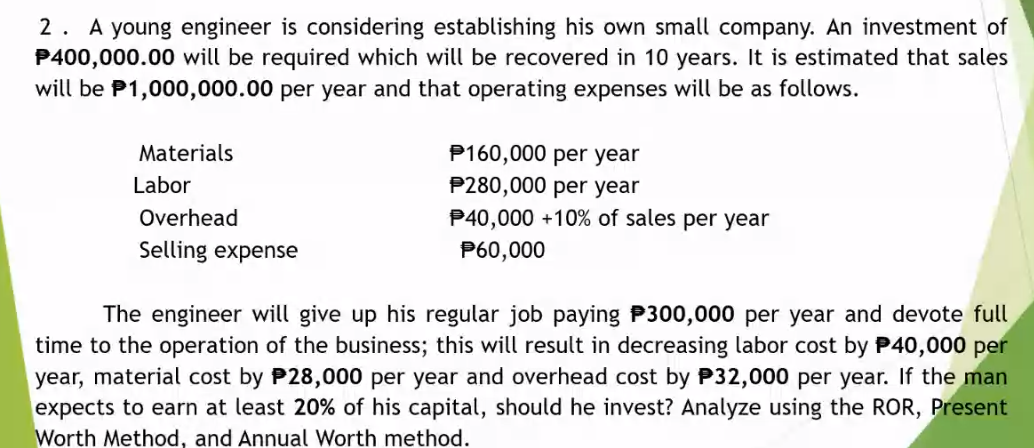

The engineer will give up his regular job paying P300,000 per year and devote full time to the operation of the business; this will result in decreasing labor cost by P40,000 per year, material cost by P28,000 per year and overhead cost by P32,000 per year. If the man expects to earn at least 20% of his capital, should he invest? Analyze using the ROR, Present Worth Method, and Annual Worth method.

Q: 2. Consider the three small mutually exclusive investment alternatives in the table below. The…

A:

Q: McGwire Aerospace expects to have net cash flow of $12 million. The company forecasts that its…

A: Net income=net cash flow-depreciation & amortization Net income=12-5=7 million Assume sales as X…

Q: A relatively small privately owned coal-mining company has the sales results summarized below.…

A: Allowed depreciation : Minimum of depreciation and taxable amount. Below is the calculation table-

Q: George Zegoyan and Amir Gupta face a difficult decision. Their private auto parts manufacturing…

A: To be considered a partial owner, a shareholder should own at least one share of a company's stock…

Q: 1. Suppose we are considering the question of how much capacity to build in the face of uncertain…

A: Find the Given details below: Given details: Demand X Units Probability of X 0 0.05 1 0.1…

Q: MAR attributes her success to taking care of customers. To her customers, MAR feel great to choose…

A: A strategy is the plan jotted down to achieve some goal. In a strategy all the challenges, elements…

Q: The data collected in running a machine, the cost of which is Rs 60,000 are given below: Year 1 2 3…

A: The data collected in running a machine, Year 1 2 3 4 5 Resale Value 42,000 30,000 20,400…

Q: Ms Sara and her friend, Ms Sameera, decided to start a restaurant. Each of them invested 3000 OMR as…

A: The type of business discussed above is partnership firm. Because features of partnership firms…

Q: Problem No. 1: The first week of chess club had 3 students. The second week had five students. The…

A: As per Bartleby guidelines, we can only solve one question at a time...Kindly upload the other…

Q: Fred has been told that diversifying his investments will significantly reduce risk. He has…

A: The expected return is calculated by multiplying the weight of each asset by its expected return.…

Q: what will be its projected new ROE

A: From the given question following points can be ascertained: Old ROE = NI / Equity…

Q: UST 40,000 (Commerce 5,000; Medicine 15%; AB 20%; Law 5% and others) Average price per computer…

A: Since you have posted multiple questions we will solve the first question for you as per our…

Q: Your firm is considering purchasing an old office building with an estimated remaining service life…

A:

Q: f the fixed costs of manufacturing a new cell phone are $40,000, the sales price is $200, and…

A: The point at production cost and revenue comes at the same point or amount. This situation is the…

Q: The manufacturing costs of Ackerman Industries for the first three months of the year follow:…

A: Data Given- Months Unit Produced Total Costs Jan 1400 2,72,160 Feb 2910 3,96,450 March…

Q: Eastman Publishing Company is considering publishing an electronic textbook about spreadsheet…

A: Given that: Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Variable Cost/Book $6 $8…

Q: As part of their application for a loan to buy Lakeside Farm, a property they hope to develop as a…

A: Breakeven is that point where revenue is equal to cost

Q: For the Orlando real estate investment problem, assume the probabilities for the gasoline shortage,…

A: Given data is

Q: PT. Corona is currently trying to determine the size of the computer system which will provide…

A: Given data is

Q: Average price per computer device Php25,000 Average price per Apple device Php30,000 In UST,…

A: The following data is given: Total = 40,000, Commerce= 5000, Medicine= 6000,AB= 8000, Law=2000,…

Q: The Sloan Corporation is trying to choose between the following two mutually exclusive design…

A: This question is related to the topic of project management and this topic falls under the…

Q: Jasmine is a mother of three children, ages 6 months, 2 years, and 3 and a half. Jasmine makes…

A: An individual is faced with tough decisions which change the course of life after being taken. There…

Q: Easy-Tech Soft ware Corporation is evaluating theproduction of a new soft ware product to compete…

A: It is given that the new software production is being evaluated for competing with a popular…

Q: What is the maximum profit? What is the value of X? * What is the objective function? (write the…

A: First, let me formulate the linear programming problem, this LP formulation is done below: Here,…

Q: The NBS television network earns an average of$400,000 from a hit show and loses an average of…

A: Given, P(Hit) = 0.25 Joint Probabilities: P(Predict Hit|Hit) = 0.9 P(Predict Flop|Hit) = 0.1…

Q: Which one of the following is key element to overall athletic performance? Select one: a. Increase…

A: To turn into the best athlete you can become and come to your fullest potential at all measure of…

Q: Suppose that an aircraft manufacturer desires to make a preliminary estimate of the cost of building…

A: Cost is the sum of money used by the manufacturer to manufacture and sell the commodities in the…

Q: Today a proposed community college is estimated to cost K795,527,518. which is K2806 per square foot…

A: Please find the attached answer as calculated below- Given, Estimated cost- K795,527,518 Per sq ft.…

Q: An airline company has been contracting a maintenance company to do overhauls for its planes at a…

A: Let the number of planes be x per quarter Current cost per quarter = 51275 per plane Cost after…

Q: Suppose that an aircraft manufacturer desires to make a preliminary estimate of the cost of building…

A: Assume, CA be the cost of 600-MW fossil-fuel plant. CB be the cost of 200-MW fossil-fuel plant.…

Q: As part of their application for a loan to buy Lakeside Farm, a property they hope to develop as a…

A: Taking the number of rooms occupied in a month a 'X' . Given: Fixed Cost = $ 6,000 Variable Cost =…

Q: 11. for the year 2020, company a implemented a strategy of horizontal integration. on this action,…

A: Ans. A successful marketing strategy help the company I yielding good return on investment. Also,…

Q: Q2 is estimated to be 8 years. The sinking-fund method for determining the rate of depreciation is…

A: The book value of a business is the net difference within the company's total assets and total…

Q: A company plans to manufacture a product and sell it for $3.00 per unit. Equipment to manufacture…

A: Given: Per unit Selling price 3 Less: Variable cost Direct material 0.85 Direct labor…

Q: Cluck Farms, Inc. produces a crop of chickens at a total cost of $66,000. The production generates…

A: Incremental Revenue = 60000 x (2.75-1.50) = $ 75000

Q: George Zegoyan and Amir Gupta face a ditticult decision. Their private auto parts manufacturing…

A: Answer 1: They have other options besides going public is that they can sale debentures to…

Q: A new electric power generation plant is expected to cost $42,000,000 to complete. The revenues…

A: The question is related to the Capital Budgeting. IRR is the internal rate of return is the rate…

