The firm should the semiconductors because this decision has an expected cost of S

Q: Describe ERP, the services it provides, and the hidden costs that come with it.

A: Enterprise resource planning (ERP) refers to a type of software that associations use to manage day-...

Q: What are the distinctions between the agile project management model and the traditional waterfall m...

A: Agile and waterfall project management strategies exist on a spectrum that should be used as needed ...

Q: Harvey Gold, orders an unusual olive from the island of Santorini, off the Greek coast. Over the yea...

A: case of variable demand and variable lead time

Q: Riex Blocks – “Hastang gahi a” specialized in the manufacturing of high-rise CHB (concrete hollow bl...

A: Economic order quantity is the optimal order quantity that any business should purchase so that the ...

Q: Omar has heard from some of his customers that they will probably cut back on order sizes in the nex...

A: Ans 4: Business forecasts help every stakeholder of the organization have a sensation or perception ...

Q: Evaluate the persuasiveness of Mazzucato’s arguments in The Value of Everything (2018) using the con...

A: A Small Introduction About Critical Management Being basic can be positive and valuable and can bri...

Q: 13. The production analyst of gas company is faced with deciding whether to purchase a patent to dev...

A: In the given situation, there are 2 alternatives. 1. Purchase the patent and develop the product 2. ...

Q: a. “To do what is right, you need to know what is right!” discuss the quote in relation to quality a...

A: Quality assurance is nothing but an important part of the quality management concentrated or focused...

Q: Chapter 8. In Problem Set 6, we worked on a problem for Flor’s Flours, a small business that produce...

A: From the given data: Let the decision variables be as shown below (all in lbs): Wheat Garba...

Q: Suppose Panini employs 1 worker at each step. a) Does Panini have enough capacity to fulfill the cu...

A: Given Details Grilled Vegetables Grilled Chicken Pastrami Demand per hour 25 9 12 Step Gr...

Q: Solve the game whose pay-off matrix is given by Player B B1 B2 B3 A1 1 3 Player A A2 -4 -3 A3 1 -1 1...

A: Game theory is a theoretical framework for conceiving social problems among competing players. Game ...

Q: 1. The Production/Operations function is considered as the core function of the organization because...

A: Note: - Since the exact question that has to be answered is not specified we will answer the first q...

Q: Max −A + 2B s.t. -2A + 3B ≤ 8 (Constraint 1) 6A - 2B ≤ 5 (Constraint 2) A + ...

A: a) Z is maximum when A = 1.4 and B = 3.6

Q: 16. To complete the wing assembly for an experimental aircraft, Rhea V. has laid out the major steps...

A: Activity Optimistic time Most Likely time Pessimistic time Predecessor A 1 2 3 B 2 3 4 C ...

Q: What is Integer linear optimization problem?

A: An integer programming problem refers to a mathematical optimization or feasibility problem that has...

Q: Policies, rules, procedures and regulations are required in the firm. Explain with example their sig...

A: Policies and procedures are an important part of any organization. Policies and procedures provide a...

Q: S7.6. Robin Dillon has recently accepted a new job in the Washing- ton, DC, area and has been huntin...

A: Given-

Q: Questions: a. Develop and complete the material requirement planning to plan the production of the l...

A: given,

Q: Explain the 5Ss of lean operations

A: The 5Ss are the steps of visual management. They are the 5 pillers of operations. In Japanese these ...

Q: Briefly explain the 5 critical decision making criteria in Operations which can support mission and ...

A: Supply chain management is the management in which production of production services are managed. It...

Q: The chairperson of the department of management at Tech wants to forecast the number of students who...

A: Given data: Semester Students Enrolled in OM 1 270 2 310 3 250 4 290 5 370 6 410 7...

Q: XYZ Leather Company manufactures and sells two products, wallets and belts, in its two-department pl...

A:

Q: Solve the problem about linear programming subparts A,B,C with the step and no reject. Im needed in ...

A:

Q: A telephone company have a production capacity of 500,000 units per month. At its present capacity o...

A: Given- Production capacity = 500,000 units per monthMonthly income = ₱350,000,000Monthly producti...

Q: 1) List and explain the phases that mark the life of a project.

A: The project management and its lifecycle is a system of best practices employed to shepherd a task f...

Q: What do you think are the advantages of understanding the development of Outline/Operations Process ...

A: Operation process & the flow Process Chart is also understood as an outline process chart & ...

Q: ch, 1. Prepare a flowchart on preparing You need to follow the correct flow chart symbol. meal, you ...

A: COOKING AN EGG: 1. If Scrambled, then egg is cracked egg is broken with mike and butter ...

Q: 1. Identify the organizational driver/s that help P&G recognize the need for its environmental initi...

A: (1)Here during this half i will be able to first justify organizational drivers, thus structure driv...

Q: What are INCOTERMS and why are they so important in international transactions? Give an example of a...

A: Incoterms are identified as International Commercial Terms. They are outline as commercial terms lin...

Q: How does operations research improve the betterment of our society? And how can we link it to optimi...

A: Introduction: Operations research (OR) is an analytical approach to hassle-fixing and selection-maki...

Q: Distinguish between slots that are fixed and those that can move. How might they change the design o...

A: Designing a warehouse - is an essential task often carried up by manufacturing businesses. It concer...

Q: Given the following list of items,(a) Calculate the annual usage cost of each item.(b) Classify the ...

A: The ABC analysis is the technique of inventory management that is used to identify the value of inve...

Q: 3. Explain the Determine Budget process.

A: Project cost is the total cost required to complete the whole project successfully without wasting f...

Q: Determine the product lead time by developing a timeline from the initiation of a purchase order to ...

A: A Small Introduction about Purchasing Purchasing is the purchasing of labor and products. A thing t...

Q: Case Study Kathryn was employed at a large retail store at the mall. Her responsibilities were to st...

A: (A) Kathryn's friends were not the wrong people, but Kathryn was wrong because she did not tell t...

Q: How to solve a problem regarding poor quality cost

A: Businesses and organizations take quality for priority until they face a disturbance in the business...

Q: Bob is a manufacturer of artificial bananas. He believes that they are an excellent and unique energ...

A: 45) The correct answer is License agreement. 46) The correct answer is Bob's Burgers is the Princi...

Q: "he percent change in productivity for one month last year versus one month this year on a multifact...

A:

Q: Using the cut-and-try method for aggregate operations planning, as described in the textbook, we can...

A: Safety stock is the stock that any business maintain so that the shortage issue can be eliminated in...

Q: You are given the following information (a) Develop the mean observed time for each element.(b) Calc...

A: Given-

Q: Define risk retention and explain why a large corporation may be able to use this technique more eff...

A: Risk retention is an individual or association's choice to assume liability for a specific danger it...

Q: (H) linear programming formulation Let x- number of units i shipped to client j, using the indices f...

A: Given data is As the capacity was less than demand a dummy row is added.

Q: 3. The marketing group for a cell phone manufacturer plans to conduct a telephone survey to determin...

A: Let, D = Number of daytime calls to be made E = Number of evening calls to be made The cost to make ...

Q: 5-37 Trevor Harty, an avid mountain biker, always wanted to start a business selling top-of-the-line...

A: Given- Sales data-

Q: A science that concerns with the efficient movement of people and goods that is undertaken to accomp...

A: Transportation engineering can be defined as the process that involves planning, designing, construc...

Q: Risk management types

A: Risk management deals with all the errors, mistakes, losses, etc. that can bring a negative result o...

Q: At sejahtera.com, a large retailer of popular books, demand is constant at 32,000 books per year. Th...

A: Here, given data annual demand=32000 The cost of placing the order=10 The annual cost of holding =4 ...

Q: Kendi Company uses 800 units of a product per year on a continuous basis. The product has a Fixed Co...

A: The detailed solution is given in Step 2.

Q: 1. A computer repair shop had received several complaints on the length of time it took to make repa...

A: As specified, I have solved the first question for you. Kindly find the solution from Step 2 onwards...

Q: 1. Discuss project cost relative to project planning.

A: Project management is the management in which different types of skills and knowledge for the delive...

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

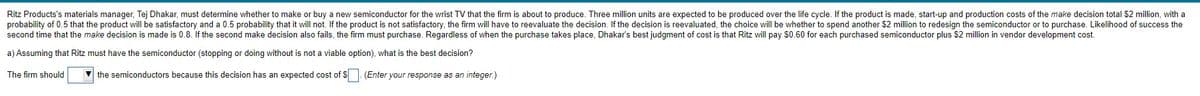

- Ritz Products’s materials manager, Tej Dhakar, mustdetermine whether to make or buy a new semiconductor for thewrist TV that the firm is about to produce. One million unitsare expected to be produced over the life cycle. If the product ismade, start-up and production costs of the make decision total$1 million, with a probability of .4 that the product will be satisfactory and a .6 probability that it will not. If the product isnot satisfactory, the firm will have to reevaluate the decision. Ifthe decision is reevaluated, the choice will be whether to spendanother $1 million to redesign the semiconductor or to purchase.Likelihood of success the second time that the make decision ismade is .9. If the second make decision also fails, the firm mustpurchase. Regardless of when the purchase takes place, Dhakar’sbest judgment of cost is that Ritz will pay $.50 for each purchasedsemiconductor plus $1 million in vendor development cost.a) Assuming that Ritz must have the semiconductor (stopping…Ritz Products's materials manager, Tej Dhakar, must determine whether to make or buy a new semiconductor for the wrist TV that the firm is about to produce. One million units are expected to be produced over the life cycle. If the product is made, start-up and production costs of the make decision total $3 million, with a probability of 0.4 that the product will be satisfactory and a 0.6 probability that it will not. If the product is not satisfactory, the firm will have to reevaluate the decision. If the decision is reevaluated, the choice will be whether to spend another $3 million to redesign the semiconductor or to purchase. Likelihood of success the second time that the make decision is made is 0.8. If the second make decision also fails, the firm must purchase. Regardless of when the purchase takes place, Dhakar's best judgment of cost is that Ritz will pay $0.40 for each purchased semiconductor plus $2 million in vendor development cost. Part 2 a) Assuming that…Ritz Products’s materials manager, Tej Dhakar, mustdetermine whether to make or buy a new semiconductor for thewrist TV that the firm is about to produce. One million unitsare expected to be produced over the life cycle. If the product ismade, start-up and production costs of the make decision total $1 million, with a probability of .4 that the product will be sat-isfactory and a .6 probability that it will not. If the product is not satisfactory, the firm will have to reevaluate the decision. Ifthe decision is reevaluated, the choice will be whether to spendanother $1 million to redesign the semiconductor or to purchase.Likelihood of success the second time that the make decision ismade is .9. If the second make decision also fails, the firm mustpurchase. Regardless of when the purchase takes place, Dhakar’sbest judgment of cost is that Ritz will pay $.50 for each purchasedsemiconductor plus $1 million in vendor development cost.a) Assuming that Ritz must have the semiconductor…

- Ritz Products's materials manager, Tej Dhakar, must determine whether to make or buy a new semiconductor for the wrist TV that the firm is about to produce. Three million units are expected to be produced over the life cycle. If the product is made, start-up and production costs of the make decision total $1 million, with a probability of 0.5 that the product will be satisfactory and a 0.5 probability that it will not. If the product is not satisfactory, the firm will have to reevaluate the decision. If the decision is reevaluated, the choice will be whether to spend another $1 million to redesign the semiconductor or to purchase. Likelihood of success the second time that the make decision is made is 0.8. If the second make decision also fails, the firm must purchase. Regardless of when the purchase takes place, Dhakar's best judgment of cost is that Ritz will pay $0.40 for each purchased semiconductor plus $2 million in vendor development cost. a) Assuming that Ritz…Ritz Products’s materials manager, Tej Dhakar,must determine whether to make or buy a new semiconduc-tor for the wrist TV that the firm is about to produce. Onemillion units are expected to be produced over the life cycle.If the product is made, start-up and production costs of themake decision total $1 million, with a probability of .4 thatthe product will be satisfactory and a .6 probability that itwill not. If the product is not satisfactory, the firm will haveto reevaluate the decision. If the decision is reevaluated, thechoice will be whether to spend another $1 million to redesignthe semiconductor or to purchase. Likelihood of success thesecond time that the make decision is made is .9. If the secondmake decision also fails, the firm must purchase. Regardlessof when the purchase takes place, Dhakar’s best judgment ofcost is that Ritz will pay $.50 for each purchased semiconduc-tor plus $1 million in vendor development cost.a) Assuming that Ritz must have the semiconductor…The following table shows the performance criteria, weights, and scores (1 = worst, 10 = best) for a new product: a thermal storage air conditioner. If management wants to introduce just one new product and the highest total score of any of the other product ideas is 800, should the firm pursue making the air conditioner? Performance Criterion Weight (A) Score (B) Weighted Score (A x B) Market potential Unit profit margin Operations compatibility Competitive advantage Investment requirement Project risk 30 20 20 15 10 5 8 10 6 10 2 4 240 200 120 150 20 20 Weighted score = 750

- Product X currently sells for $12 per unit. The variable costs is $4 per unit and 10,000 units are sold annually with a profit of $30,000 per year. A new design will increase the variable cost by 24% and fixed cost by 13% but sales will increase to 13974 units per year. At what selling price do the break even occurs for the new design?Break-Even Analysis Jesaki Publishing is planning for a new novel, and figures fixed costs (overhead, advances, promotion, copy editing, typesetting) at $65,000, and variable costs (printing, paper, binding, shipping) at $1.60 for each book produced. The book will be sold to distributors for $12 each. Answer the following questions about this venture. What is the total cost if Jesaki Publishing breaks even? $ . Round to the nearest dollar.Walton, Inc. is unsure whether to sell its product assembled or unassembled. The unit cost of the unassembled product is $32, while the cost of assembling each unit is estimated at $34. Unassembled units can be sold for $110, while assembled units could be sold for $142 per unit. What decision should Walton make?

- Downhill Boards (DB), a producer of snow boards, isevaluating a new process for applying the finish to its snowboards. Durable Finish Company (DFC) has offered to apply thefinish for $170,000 in fixed costs and a unit variable cost of $0.65.Downhill Boards currently incurs a fixed annual cost of $125,000and has a variable cost of $0.90 per unit. Annual demand for thesnow boards is 160,000.(a) Calculate the annual cost of the current process used atDownhill Boards.(b) Calculate the annual cost if Durable Finish Companyapplies the finish.(c) Find the indifference point for these two alternatives.(d) How much of a change in demand is needed to justifyoutsourcing the process?Sales for the last quarter of the year were good, with tops sales at 3,400 units and pants sales at 3,200 units. Demand for the first quarter sales of next year is expected to decline by 8%. What is your forecast for the demand of tops and pants? Tops Sales Forecast: 0 ▲ ▼ Pants Sales Forecast: 0 ▲ ▼ Is there anything you could do to help minimize the effect of the projected decline in demand on sales?DBS is also expecting the demand for its top-of-the range devices to increase further from the next year. Given the increase in annual requirement, the production manager is contemplating to start manufacturing the special components in-house to save costs rather than sourcing them from outside. Given the current purchase price of $9000 per unit, what will the average annual requirement need to be in order to justify making the components in-house if the variable cost of making is $6750 per unit and an upfront fixed cost of $55,000,000 is needed to procure the necessary plant and equipment? However, in the event that the expected increase in demand does not materialize and the demand is actually forecast to drop to 20,000 units next year, then what will be the maximum price per unit that DBS would be willing to pay to the supplier in order to continue buying from them? Going forward, if it is found to be a better decision to make the components in-house, DBS will then need to…