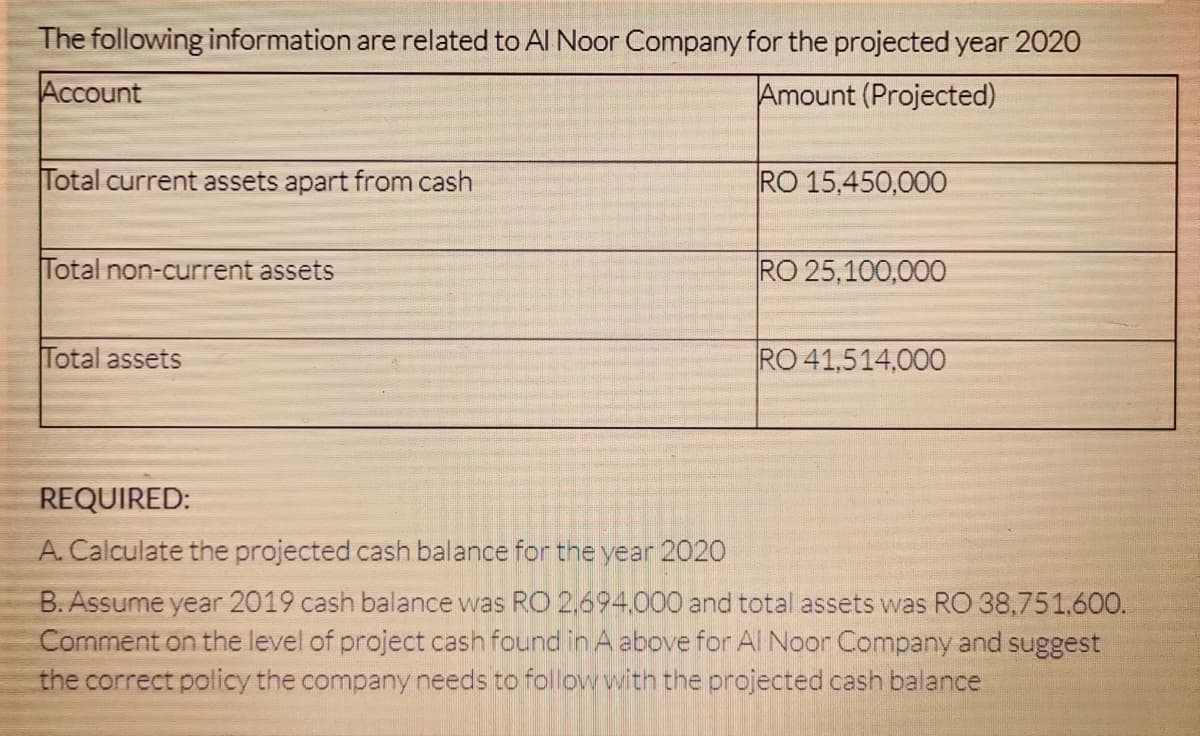

The following information are related to Al Noor Company for the projected year 2020 Account Amount (Projected) Total current assets apart from cash RO 15,450,000 Total non-current assets RO 25,100,000 Total assets RO 41,514,000 REQUIRED: A. Calculate the projected cash balance for the year 2020 B. Assume year 2019 cash balance was RO 2,694.000 and total assets was RO 38,751,600. Comment on the level of project cash found in A above for Al Noor Company and suggest the correct policy the company needs to follow with the projected cash balance

The following information are related to Al Noor Company for the projected year 2020 Account Amount (Projected) Total current assets apart from cash RO 15,450,000 Total non-current assets RO 25,100,000 Total assets RO 41,514,000 REQUIRED: A. Calculate the projected cash balance for the year 2020 B. Assume year 2019 cash balance was RO 2,694.000 and total assets was RO 38,751,600. Comment on the level of project cash found in A above for Al Noor Company and suggest the correct policy the company needs to follow with the projected cash balance

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 80BPSB: Ratio Analysis Consider the following information taken from Chicago Water Slides (CWSs) financial...

Related questions

Question

Transcribed Image Text:The following information are related to Al Noor Company for the projected year 2020

Account

Amount (Projected)

Total current assets apart from cash

RO 15,450,000

Total non-current assets

RO 25,100,000

Total assets

RO 41,514,000

REQUIRED:

A. Calculate the projected cash balance for the year 2020

B. Assume year 2019 cash balance was RO 2,694000 and total assets was RO 38,751,600.

Comment on the level of project cash found in A above for Al Noor Company and suggest

the correct policy the company needs to follow with the projected cash balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,