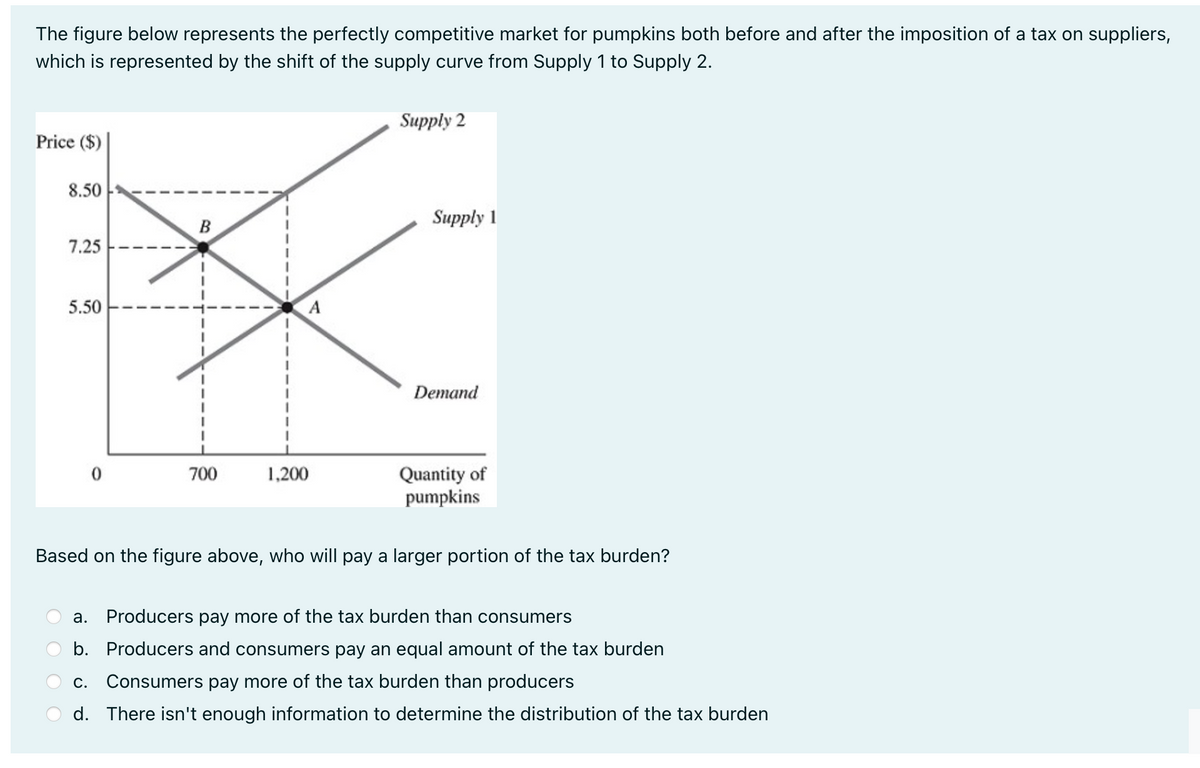

The figure below represents the perfectly competitive market for pumpkins both before and after the imposition of a tax on suppliers, which is represented by the shift of the supply curve from Supply 1 to Supply 2. Price ($) 8.50 7.25 5.50 0 B 700 A 1,200 Supply 2 Supply 1 Demand Quantity of pumpkins Based on the figure above, who will pay a larger portion of the tax burden? a. Producers pay more of the tax burden than consumers Ob. Producers and consumers pay an equal amount of the tax burden c. Consumers pay more of the tax burden than producers Od. There isn't enough information to determine the distribution of the tax burden

The figure below represents the perfectly competitive market for pumpkins both before and after the imposition of a tax on suppliers, which is represented by the shift of the supply curve from Supply 1 to Supply 2. Price ($) 8.50 7.25 5.50 0 B 700 A 1,200 Supply 2 Supply 1 Demand Quantity of pumpkins Based on the figure above, who will pay a larger portion of the tax burden? a. Producers pay more of the tax burden than consumers Ob. Producers and consumers pay an equal amount of the tax burden c. Consumers pay more of the tax burden than producers Od. There isn't enough information to determine the distribution of the tax burden

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter8: Application: The Cost Of Taxation

Section: Chapter Questions

Problem 1PA

Related questions

Question

Transcribed Image Text:The figure below represents the perfectly competitive market for pumpkins both before and after the imposition of a tax on suppliers,

which is represented by the shift of the supply curve from Supply 1 to Supply 2.

Price ($)

8.50

7.25

5.50

B

700

1,200

Supply 2

Supply 1

Demand

Quantity of

pumpkins

Based on the figure above, who will pay a larger portion of the tax burden?

a.

Producers pay more of the tax burden than consumers

b. Producers and consumers pay an equal amount of the tax burden

C. Consumers pay more of the tax burden than producers

d. There isn't enough information to determine the distribution of the tax burden

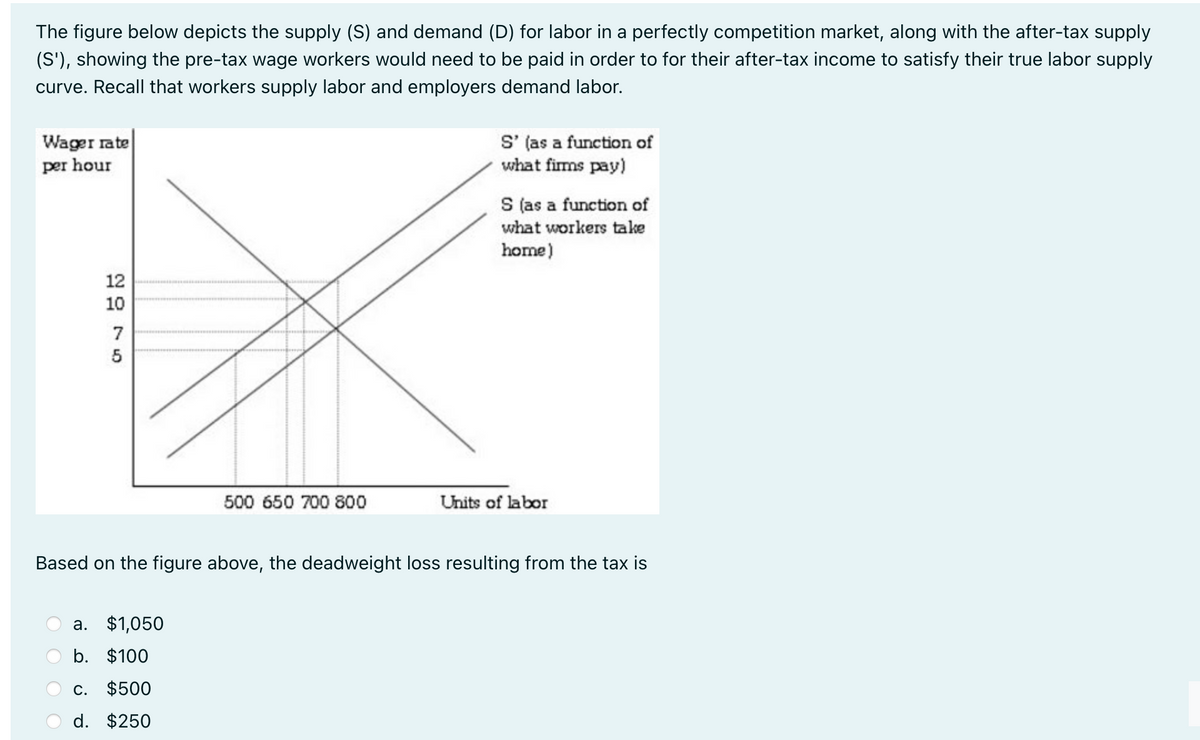

Transcribed Image Text:The figure below depicts the supply (S) and demand (D) for labor in a perfectly competition market, along with the after-tax supply

(S'), showing the pre-tax wage workers would need to be paid in order to for their after-tax income to satisfy their true labor supply

curve. Recall that workers supply labor and employers demand labor.

Wager rate

per hour

12

2075

10

a. $1,050

b. $100

500 650 700 800

C. $500

d. $250

S' (as a function of

what firms pay)

S (as a function of

what workers take

home)

Based on the figure above, the deadweight loss resulting from the tax is

Units of labor

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc