The first audit of the books of Swift Limited was recently carried out for the year ended December 31, 2021. Swift follows IFRS. In examining the books, the auditor found that certain items had been overlooked or might have been incorrectly handled in the past: 1. At the beginning of 2019, the company purchased a machine for $480,000 (residual value of $30,000) that had a useful life of six years. The bookkeeper used straight-line depreciation but failed to deduct the residual value in calculating the depreciation base for the three years. 2. Swift purchased another company early in 2017 and recorded goodwill of $450,000 Swift amortized $20,000 of goodwill in 2017, and $40,000 in each subsequent year. The tax treatment for goodwill was properly applied. Assuming the company has a tax rate of 20% Instructions a. Prepare the journal entries in 2021 to correct the books where necessary, assuming that the 2021 books have not been closed. b. Identify the type of change for each of the items.

The first audit of the books of Swift Limited was recently carried out for the year ended December 31, 2021. Swift follows IFRS. In examining the books, the auditor found that certain items had been overlooked or might have been incorrectly handled in the past: 1. At the beginning of 2019, the company purchased a machine for $480,000 (residual value of $30,000) that had a useful life of six years. The bookkeeper used straight-line depreciation but failed to deduct the residual value in calculating the depreciation base for the three years. 2. Swift purchased another company early in 2017 and recorded goodwill of $450,000 Swift amortized $20,000 of goodwill in 2017, and $40,000 in each subsequent year. The tax treatment for goodwill was properly applied. Assuming the company has a tax rate of 20% Instructions a. Prepare the journal entries in 2021 to correct the books where necessary, assuming that the 2021 books have not been closed. b. Identify the type of change for each of the items.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter12: Auditing Long-lived Assets: Acquisition, Use, Impairment, And Disposal

Section: Chapter Questions

Problem 52RSCQ

Related questions

Question

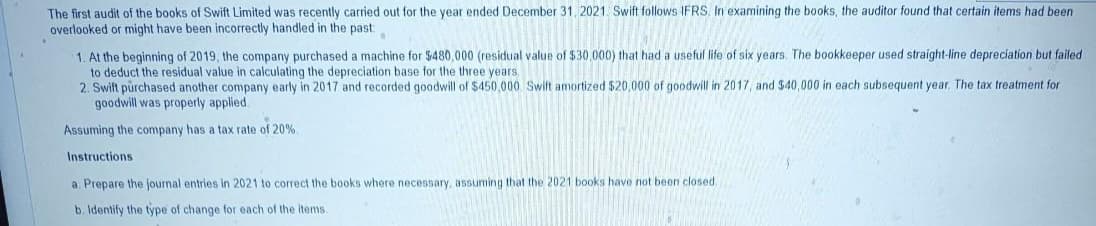

Transcribed Image Text:The first audit of the books of Swift Limited was recently carried out for the year ended December 31, 2021. Swift follows IFRS. In examining the books, the auditor found that certain items had been

overlooked or might have been incorrectly handled in the past:

1. At the beginning of 2019, the company purchased a machine for $480,000 (residual value of $30,000) that had a useful life of six years. The bookkeeper used straight-line depreciation but failed

to deduct the residual value in calculating the depreciation base for the three years.

2. Swift purchased another company early in 2017 and recorded goodwill of $450,000 Swift amortized $20,000 of goodwill in 2017, and $40,000 in each subsequent year. The tax treatment for

goodwill was properly applied.

Assuming the company has a tax rate of 20%

Instructions

a. Prepare the journal entries in 2021 to correct the books where necessary, assuming that the 2021 books have not been closed.

b. Identify the type of change for each of the items.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning