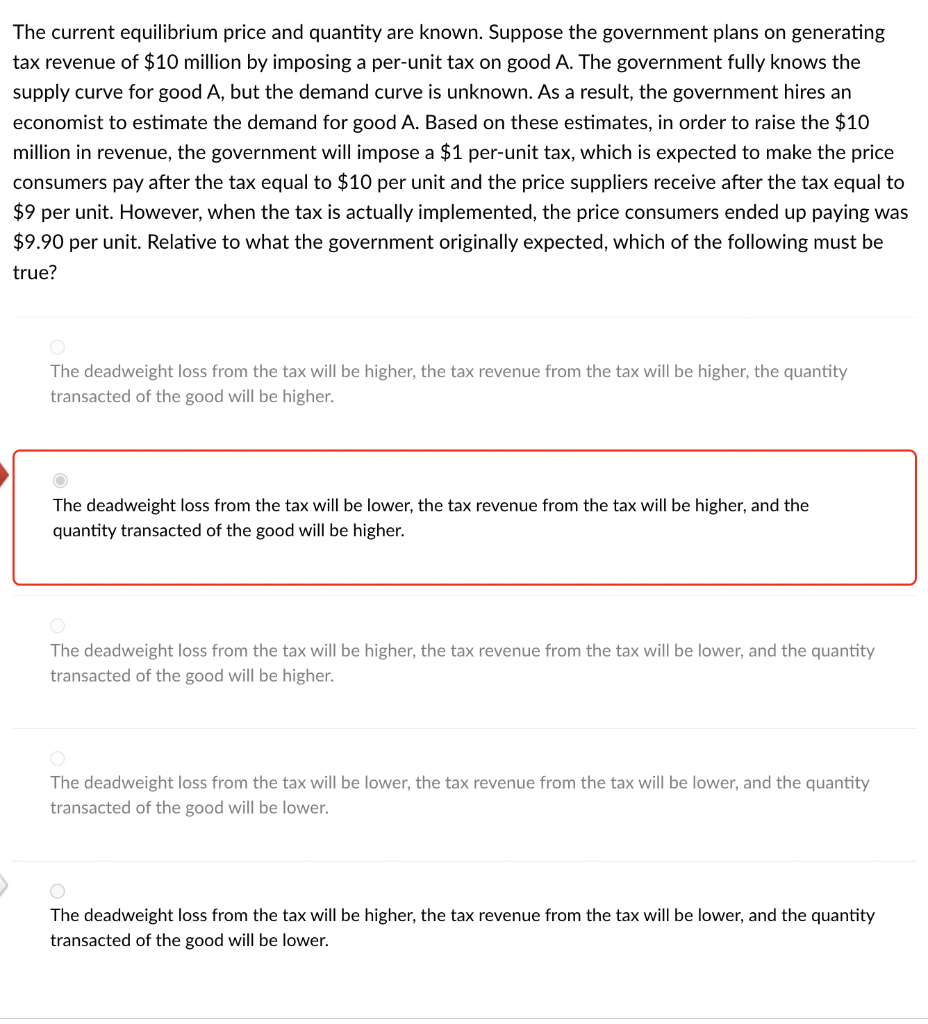

The current equilibrium price and quantity are known. Suppose the government plans on generating tax revenue of $10 million by imposing a per-unit tax on good A. The government fully knows the supply curve for good A, but the demand curve is unknown. As a result, the government hires an economist to estimate the demand for good A. Based on these estimates, in order to raise the $10 million in revenue, the government will impose a $1 per-unit tax, which is expected to make the price consumers pay after the tax equal to $10 per unit and the price suppliers receive after the tax equal to $9 per unit. However, when the tax is actually implemented, the price consumers ended up paying was $9.90 per unit. Relative to what the government originally expected, which of the following must be true? The deadweight loss from the tax will be higher, the tax revenue from the tax will be higher, the quantity transacted of the good will be higher. O The deadweight loss from the tax will be lower, the tax revenue from the tax will be higher, and the quantity transacted of the good will be higher. O The deadweight loss from the tax will be higher, the tax revenue from the tax will be lower, and the quantity transacted of the good will be higher. The deadweight loss from the tax will be lower, the tax revenue from the tax will be lower, and the quantity transacted of the good will be lower. O The deadweight loss from the tax will be higher, the tax revenue from the tax will be lower, and the quantity transacted of the good will be lower.

The current equilibrium price and quantity are known. Suppose the government plans on generating tax revenue of $10 million by imposing a per-unit tax on good A. The government fully knows the supply curve for good A, but the demand curve is unknown. As a result, the government hires an economist to estimate the demand for good A. Based on these estimates, in order to raise the $10 million in revenue, the government will impose a $1 per-unit tax, which is expected to make the price consumers pay after the tax equal to $10 per unit and the price suppliers receive after the tax equal to $9 per unit. However, when the tax is actually implemented, the price consumers ended up paying was $9.90 per unit. Relative to what the government originally expected, which of the following must be true? The deadweight loss from the tax will be higher, the tax revenue from the tax will be higher, the quantity transacted of the good will be higher. O The deadweight loss from the tax will be lower, the tax revenue from the tax will be higher, and the quantity transacted of the good will be higher. O The deadweight loss from the tax will be higher, the tax revenue from the tax will be lower, and the quantity transacted of the good will be higher. The deadweight loss from the tax will be lower, the tax revenue from the tax will be lower, and the quantity transacted of the good will be lower. O The deadweight loss from the tax will be higher, the tax revenue from the tax will be lower, and the quantity transacted of the good will be lower.

Microeconomics A Contemporary Intro

10th Edition

ISBN:9781285635101

Author:MCEACHERN

Publisher:MCEACHERN

Chapter5: Elasticity Of Demand And Supply

Section5.A: Appendix: Price Elasticity And Tax Incidence

Problem 1AQ

Related questions

Question

Transcribed Image Text:The current equilibrium price and quantity are known. Suppose the government plans on generating

tax revenue of $10 million by imposing a per-unit tax on good A. The government fully knows the

supply curve for good A, but the demand curve is unknown. As a result, the government hires an

economist to estimate the demand for good A. Based on these estimates, in order to raise the $10

million in revenue, the government will impose a $1 per-unit tax, which is expected to make the price

consumers pay after the tax equal to $10 per unit and the price suppliers receive after the tax equal to

$9 per unit. However, when the tax is actually implemented, the price consumers ended up paying was

$9.90 per unit. Relative to what the government originally expected, which of the following must be

true?

The deadweight loss from the tax will be higher, the tax revenue from the tax will be higher, the quantity

transacted of the good will be higher.

The deadweight loss from the tax will be lower, the tax revenue from the tax will be higher, and the

quantity transacted of the good will be higher.

The deadweight loss from the tax will be higher, the tax revenue from the tax will be lower, and the quantity

transacted of the good will be higher.

The deadweight loss from the tax will be lower, the tax revenue from the tax will be lower, and the quantity

transacted of the good will be lower.

O

The deadweight loss from the tax will be higher, the tax revenue from the tax will be lower, and the quantity

transacted of the good will be lower.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning