Sea Worthy uses three processes to manufacture lifts for personal watercrafts: forming a lift's parts from galvanized steel, assembling the lift, and testing the completed lift. The lifts are transferred to finished goods before shipment to marinas across the country. Sea Worthy's Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for October 2018: UNITS Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period 2,300 units 6,800 units

Sea Worthy uses three processes to manufacture lifts for personal watercrafts: forming a lift's parts from galvanized steel, assembling the lift, and testing the completed lift. The lifts are transferred to finished goods before shipment to marinas across the country. Sea Worthy's Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for October 2018: UNITS Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period 2,300 units 6,800 units

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 18E: For E2-17, prepare any journal entries that would have been different if the only trigger points had...

Related questions

Question

Please help me to solve this problem

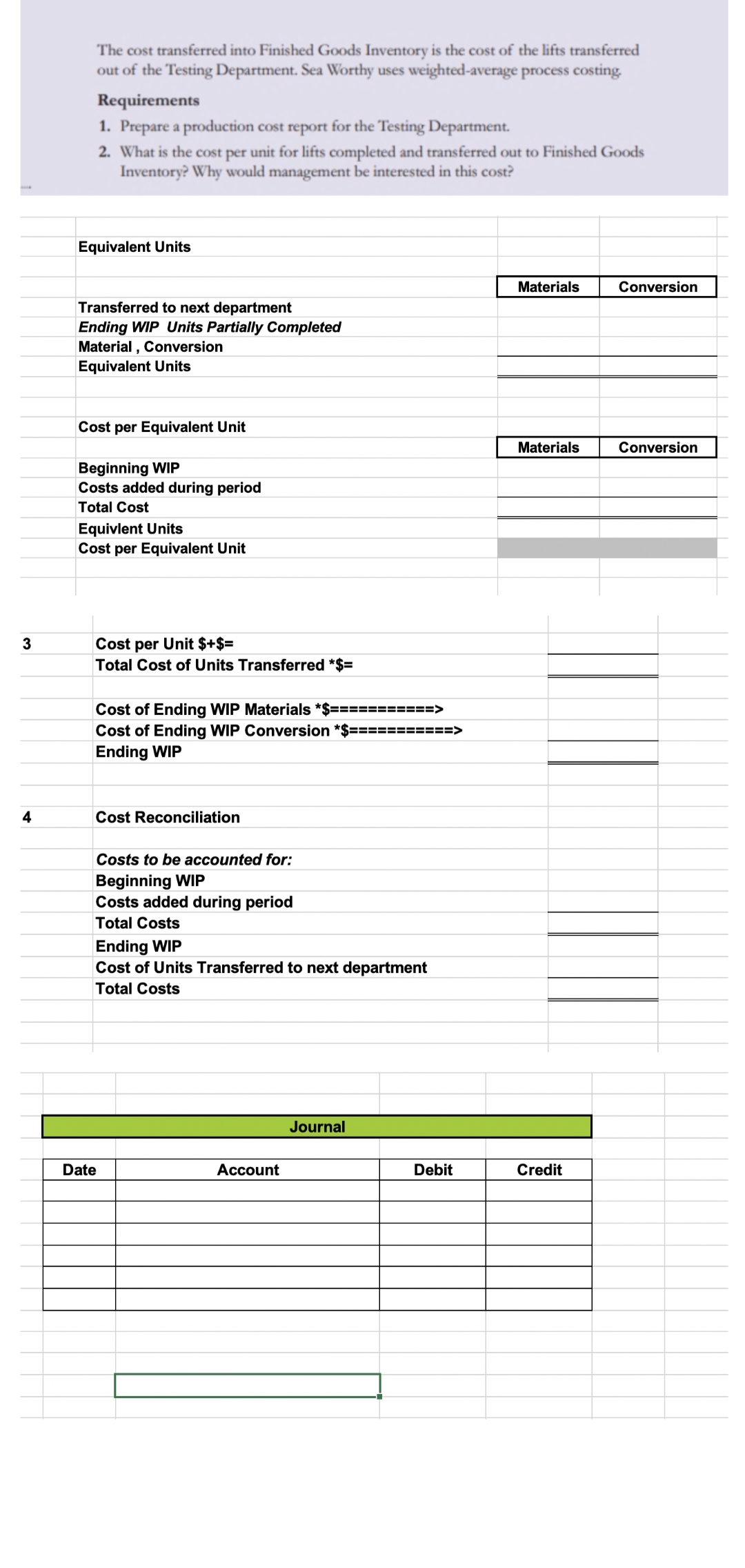

Transcribed Image Text:3

4

The cost transferred into Finished Goods Inventory is the cost of the lifts transferred

out of the Testing Department. Sea Worthy uses weighted-average process costing.

Requirements

1. Prepare a production cost report for the Testing Department.

2. What is the cost per unit for lifts completed and transferred out to Finished Goods

Inventory? Why would management be interested in this cost?

Equivalent Units

Transferred to next department

Ending WIP Units Partially Completed

Material, Conversion

Equivalent Units

Cost per Equivalent Unit

Beginning WIP

Costs added during period

Total Cost

Equivlent Units

Cost per Equivalent Unit

Cost per Unit $+$=

Total Cost of Units Transferred *$=

Cost of Ending WIP Materials *$===========>

Cost of Ending WIP Conversion *$===========>

Ending WIP

Cost Reconciliation

Costs to be accounted for:

Beginning WIP

Costs added during period

Total Costs

Ending WIP

Cost of Units Transferred to next department

Total Costs

Date

Account

Journal

Debit

Materials

Materials

Credit

Conversion

Conversion

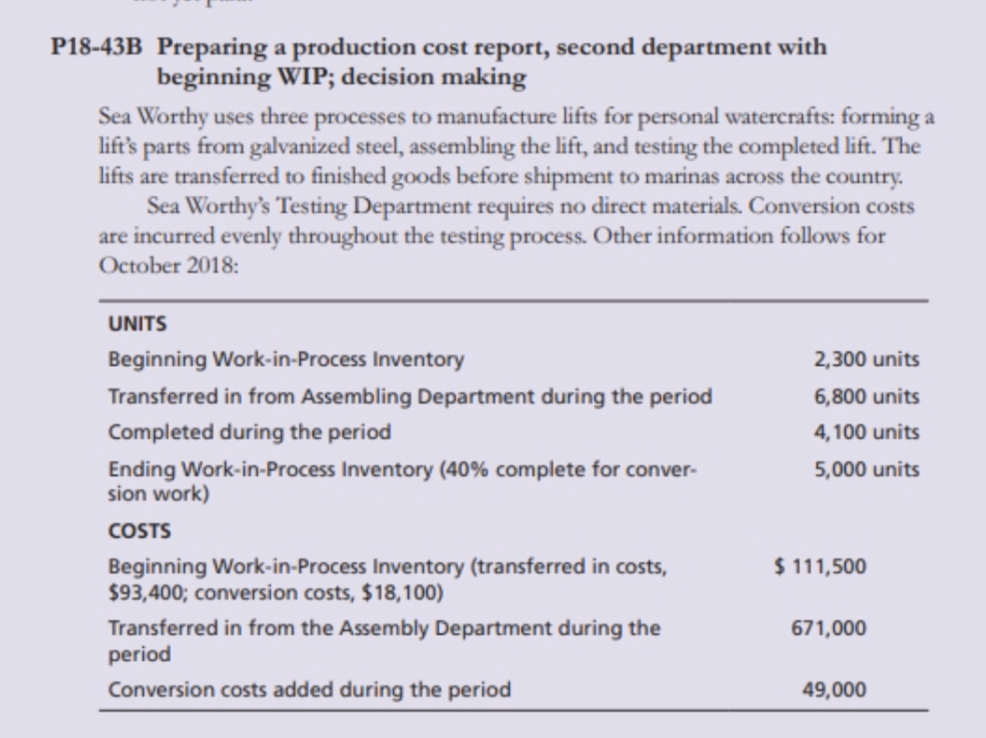

Transcribed Image Text:P18-43B Preparing a production cost report, second department with

beginning WIP; decision making

Sea Worthy uses three processes to manufacture lifts for personal watercrafts: forming a

lift's parts from galvanized steel, assembling the lift, and testing the completed lift. The

lifts are transferred to finished goods before shipment to marinas across the country.

Sea Worthy's Testing Department requires no direct materials. Conversion costs

are incurred evenly throughout the testing process. Other information follows for

October 2018:

UNITS

Beginning Work-in-Process Inventory

Transferred in from Assembling Department during the period

Completed during the period

Ending Work-in-Process Inventory (40% complete for conver-

sion work)

COSTS

Beginning Work-in-Process Inventory (transferred in costs,

$93,400; conversion costs, $18,100)

Transferred in from the Assembly Department during the

period

Conversion costs added during the period

2,300 units

6,800 units

4,100 units

5,000 units

$ 111,500

671,000

49,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning