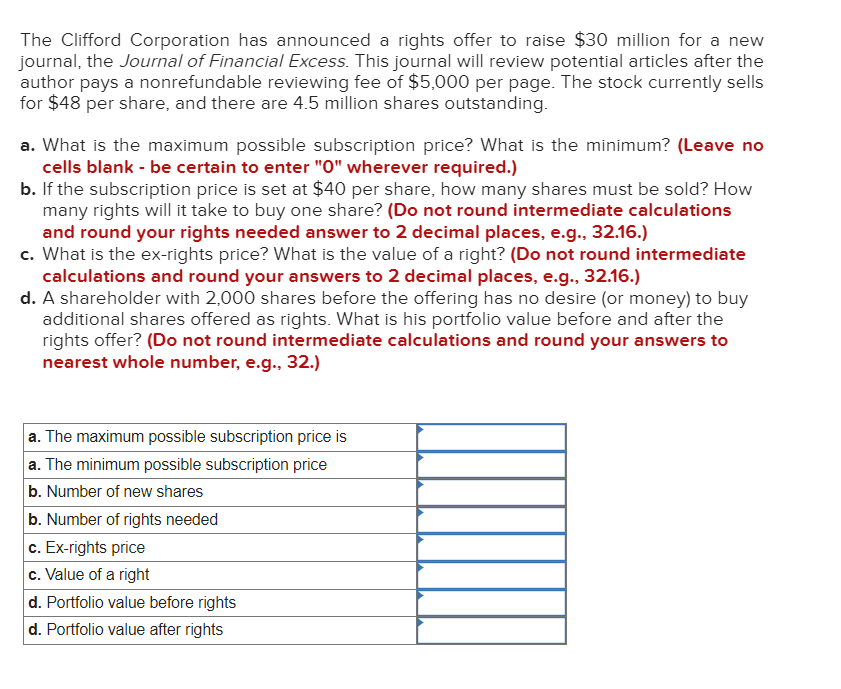

The Clifford Corporation has announced a rights offer to raise $30 million for a new journal, the Journal of Financial Excess. This journal will review potential articles after the author pays a nonrefundable reviewing fee of $5,000 per page. The stock currently sells for $48 per share, and there are 4.5 million shares outstanding. a. What is the maximum possible subscription price? What is the minimum? (Leave no cells blank - be certain to enter "0" wherever required.) b. If the subscription price is set at $40 per share, how many shares must be sold? How many rights will it take to buy one share? (Do not round intermediate calculations and round your rights needed answer to 2 decimal places, e.g., 32.16.) c. What is the ex-rights price? What is the value of a right? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. A shareholder with 2,000 shares before the offering has no desire (or money) to buy additional shares offered as rights. What is his portfolio value before and after the rights offer? (Do not round intermediate calculations and round your answers to nearest whole number, e.g., 32.) a. The maximum possible subscription price is a. The minimum possible subscription price b. Number of new shares b. Number of rights needed c. Ex-rights price c. Value of a right d. Portfolio value before rights d. Portfolio value after rights

The Clifford Corporation has announced a rights offer to raise $30 million for a new journal, the Journal of Financial Excess. This journal will review potential articles after the author pays a nonrefundable reviewing fee of $5,000 per page. The stock currently sells for $48 per share, and there are 4.5 million shares outstanding. a. What is the maximum possible subscription price? What is the minimum? (Leave no cells blank - be certain to enter "0" wherever required.) b. If the subscription price is set at $40 per share, how many shares must be sold? How many rights will it take to buy one share? (Do not round intermediate calculations and round your rights needed answer to 2 decimal places, e.g., 32.16.) c. What is the ex-rights price? What is the value of a right? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. A shareholder with 2,000 shares before the offering has no desire (or money) to buy additional shares offered as rights. What is his portfolio value before and after the rights offer? (Do not round intermediate calculations and round your answers to nearest whole number, e.g., 32.) a. The maximum possible subscription price is a. The minimum possible subscription price b. Number of new shares b. Number of rights needed c. Ex-rights price c. Value of a right d. Portfolio value before rights d. Portfolio value after rights

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter18: Initial Public Offerings, Investment Banking, And Capital Formation

Section: Chapter Questions

Problem 2P

Related questions

Question

100%

Transcribed Image Text:The Clifford Corporation has announced a rights offer to raise $30 million for a new

journal, the Journal of Financial Excess. This journal will review potential articles after the

author pays a nonrefundable reviewing fee of $5,000 per page. The stock currently sells

for $48 per share, and there are 4.5 million shares outstanding.

a. What is the maximum possible subscription price? What is the minimum? (Leave no

cells blank - be certain to enter "0" wherever required.)

b. If the subscription price is set at $40 per share, how many shares must be sold? How

many rights will it take to buy one share? (Do not round intermediate calculations

and round your rights needed answer to 2 decimal places, e.g., 32.16.)

c. What is the ex-rights price? What is the value of a right? (Do not round intermediate

calculations and round your answers to 2 decimal places, e.g., 32.16.)

d. A shareholder with 2,000 shares before the offering has no desire (or money) to buy

additional shares offered as rights. What is his portfolio value before and after the

rights offer? (Do not round intermediate calculations and round your answers to

nearest whole number, e.g., 32.)

a. The maximum possible subscription price is

a. The minimum possible subscription price

b. Number of new shares

b. Number of rights needed

c. Ex-rights price

c. Value of a right

d. Portfolio value before rights

d. Portfolio value after rights

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning