The demand curves for cases of Coke and Pepsi are given respectively by Qc(Pc- Pp) = 200 – 10p. + 5pp. Q-(Pc. Pp) = 200 – 10p, + 5pc- Each firm has a marginal cost of $10 per case and must simultaneously choose their prices. Are the following statements true or false? 6. If Pepsi charges less than Coke, then all customers will buy from Pepsi. 7. Because Coke and Pepsi are substitutes, the best model for understanding this market is the Cournot Competition Model. For the next question, note that Coke's revenue, as a function of price, is Re(Pc. Pe) = Pc(200 – 10pc + 5pe). 8. Solving the equation ƏRE (PePe) = 10 apc for pc will yield Coke's best-response function. 9. The best-response functions are pe(pp) = 15 + 0.25 pp and pi(pc) = 15 + 0.25 pc- 10. Both firms charging $20 is an equilibrium.

The demand curves for cases of Coke and Pepsi are given respectively by Qc(Pc- Pp) = 200 – 10p. + 5pp. Q-(Pc. Pp) = 200 – 10p, + 5pc- Each firm has a marginal cost of $10 per case and must simultaneously choose their prices. Are the following statements true or false? 6. If Pepsi charges less than Coke, then all customers will buy from Pepsi. 7. Because Coke and Pepsi are substitutes, the best model for understanding this market is the Cournot Competition Model. For the next question, note that Coke's revenue, as a function of price, is Re(Pc. Pe) = Pc(200 – 10pc + 5pe). 8. Solving the equation ƏRE (PePe) = 10 apc for pc will yield Coke's best-response function. 9. The best-response functions are pe(pp) = 15 + 0.25 pp and pi(pc) = 15 + 0.25 pc- 10. Both firms charging $20 is an equilibrium.

Survey of Economics (MindTap Course List)

9th Edition

ISBN:9781305260948

Author:Irvin B. Tucker

Publisher:Irvin B. Tucker

Chapter9: Monopolistic Competition And Oligoply

Section: Chapter Questions

Problem 20SQ

Related questions

Question

part 10 11 12

Transcribed Image Text:The demand curves for cases of Coke and Pepsi are given respectively by

Q.(Pc.Pe) = 200 - 10p. + 5pp.

Qp(pc. Pp) = 200 - 10pp + 5pc.

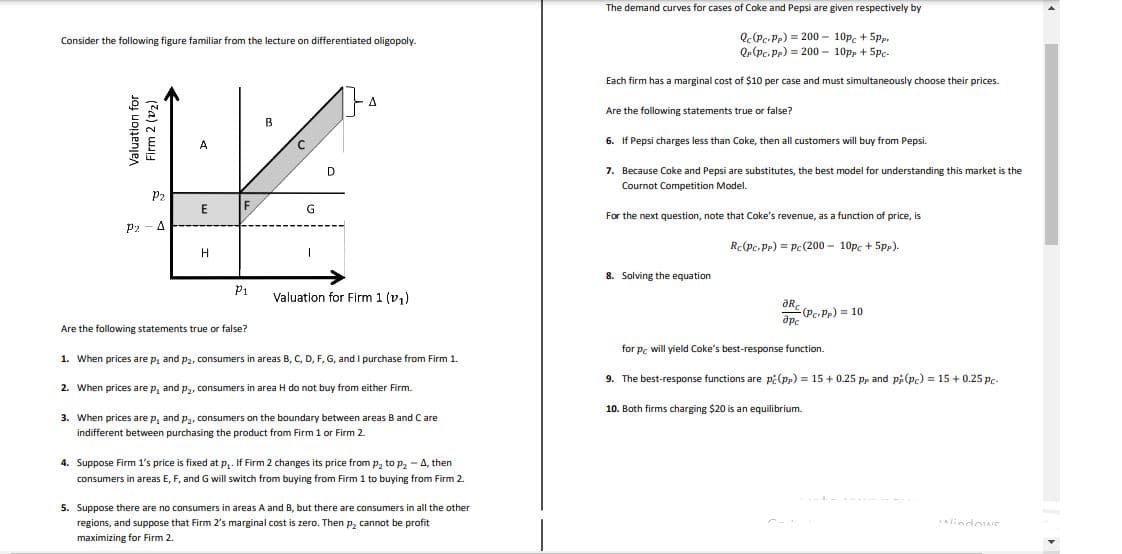

Consider the following figure familiar from the lecture on differentiated oligopoly.

Each firm has a marginal cost of $10 per case and must simultaneously choose their prices.

Are the following statements true or false?

B

A

6. If Pepsi charges less than Coke, then all customers will buy from Pepsi.

D

7. Because Coke and Pepsi are substitutes, the best model for understanding this market is the

Cournot Competition Model.

P2

F

For the next question, note that Coke's revenue, as a function of price, is

p2 - A

Rc(Pc.Pp) = Pc (200 - 10pc + 5pp).

H

8. Solving the equation

P1

Valuation for Firm 1 (v,)

OkE (PePr) = 10

Are the following statements true or false?

for pc will yield Coke's best-response function.

1. When prices are p, and p2, consumers in areas B, C, D, F, G, and I purchase from Firm 1.

9. The best-response functions are pi(pp) = 15 + 0.25 pp and pi(pc) = 15 + 0.25 pc.

2. When prices are p, and p, consumers in area H do not buy from either Firm.

10. Both firms charging $20 is an equilibrium.

3. When prices are p, and p2, consumers on the boundary between areas B and Care

indifferent between purchasing the product from Firm 1 or Firm 2.

4. Suppose Firm

s price is fixed at p, If Firm 2 changes its price from p, to p2 - 4 t

consumers in areas E, F, and G will switch from buying from Firm 1 to buying from Firm 2.

5. Suppose there are no consumers in areas A and B, but there are consumers in all the other

regions, and suppose that Firm 2's marginal cost is zero. Then p, cannot be profit

lindows

maximizing for Firm 2.

Valuation for

Firm 2 (vz)

Transcribed Image Text:The equilibrium outcome of the Leader-Follower model of duopoly has the leader behaving

more aggressively than it would in the simultaneous version of the game (i.e., in Coumat

duopoly)- The leader also enjoys first-mover advantage in that its profit is higher than that of

the follower when the firms' marginal costs are the same. These predictions derive from the

fact that, in this market, mare aggressive play by one firm (ie, a higher quantity) elicits a less

aggressive response (a lower quantity) from its competitor as each firm's best response

quantity is decreasing in the competitor's quantity. Economists refer to this by saying that the

firms' products are strategic substitutes.

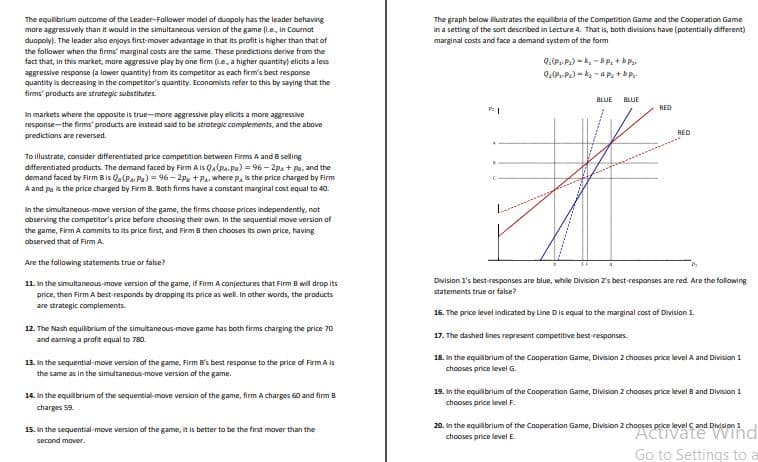

The graph below lustrates the equilibria of the Competition Game and the Cooperation Game

in a setting of the sort described in Lecture 4. That is, both divisions have (potentially different)

marginal costs and face a demand system of the form

Q.(P-P) -k -b P. +b P

BLUE

BLUE

RED

In markets where the opposite is true-more aggressive play elicits a more aggressive

response-the firms' products are instead said to be strateglc complements, and the above

RED

predictions are reversed.

To illustrate, consider differentiated price competition between Fims A and B selling

differentiated products. The demand faced by Firm A is Qa (Pa. Pa) = 96 – 2pa + Pa, and the

demand faced by Firm Bis Qa(Pa Pa) = 96 – 2p, + Pa, where p, is the price charged by Firm

A and pa is the price charged by Firm B. Both firms have a constant marginal cost equal to 40.

In the simultaneous-move version of the game, the firms choose prices independently, not

observing the competitor's price before choosing their own. In the sequential move version of

the game, Firm A commits to its price first, and Firm B then chooses its own price, having

observed that of Firm A.

Are the following statements true or false?

Division 1's best-responses are blue, while Division 2's best-responses are red. Are the following

11. in the simultaneous-move version of the game, if Firm A conjectures that Firm B will drop its

price, then Firm A best-responds by dropping its price as well. In other words, the products

statements true or false?

are strategic complements.

16. The price level indicated by Line Dis equal to the marginal cost of Division 1.

12. The Nash equilibrium of the simultaneous-move game has both firms charging the price 70

17. The dashed lines represent competitive best-responses.

and eaming a profit equal to 780.

18. In the equilibrium of the Cooperation Game, Division 2 choses price level A and Divisian 1

13. In the sequential-move version of the game, Firm B's best response to the price of Firm A is

the same as in the simultaneous-move version of the game.

chooses price level G.

14. In the equilbrium of the sequential-move version af the game, firm A charges 60 and firm B

charges 59.

19. In the equilibrium of the Cooperation Game, Division 2 chooses price level B and Division 1

chooses price level F.

20. In the equilibrium of the Cooperation Game, Division 2 chooses price level Cand Division 1

"Activate Wihd

Go to Settings to a

15. In the sequential-move version of the game, it is better to be the first mover than the

chooses price level E

second mover.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning