The demand curves for cases of Coke and Pepsi are given respectively by Qc(Pc. Pe) = 200 - 10pc + 5pe. Q-(Pc. Pe) = 200 – 10p, + 5pc- Each firm has a marginal cost of $10 per case and must simultaneously choose their prices. Are the following statements true or false? 6. If Pepsi charges less than Coke, then all customers will buy from Pepsi. 7. Because Coke and Pepsi are substitutes, the best model for understanding this market is the Cournot Competition Model. For the next question, note that Coke's revenue, as a function of price, is Re(Pc. Pp) = Pc(200 - 10pc + 5pp). 8. Solving the equation (Pc. Pr) = 10 apc for pc will yield Coke's best-response function. 9. The best-response functions are p(Pp) = 15 + 0.25 Pp and pi(Pc) = 15 + 0.25 Pc-

The demand curves for cases of Coke and Pepsi are given respectively by Qc(Pc. Pe) = 200 - 10pc + 5pe. Q-(Pc. Pe) = 200 – 10p, + 5pc- Each firm has a marginal cost of $10 per case and must simultaneously choose their prices. Are the following statements true or false? 6. If Pepsi charges less than Coke, then all customers will buy from Pepsi. 7. Because Coke and Pepsi are substitutes, the best model for understanding this market is the Cournot Competition Model. For the next question, note that Coke's revenue, as a function of price, is Re(Pc. Pp) = Pc(200 - 10pc + 5pp). 8. Solving the equation (Pc. Pr) = 10 apc for pc will yield Coke's best-response function. 9. The best-response functions are p(Pp) = 15 + 0.25 Pp and pi(Pc) = 15 + 0.25 Pc-

Chapter10: Monopolistic Competition And Oligoply

Section: Chapter Questions

Problem 14SQ

Related questions

Question

part 7 8 9

Transcribed Image Text:The demand curves for cases of Coke and Pepsi are given respectively by

Qe(Pc. Pe) = 200 - 10pc + 5pp.

Qr (Pc. Pr) = 200 – 10pp + 5pc-

Each firm has a marginal cost of $10 per case and must simultaneously choose their prices.

Are the following statements true or false?

6. If Pepsi charges less than Coke, then all customers will buy from Pepsi.

7. Because Coke and Pepsi are substitutes, the best model for understanding this market is the

Cournot Competition Model.

For the next question, note that Coke's revenue, as a function of price, is

Re(Pc. Pp) = Pc(200 - 10pc + 5pp).

8. Solving the equation

(Pc. Pp) = 10

ape

for pe will yield Coke's best-response function.

9. The best-response functions are p(Pp) = 15 + 0.25 p, and pp(Pc) = 15 + 0.25 pc-

10. Both firms charging $20 is an equilibrium.

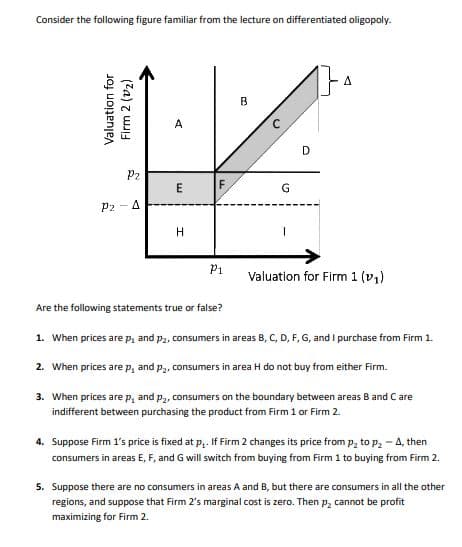

Transcribed Image Text:Consider the following figure familiar from the lecture on differentiated oligopoly.

A

D

P2

F

P2 -4

H

P1

Valuation for Firm 1 (v1)

Are the following statements true or false?

1. When prices are p, and p2, consumers in areas B, C, D, F, G, and I purchase from Firm 1.

2. When prices are p, and p,, consumers in area H do not buy from either Firm.

3. When prices are p, and p2, consumers on the boundary between areas B and Care

indifferent between purchasing the product from Firm 1 or Firm 2.

4. Suppose Firm 1's price is fixed at p,. If Firm 2 changes its price from p, to p2 - 4, then

consumers in areas E, F, and G will switch from buying from Firm 1 to buying from Firm 2.

5. Suppose there are no consumers in areas A and B, but there are consumers in all the other

regions, and suppose that Firm 2's marginal cost is zero. Then p, cannot be profit

maximizing for Firm 2.

Valuation for

(Za) z w

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning