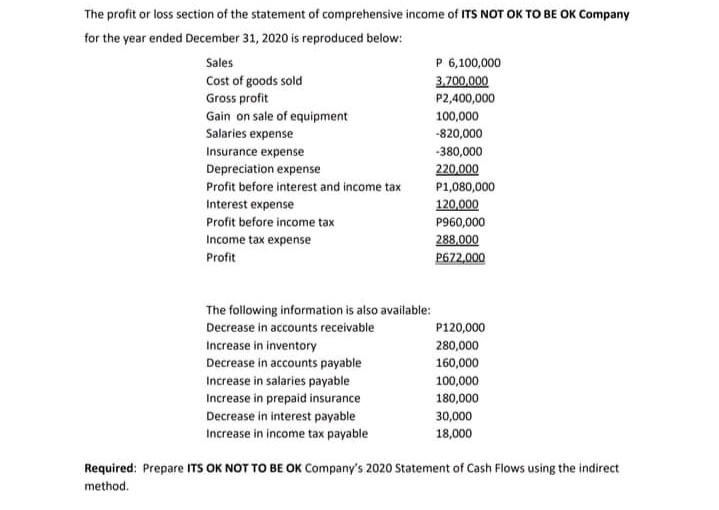

The profit or loss section of the statement of comprehensive income of ITS NOT OK TO BE OK Company for the year ended December 31, 2020 is reproduced below: P 6,100,000 3.700,000 Sales Cost of goods sold Gross profit Gain on sale of equipment Salaries expense P2,400,000 100,000 -820,000 Insurance expense -380,000 Depreciation expense 220,000 Profit before interest and income tax P1,080,000 Interest expense 120,000 Profit before income tax P960,000 288.000 P672,000 Income tax expense Profit The following information is also available: Decrease in accounts receivable P120,000 Increase in inventory 280,000 Decrease in accounts payable Increase in salaries payable 160,000 100,000 Increase in prepaid insurance 180,000 Decrease in interest payable Increase in income tax payable 30,000 18,000 Required: Prepare ITS OK NOT TO BE OK Company's 2020 Statement of Cash Flows using the indirect method.

The profit or loss section of the statement of comprehensive income of ITS NOT OK TO BE OK Company for the year ended December 31, 2020 is reproduced below: P 6,100,000 3.700,000 Sales Cost of goods sold Gross profit Gain on sale of equipment Salaries expense P2,400,000 100,000 -820,000 Insurance expense -380,000 Depreciation expense 220,000 Profit before interest and income tax P1,080,000 Interest expense 120,000 Profit before income tax P960,000 288.000 P672,000 Income tax expense Profit The following information is also available: Decrease in accounts receivable P120,000 Increase in inventory 280,000 Decrease in accounts payable Increase in salaries payable 160,000 100,000 Increase in prepaid insurance 180,000 Decrease in interest payable Increase in income tax payable 30,000 18,000 Required: Prepare ITS OK NOT TO BE OK Company's 2020 Statement of Cash Flows using the indirect method.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 8E: Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives...

Related questions

Question

Please help me prepare the statement of cash flow using the indirect method. Thank you

Transcribed Image Text:The profit or loss section of the statement of comprehensive income of ITS NOT OK TO BE OK Company

for the year ended December 31, 2020 is reproduced below:

P 6,100,000

Sales

Cost of goods sold

Gross profit

3,700,000

P2,400,000

Gain on sale of equipment

Salaries expense

100,000

-820,000

Insurance expense

-380,000

Depreciation expense

220,000

Profit before interest and income tax

P1,080,000

Interest expense

120,000

Profit before income tax

P960,000

Income tax expense

288,000

P672,000

Profit

The following information is also available:

Decrease in accounts receivable

P120,000

Increase in inventory

280,000

Decrease in accounts payable

Increase in salaries payable

Increase in prepaid insurance

Decrease in interest payable

Increase in income tax payable

160,000

100,000

180,000

30,000

18,000

Required: Prepare ITS OK NOT TO BE OK Company's 2020 Statement of Cash Flows using the indirect

method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning