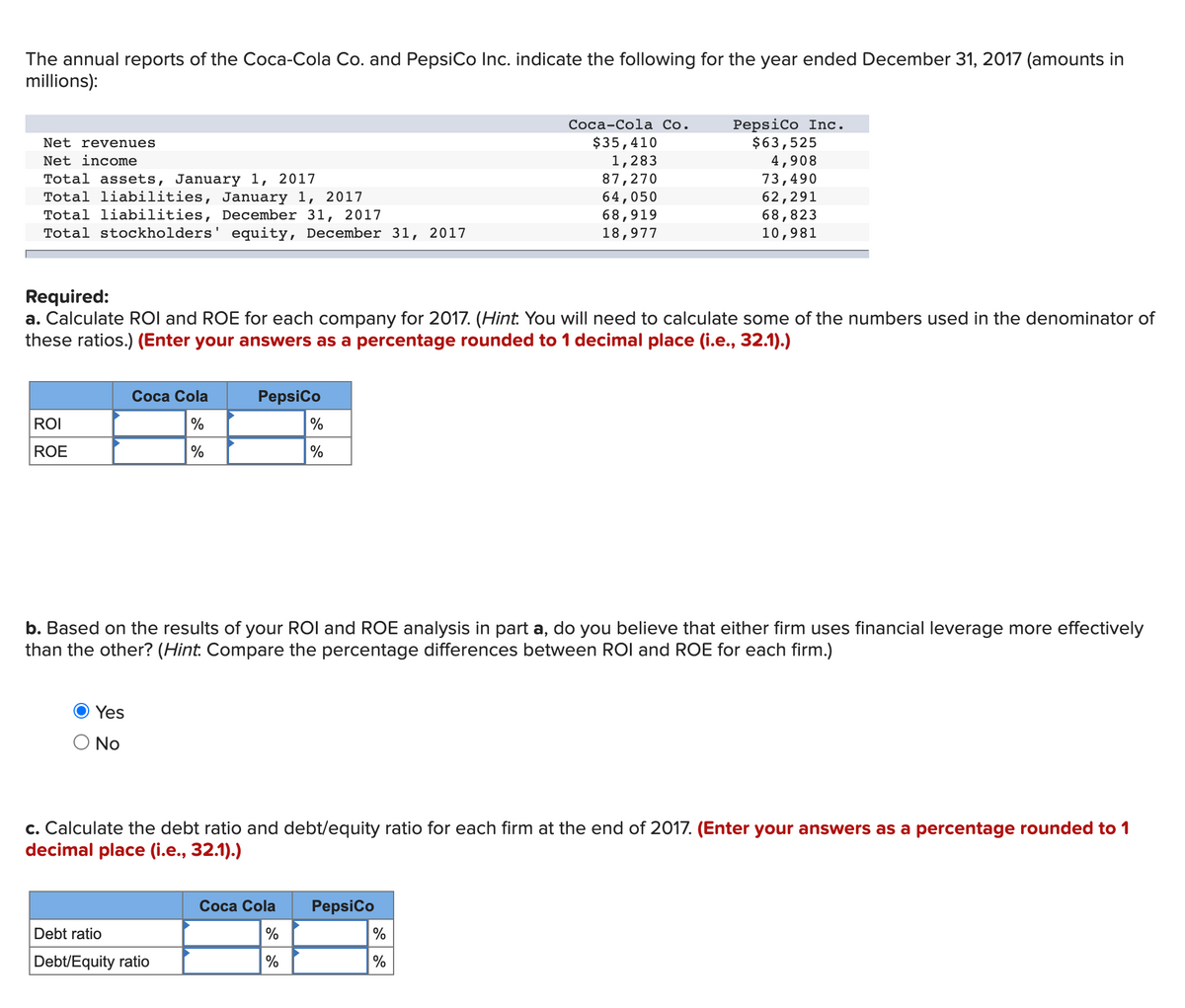

The annual reports of the Coca-Cola Co. and PepsiCo Inc. indicate the following for the year ended December 31, 2017 (amounts in millions): Coca-Cola Co. Pepsico Inc. $63,525 4,908 $35,410 1,283 87,270 64,050 68,919 18,977 Net revenues Net income Total assets, January 1, 2017 Total liabilities, January 1, 2017 Total liabilities, December 31, 2017 Total stockholders' equity, December 31, 2017 73,490 62,291 68,823 10,981 Required: a. Calculate ROI and ROE for each company for 2017. (Hint. You will need to calculate some of the numbers used in the denominator these ratios.) (Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).) Соcа Cola Pepsico ROI % ROE % b. Based on the results of your ROI and ROE analysis in part a, do you believe that either firm uses financial leverage more effectively than the other? (Hint. Compare the percentage differences between ROI and ROE for each firm.) O Yes O No c. Calculate the debt ratio and debt/equity ratio for each firm at the end of 2017. (Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).) Coca Cola PepsiCo Debt ratio % % Debt/Equity ratio % %

The annual reports of the Coca-Cola Co. and PepsiCo Inc. indicate the following for the year ended December 31, 2017 (amounts in millions): Coca-Cola Co. Pepsico Inc. $63,525 4,908 $35,410 1,283 87,270 64,050 68,919 18,977 Net revenues Net income Total assets, January 1, 2017 Total liabilities, January 1, 2017 Total liabilities, December 31, 2017 Total stockholders' equity, December 31, 2017 73,490 62,291 68,823 10,981 Required: a. Calculate ROI and ROE for each company for 2017. (Hint. You will need to calculate some of the numbers used in the denominator these ratios.) (Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).) Соcа Cola Pepsico ROI % ROE % b. Based on the results of your ROI and ROE analysis in part a, do you believe that either firm uses financial leverage more effectively than the other? (Hint. Compare the percentage differences between ROI and ROE for each firm.) O Yes O No c. Calculate the debt ratio and debt/equity ratio for each firm at the end of 2017. (Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).) Coca Cola PepsiCo Debt ratio % % Debt/Equity ratio % %

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:The annual reports of the Coca-Cola Co. and PepsiCo Inc. indicate the following for the year ended December 31, 2017 (amounts in

millions):

РеpsiCo Inс.

$63,525

4,908

73,490

62,291

68,823

10,981

Соса-Сola Со.

$35,410

1,283

87,270

64,050

68,919

18,977

Net revenues

Net income

Total assets, January 1, 2017

Total liabilities, January 1, 2017

Total liabilities, December 31, 2017

Total stockholders' equity, December 31, 2017

Required:

a. Calculate ROI and ROE for each company for 2017. (Hint. You will need to calculate some of the numbers used in the denominator of

these ratios.) (Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).)

Соcа Cola

Pepsico

%

%

ROI

%

ROE

b. Based on the results of your ROI and ROE analysis in part a, do you believe that either firm uses financial leverage more effectively

than the other? (Hint: Compare the percentage differences between ROI and ROE for each firm.)

Yes

O No

c. Calculate the debt ratio and debt/equity ratio for each firm at the end of 2017. (Enter your answers as a percentage rounded to 1

decimal place (i.e., 32.1).)

Соcа Cola

РepsiCo

Debt ratio

%

%

Debt/Equity ratio

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education