Q: How is EMV calculated for these steps. What is the probability and impact in these questions. 1)…

A: 1) Yes, I should play. The expected net monetary value is $ 1780 2) I should try again, because the…

Q: Even though independent gasoline stations have been having a difficult time, lan Langella been…

A: Find the given details below: Given details: Size for the first station Good Market Fair Market…

Q: The Ace Company sells a single product at a budgeted selling price per unit of $20. Budgeted…

A: The term Budgeted operating income means the income which is earned by the specific company before…

Q: Scott Power produces batteries. The company has determined its contribution margin to be $8…

A: Contribution margin = $8 per battery Contribution margin ratio = 0.4 (it provides a direct measure…

Q: A rock concert producer has scheduled an outdoor concert. The producer estimates the attendance will…

A: Formula to be used to calculate the profit = Profit = Revenue - Cost

Q: Sameena works as a free-lance worker at a software house in Rawalpindi. Suppose she keeps awake for…

A: Hello thank you for the question. As per guidelines, we would provide only one answer at a time.…

Q: A firm is considering the replacement of a machine, whose cost price is Rs 12,200 and its scrap…

A: We are given the running cost, R(n), the scrap value S = Rs 200, and the cost of the machine, C = Rs…

Q: There are two competing alternatives in your textile business. A-type Tufting Machine costs $10,000…

A: Type A Tufting Machine cost =$10,000 Type B Tufting Machine cost =$10,000 Saving from Machine A in…

Q: Williams & Williams Co. produces plastic spray bottles and wants to earn a before-tax profit…

A: Formula:

Q: The lease cost for a specialized highway design software package is estimated to be $13,000 for each…

A:

Q: A company sells its products to wholesalers in batches of 1,000 units only. The daily demand for its…

A: Given data is

Step by step

Solved in 3 steps with 2 images

- Suppose you are going to receive $20,000 per year forfive years. The appropriate interest rate is 7 percent.a. What is the present value of the payments if they are in the form of an ordinaryannuity? What is the present value if the payments are an annuity due?b. Suppose you plan to invest the payments for five years. What is the future valueif the payments are an ordinary annuity? What if the payments are an annuitydue?c. Which has the highest present value, the ordinary annuity or annuity due? Whichhas the highest future value? Will this always be true?A recently hired chief executive officer wants to reduce future production costs to improve the company's earnings, thereby increasingthe value of the company's stock. The plan is to invest $76,000 now and $58,000 in each of the next 6 years to improveproductivity. By how much must annual costs decrease in years 7 through 12 to recover the investment plus a return of 13% per year? The annual cost decreases by $....A. Write a document with the following information: 1. What do you expect your job to pay when you start? 2. What benefits are musts for you? 3. What benefits would you like to have even though they are not musts? 4. Include the graph you generate in step B below. B. Create a spreadsheet and a graph of life vs funds For each year of your remaining life specify the amount you plan to save/invest/withdraw that year and how much you expect that amount to increase during the year (base on actual data – typical savings interest rate, typical stock market interest rate, typical CDs, typical…). Calculate how much your funds will increase/decrease over your life and create a life (x-axis) vs funds (y-axis) plot.

- 2. A firm makes two products, Y and Z. Each unit of Y costs $10 and sells for $40. Each unit of Z costs $5 and sells for $25. If the firm's goal is to maximize profit, what would be the appropriate objective function? Select one: a. Maximize profit Z = $10Y + $25Z b. Maximize profit Z = 0.25Y + 0.20Z c. Maximize profit Z = $40Y + $25Z d. Maximize profit Z = $50(Y + Z) e. Maximize profit Z = $30Y + $20ZChris LeBlanc estimates that if he does five hours of research using datathat will cost $175, there is a good chance that he can improve hisexpected return on a $10,000, one-year investment from 6% to 9%. Chrisfeels that he must earn at least $30 per hour on the time he devotes to hisresearch.a. Find the cost of Chris’s research.b. By how much (in dollars) will Chris’s return increase as a result ofthe research?c. On a strict economic basis, should Chris perform the proposed reserach?Rollo Megabux has $1 million to invest in stocks orbonds. The percentage yield on each investment during thecoming year depends on whether the economy has a goodor a bad year (see Table 17). It is equally likely that theeconomy will have a good or a bad year.a If Rollo is risk-neutral, how should he invest hismoney?b For $10,000, Rollo can hire a consulting firm toforecast the state of the economy. The consulting firm’sforecasts have the following properties:P(good forecast|economy good) .80P(good forecast|economy bad) .20Should Rollo hire the consulting firm? What are EVSIand EVPI? Economy EconomyHas Good Has BadYear YearYield on stocks 22% 10%Yield on bonds 16% 14%

- The below is an extract from the fixed asset register of ABC Ltd as at 31 December 2019Date of PurchaseCostuseful lifeLand1-Jan-306,000,000.000Building28-Feb-172,000,000.0020Vehicle:650,000.00Toyota Hilux1-Oct-19 350,000.005Ford Ranger30-Jun-17 300,000.005Furniture and Fittings1-May-20150,000.002Activities throughout the 2020 Financial Period:1. New Machinery have been purchased on 01 April 2020 at a Cost of N$ 4000,000. The machinery has been installed on the 15 April 2020 and was available for use on the 01 May 2020. Machinery is the only property plant and equipment of the company that is measured according to the revaluation method.1.1. On the 30th of October 2020 management decided to revalue the machinery due to a drastic decline in the revenue from sale of machinery produced inventory.Net replacement cost for the machine as at the 30th of October 2020 is N$2 000 000.2. The Toyota Hilux was involved in an accident on 1 October 2020 due to the floods and was written off by the…Consider an investment project with the following cash flows: N Cash Flow 0 -$5,0001 $02 $4,8403 $1,331ComputcthelRRforthisinvestment.lsthisprojectacceptablcatMARR = 10%?A young engineer is considering establishing his own small company.An investment of Php 100,000 will be required which must be recovered in 15years . It is estimated that sales will be Php 150,000 per year and thatoperating expenses will be as follows:Material Php 40,000 per yearLabor Php 70,000 per yearOverhead Php 10,000 + 10% of sales/yearSelling expenses Php 5,000/yearThe young engineer will give up his regular job paying Php 150,000 per yearand devote full time to the operation of the business. This will result indecreasing labor by Php 10,000 per year , material cost by Php 7000 peryear, and overhead cost by Php 8000 per year. If the young engineer expectsto earn at least 20% on his capital, should he invest ?

- SureStep is currently getting 160 regular-time hours from each worker per month. This is actu-ally calculated from 8 hours per day times 20 days per month. For this, they are paid $9.375 per hour(51500y160). Suppose workers can change theircontract so that they only have to work 7.5 hours perday regular-time—everything above this becomesovertime—and their regular-time wage rate increasesto $10 per hour. They will still work 20 days per month. Will this change the optimal no-backloggingsolution?1. Suppose you are going on a weekend trip to a city that is d miles away. Develop a model that determines your round-trip gasoline costs. What assumptions or approximations are necessary to treat this model as a deterministic model? Are these assumptions or approximations acceptable to you? 2. Suppose that a manager has a choice between the following two mathematical models of a given situation: (a)a relatively simple model that is a reasonable approximation of the real situation, and (b)a thorough and complex model that is the most accurate mathematical representation of the real situation possible. Why might the model described in part (a) be preferred by the manager?The cost data for Evencoat Paint for the year 2019 is as follows: Month Gallons ofPaintProduced EquipmentMaintenanceExpenses January 110,000 $70,700 February 68,000 66,800 March 71,000 67,000 April 77,000 68,100 May 95,000 69,200 June 101,000 70,300 July 125,000 70,400 August 95,000 68,900 September 95,000 69,500 October 89,000 68,600 November 128,000 72,800 December 122,000 71,450 A. Using the high-low method, express the company’s maintenance costs as an equation where x represents the gallons of paint produced. Then estimate the fixed and variable costs. Fixed cost $ Variable cost $