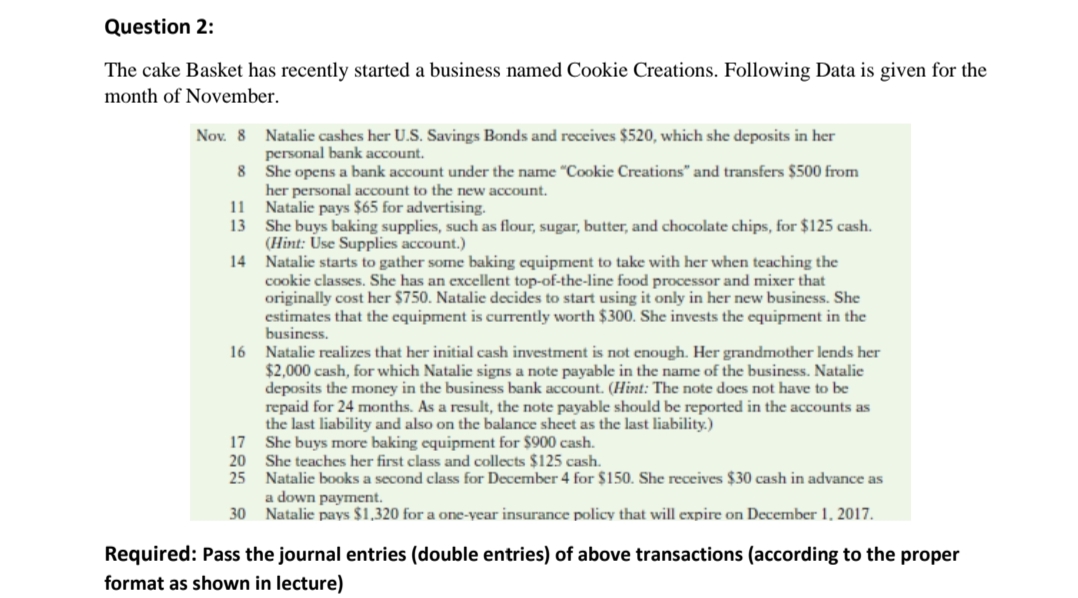

The cake Basket has recently started a business named Cookie Creations. Following Data is given for the month of November. Nov. 8 Natalie cashes her U.S. Savings Bonds and receives $520, which she deposits in her personal bank account. 8 She opens a bank account under the name "Cookie Creations" and transfers $500 from her personal account to the new account. 11 Natalie pays $65 for advertising. 13 She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for $125 cash. (Hint: Use Supplies account.) 14 Natalie starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent top-of-the-line food processor and mixer that originally cost her $750. Natalie decides to start using it only in her new business. She estimates that the equipment is currently worth $300. She invests the equipment in the business. 16 Natalie realizes that her initial cash investment is not enough. Her grandmother lends her $2,000 cash, for which Natalie signs a note payable in the name of the business. Natalie deposits the money in the business bank account. (Hint: The note does not have to be repaid for 24 months. As a result, the note payable should be reported in the accounts as the last liability and also on the balance sheet as the last liability.) 17 She buys more baking equipment for $900 cash. 20 She teaches her first class and collects $125 cash. 25 Natalie books a second class for December 4 for $150. She receives $30 cash in advance as a down payment. 30 Natalie pavs $1,320 for a one-vear insurance policy that will expire on December 1, 2017. Required: Pass the journal entries (double entries) of above transactions (according to the proper format as shown in lecture)

The cake Basket has recently started a business named Cookie Creations. Following Data is given for the month of November. Nov. 8 Natalie cashes her U.S. Savings Bonds and receives $520, which she deposits in her personal bank account. 8 She opens a bank account under the name "Cookie Creations" and transfers $500 from her personal account to the new account. 11 Natalie pays $65 for advertising. 13 She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for $125 cash. (Hint: Use Supplies account.) 14 Natalie starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent top-of-the-line food processor and mixer that originally cost her $750. Natalie decides to start using it only in her new business. She estimates that the equipment is currently worth $300. She invests the equipment in the business. 16 Natalie realizes that her initial cash investment is not enough. Her grandmother lends her $2,000 cash, for which Natalie signs a note payable in the name of the business. Natalie deposits the money in the business bank account. (Hint: The note does not have to be repaid for 24 months. As a result, the note payable should be reported in the accounts as the last liability and also on the balance sheet as the last liability.) 17 She buys more baking equipment for $900 cash. 20 She teaches her first class and collects $125 cash. 25 Natalie books a second class for December 4 for $150. She receives $30 cash in advance as a down payment. 30 Natalie pavs $1,320 for a one-vear insurance policy that will expire on December 1, 2017. Required: Pass the journal entries (double entries) of above transactions (according to the proper format as shown in lecture)

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 3PB: Hajun Company started its business on May 1, 2019. The following transactions occurred during the...

Related questions

Question

Transcribed Image Text:Question 2:

The cake Basket has recently started a business named Cookie Creations. Following Data is given for the

month of November.

Nov. 8 Natalie cashes her U.S. Savings Bonds and receives $520, which she deposits in her

personal bank account.

8 She opens a bank account under the name "Cookie Creations" and transfers $500 from

her personal account to the new account.

11 Natalie pays $65 for advertising.

13 She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for $125 cash.

(Hint: Use Supplies account.)

14 Natalie starts to gather some baking equipment to take with her when teaching the

cookie classes. She has an excellent top-of-the-line food processor and mixer that

originally cost her $750. Natalie decides to start using it only in her new business. She

estimates that the equipment is currently worth $300. She invests the equipment in the

business.

16 Natalie realizes that her initial cash investment is not enough. Her grandmother lends her

$2,000 cash, for which Natalie signs a note payable in the name of the business. Natalie

deposits the money in the business bank account. (Hint: The note does not have to be

repaid for 24 months. As a result, the note payable should be reported in the accounts as

the last liability and also on the balance sheet as the last liability.)

17 She buys more baking equipment for $900 cash.

20 She teaches her first class and collects $125 cash.

25 Natalie books a second class for December 4 for $150. She receives $30 cash in advance as

a down payment.

30 Natalie pays $1,320 for a one-year insurance policy that will expire on December 1, 2017.

Required: Pass the journal entries (double entries) of above transactions (according to the proper

format as shown in lecture)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage