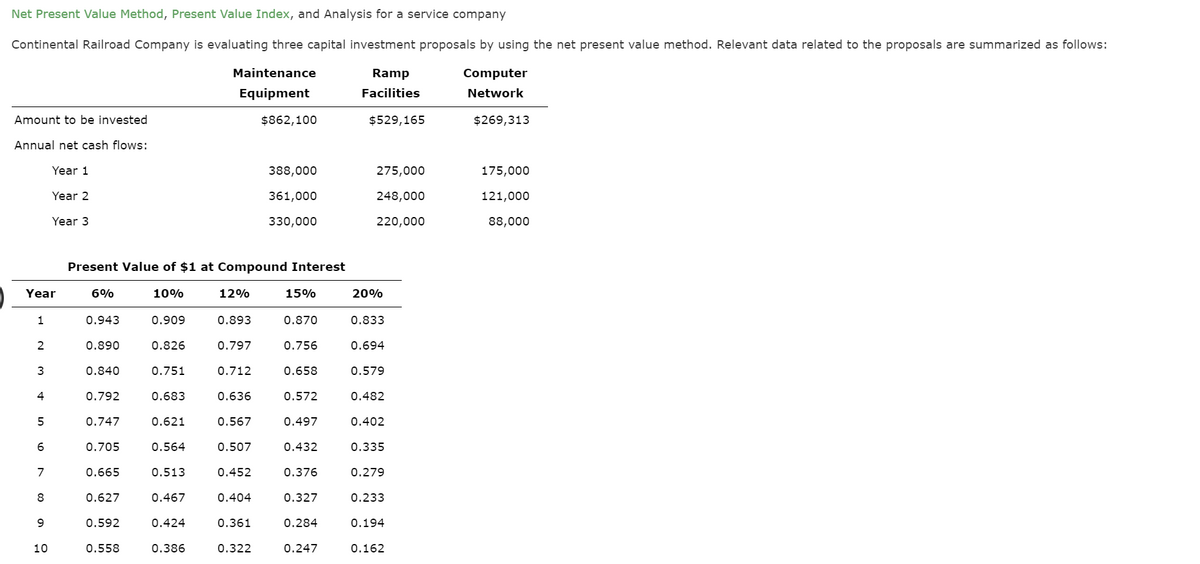

Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows: Maintenance Ramp Computer Equipment Facilities Network Amount to be invested $862,100 $529,165 $269,313 Annual net cash flows: Year 1 388,000 275,000 175,000 Year 2 361,000 248,000 121,000 Year 3 330,000 220,000 88,000

Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows: Maintenance Ramp Computer Equipment Facilities Network Amount to be invested $862,100 $529,165 $269,313 Annual net cash flows: Year 1 388,000 275,000 175,000 Year 2 361,000 248,000 121,000 Year 3 330,000 220,000 88,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.3.3P

Related questions

Question

Transcribed Image Text:Net Present Value Method, Present Value Index, and Analysis for a service company

Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows:

Maintenance

Ramp

Computer

Equipment

Facilities

Network

Amount to be invested

$862,100

$529,165

$269,313

Annual net cash flows:

Year 1

388,000

275,000

175,000

Year 2

361,000

248,000

121,000

Year 3

330,000

220,000

88,000

Present Value of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

0.890

0.826

0.797

0.756

0.694

0.840

0.751

0.712

0.658

0.579

4

0.792

0.683

0.636

0.572

0.482

0.747

0.621

0.567

0.497

0.402

0.705

0.564

0.507

0.432

0.335

7

0.665

0.513

0.452

0.376

0.279

8

0.627

0.467

0.404

0.327

0.233

0.592

0.424

0.361

0.284

0.194

10

0.558

0.386

0.322

0.247

0.162

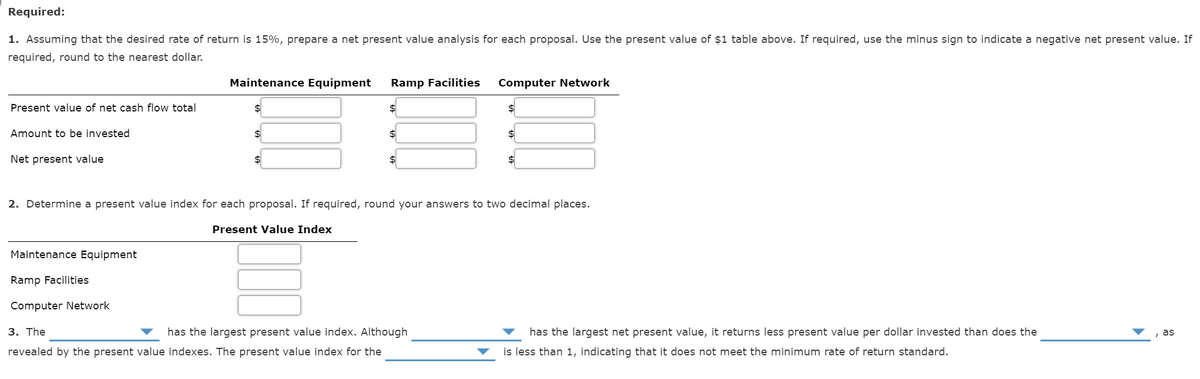

Transcribed Image Text:Required:

1. Assuming that the desired rate of return is 15%, prepare a net present value analysis for each proposal. Use the present value of $1 table above. If required, use the minus sign to indicate a negative net present value. If

required, round to the nearest dollar.

Maintenance Equipment

Ramp Facilities

Computer Network

Present value of net cash flow total

2$

$4

Amount to be invested

%$

Net present value

2. Determine a present value index for each proposal. If required, round your answers to two decimal places.

Present Value Index

Maintenance Equipment

Ramp Facilities

Computer Network

3. The

has the largest present value index. Although

has the largest net present value, it returns less present value per dollar invested than does the

, as

revealed by the present value indexes. The present value index for the

is less than 1, indicating that it does not meet the minimum rate of return standard.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT