The Bayblade, Inc. started operations in 2003 with an expected production of 120,000 units and sales volume of 110,000 units. It has a normal operating capacity of 100,000 units. The following data were made available: P25.40 5.20 Variable manufacturing cost per Fixed manufacturing cost per unit based on normal capacity Variable selling and administrative cost per unit Annual fixed selling and administrative expernses Plant assets (fixed capital) used in operations Expected ratio of current assets to projected sales unit 6.60 P240,000 900,000 30%

The Bayblade, Inc. started operations in 2003 with an expected production of 120,000 units and sales volume of 110,000 units. It has a normal operating capacity of 100,000 units. The following data were made available: P25.40 5.20 Variable manufacturing cost per Fixed manufacturing cost per unit based on normal capacity Variable selling and administrative cost per unit Annual fixed selling and administrative expernses Plant assets (fixed capital) used in operations Expected ratio of current assets to projected sales unit 6.60 P240,000 900,000 30%

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter21: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 4CMA: Bethany Company has just completed the first month of producing a new product but has not yet...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

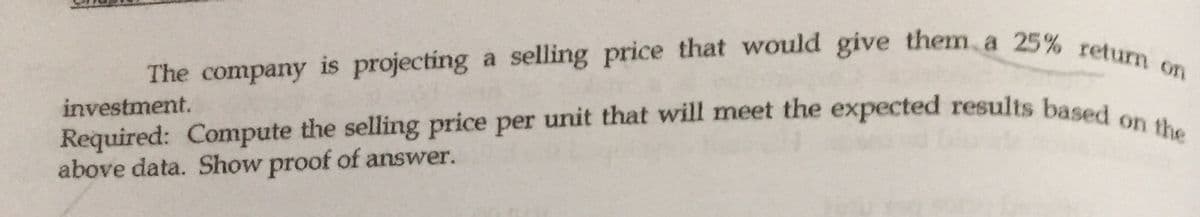

Transcribed Image Text:Required: Compute the selling price per unit that will meet the expected results based on the

The company is projecting a selling price that would give them, a 25% return on

investment.

above data. Show proof of answer.

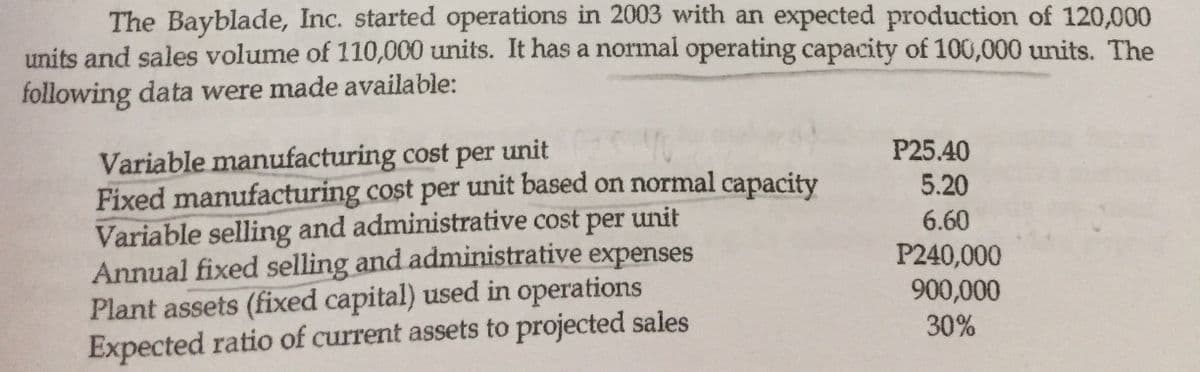

Transcribed Image Text:The Bayblade, Inc. started operations in 2003 with an expected production of 120,000

units and sales volume of 110,000 units. It has a normal operating capacity of 100,000 units. The

following data were made available:

Variable manufacturing cost per unit

Fixed manufacturing cost per unit based on normal capacity

Variable selling and administrative cost per unit

Annual fixed selling and administrative expenses

Plant assets (fixed capital) used in operations

Expected ratio of current assets to projected sales

P25.40

5.20

6.60

P240,000

900,000

30%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT