The consolidated statement of profit or loss for Alliance Group for the year ended 31 2017 is shown below: RM'000 Revenue 12,000 Cost of sales (8,400) 3,600 (400) (1,260) (450) 500 Gross profit Distribution costs Administrative expenses Finance costs Share of profit of associate Profit before tax 1.990

The consolidated statement of profit or loss for Alliance Group for the year ended 31 2017 is shown below: RM'000 Revenue 12,000 Cost of sales (8,400) 3,600 (400) (1,260) (450) 500 Gross profit Distribution costs Administrative expenses Finance costs Share of profit of associate Profit before tax 1.990

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please show all the working

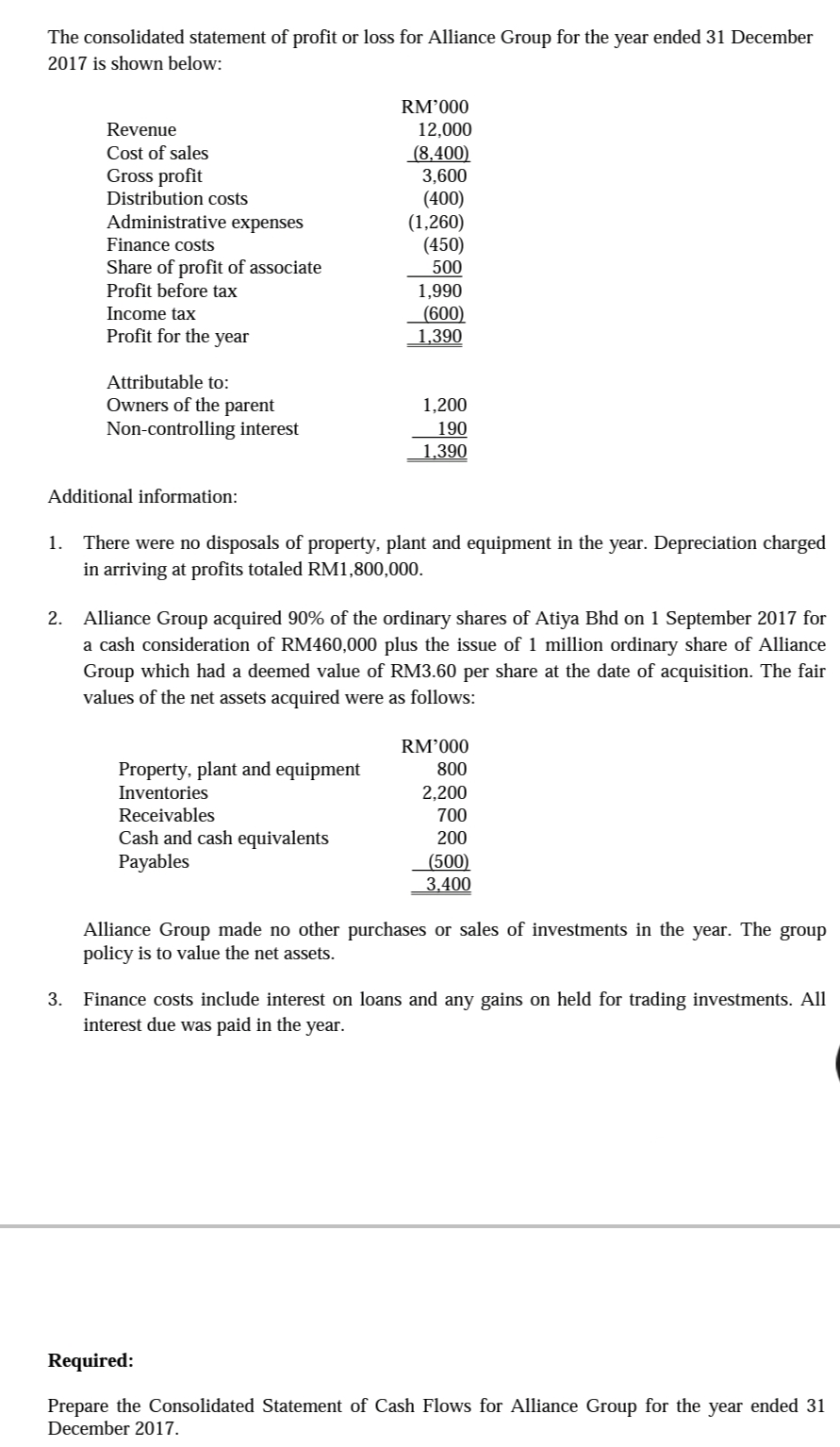

Transcribed Image Text:The consolidated statement of profit or loss for Alliance Group for the year ended 31 December

2017 is shown below:

RM'000

12,000

(8,400)

3,600

(400)

(1,260)

(450)

Revenue

Cost of sales

Gross profit

Distribution costs

Administrative expenses

Finance costs

Share of profit of associate

Profit before tax

500

1,990

(600)

1,390

Income tax

Profit for the year

Attributable to:

Owners of the parent

Non-controlling interest

1,200

190

1,390

Additional information:

1. There were no disposals of property, plant and equipment in the year. Depreciation charged

in arriving at profits totaled RM1,800,000.

2. Alliance Group acquired 90% of the ordinary shares of Atiya Bhd on 1 September 2017 for

a cash consideration of RM460,000 plus the issue of 1 million ordinary share of Alliance

Group which had a deemed value of RM3.60 per share at the date of acquisition. The fair

values of the net assets acquired were as follows:

RM’000

Property, plant and equipment

800

Inventories

2,200

Receivables

Cash and cash equivalents

Payables

700

200

(500)

3.400

Alliance Group made no other purchases or sales of investments in the year. The group

policy is to value the net assets.

3. Finance costs include interest on loans and any gains on held for trading investments. All

interest due was paid in the year.

Required:

Prepare the Consolidated Statement of Cash Flows for Alliance Group for the year ended 31

December 2017.

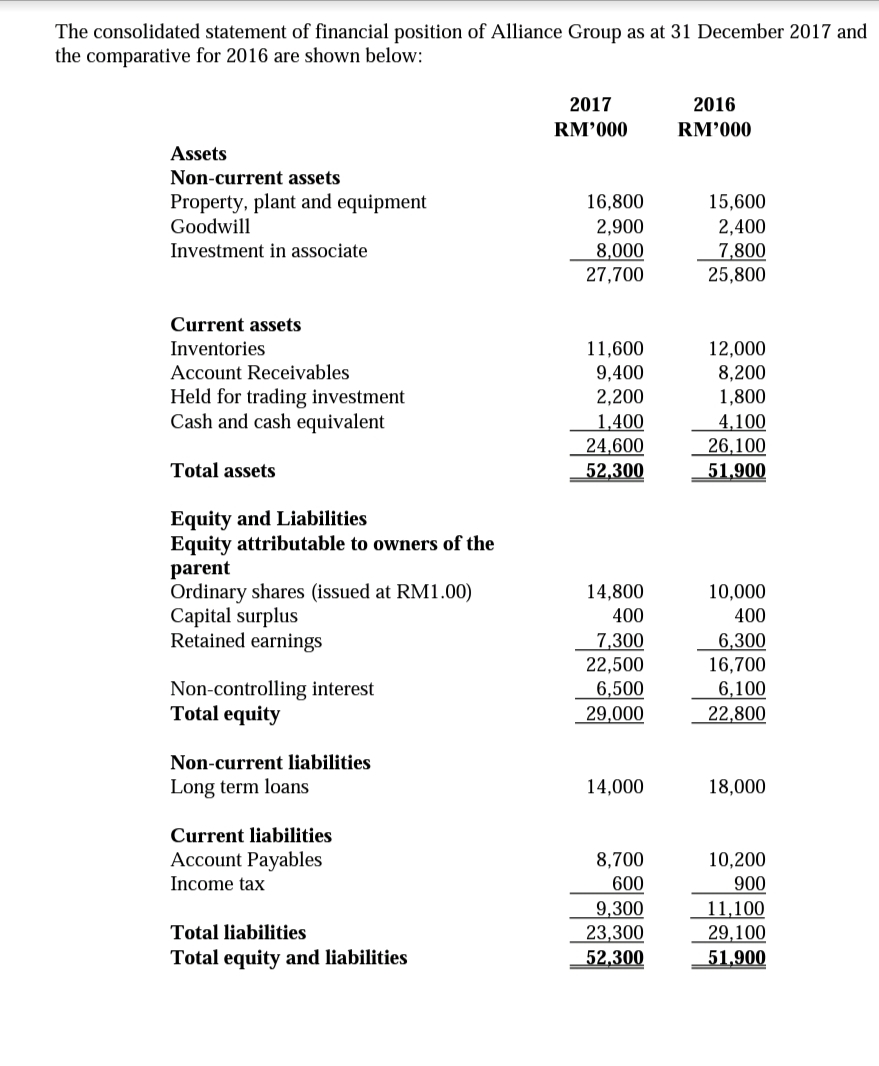

Transcribed Image Text:The consolidated statement of financial position of Alliance Group as at 31 December 2017 and

the comparative for 2016 are shown below:

2017

2016

RM'000

RM'000

Assets

Non-current assets

Property, plant and equipment

16,800

15,600

Goodwill

2,900

8,000

27,700

2,400

7,800

25,800

Investment in associate

Current assets

Inventories

11,600

9,400

12,000

8,200

1,800

Account Receivables

Held for trading investment

Cash and cash equivalent

2,200

1,400

24,600

52,300

4,100

26,100

51,900

Total assets

Equity and Liabilities

Equity attributable to owners of the

parent

Ordinary shares (issued at RM1.00)

Capital surplus

Retained earnings

14,800

10,000

400

400

_ 7,300

22,500

6,500

29,000

6,300

16,700

6,100

Non-controlling interest

Total equity

22,800

Non-current liabilities

Long term loans

14,000

18,000

Current liabilities

Account Payables

8,700

10,200

Income tax

600

900

9,300

23,300

52,300

11,100

29,100

51,900

Total liabilities

Total equity and liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education