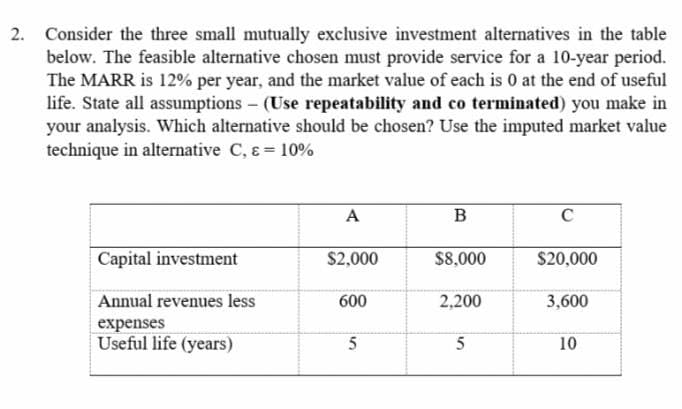

2. Consider the three small mutually exclusive investment alternatives in the table below. The feasible alternative chosen must provide service for a 10-year period. The MARR is 12% per year, and the market value of each is 0 at the end of useful life. State all assumptions - (Use repeatability and co terminated) you make in your analysis. Which alternative should be chosen? Use the imputed market value technique in alternative C, ɛ = 10% A C Capital investment $2,000 $8,000 $20,000 Annual revenues less 600 2,200 3,600 expenses Useful life (years) 5 10

2. Consider the three small mutually exclusive investment alternatives in the table below. The feasible alternative chosen must provide service for a 10-year period. The MARR is 12% per year, and the market value of each is 0 at the end of useful life. State all assumptions - (Use repeatability and co terminated) you make in your analysis. Which alternative should be chosen? Use the imputed market value technique in alternative C, ɛ = 10% A C Capital investment $2,000 $8,000 $20,000 Annual revenues less 600 2,200 3,600 expenses Useful life (years) 5 10

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section9.4: The Precision Tree Add-in

Problem 9P

Related questions

Question

Show complete solution

Transcribed Image Text:2. Consider the three small mutually exclusive investment alternatives in the table

below. The feasible alternative chosen must provide service for a 10-year period.

The MARR is 12% per year, and the market value of each is 0 at the end of useful

life. State all assumptions – (Use repeatability and co terminated) you make in

your analysis. Which alternative should be chosen? Use the imputed market value

technique in alternative C, &= 10%

A

В

C

Capital investment

$2,000

$8,000

$20,000

Annual revenues less

600

2,200

3,600

expenses

Useful life (years)

5

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,