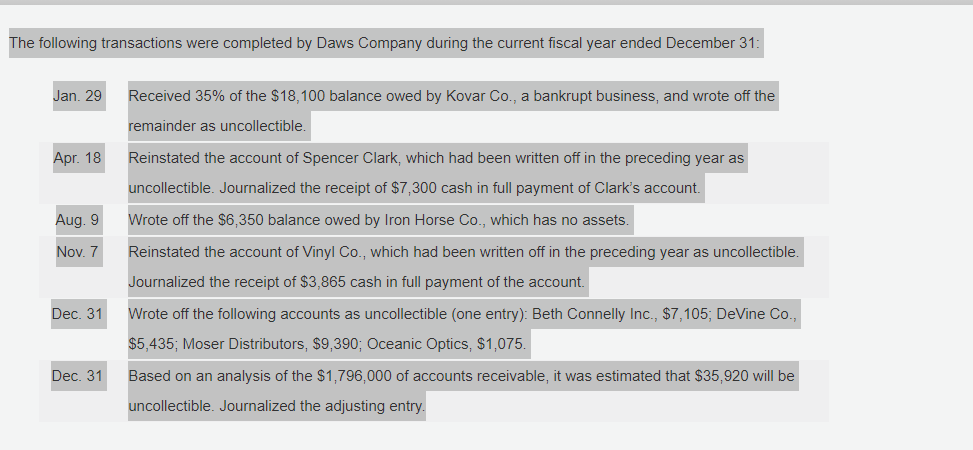

The following transactions were completed by Daws Company during the current fiscal year ended December 31: Jan. 29 Received 35% of the $18,100 balance owed by Kovar Co., a bankrupt business, and wrote off the remainder as uncollectible. Аpr. 18 Reinstated the account of Spencer Clark, which had been written off in the preceding year as uncollectible. Journalized the receipt of $7,300 cash in full payment of Clark's account. Aug. 9 Wrote off the $6,350 balance owed by Iron Horse Co., which has no assets. Nov. 7 Reinstated the account of Vinyl Co., which had been written off in the preceding year as uncollectible. Journalized the receipt of $3,865 cash in full payment of the account. Dec. 31 Wrote off the following accounts as uncollectible (one entry): Beth Connelly Inc., $7,105; DeVine Co., $5,435; Moser Distributors, $9,390; Oceanic Optics, $1,075. Dec. 31 Based on an analysis of the $1,796,000 of accounts receivable, it was estimated that $35,920 will be uncollectible. Journalized the adjusting entry.

The following transactions were completed by Daws Company during the current fiscal year ended December 31: Jan. 29 Received 35% of the $18,100 balance owed by Kovar Co., a bankrupt business, and wrote off the remainder as uncollectible. Аpr. 18 Reinstated the account of Spencer Clark, which had been written off in the preceding year as uncollectible. Journalized the receipt of $7,300 cash in full payment of Clark's account. Aug. 9 Wrote off the $6,350 balance owed by Iron Horse Co., which has no assets. Nov. 7 Reinstated the account of Vinyl Co., which had been written off in the preceding year as uncollectible. Journalized the receipt of $3,865 cash in full payment of the account. Dec. 31 Wrote off the following accounts as uncollectible (one entry): Beth Connelly Inc., $7,105; DeVine Co., $5,435; Moser Distributors, $9,390; Oceanic Optics, $1,075. Dec. 31 Based on an analysis of the $1,796,000 of accounts receivable, it was estimated that $35,920 will be uncollectible. Journalized the adjusting entry.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 26E

Related questions

Question

Transcribed Image Text:The following transactions were completed by Daws Company during the current fiscal year ended December 31:

Jan. 29

Received 35% of the $18,100 balance owed by Kovar Co., a bankrupt business, and wrote off the

remainder as uncollectible.

Apr. 18

Reinstated the account of Spencer Clark, which had been written off in the preceding year as

uncollectible. Journalized the receipt of $7,300 cash in full payment of Clark's account.

Aug. 9

Wrote off the $6,350 balance owed by Iron Horse Co., which has no assets.

Nov. 7

Reinstated the account of Vinyl Co., which had been written off in the preceding year as uncollectible.

Journalized the receipt of $3,865 cash in full payment of the account.

Dec. 31

Wrote off the following accounts as uncollectible (one entry): Beth Connelly Inc., $7,105; DeVine Co.,

$5,435; Moser Distributors, $9390; Oceanic Optics, $1,075.

Dec. 31

Based on an analysis of the $1,796,000 of accounts receivable, it was estimated that $35,920 will be

uncollectible. Journalized the adjusting entry.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning